that time when you got your first paycheck, only to find a chunk of it was already gone for something called “Social Security”? We all do. Jump ahead a few years and now you’re collecting those benefits. You thought your tax days were behind you, but then someone asks: “is social security taxable“?

You see, Social Security isn’t just about retirement checks and disability assistance – there’s also an intricate web spun around taxes which we’ll untangle in this guide.

We’ll take apart the knots of confusion surrounding topics like combined income calculation or how having a Roth IRA might influence your taxation scenario. Plus, tips to keep Uncle Sam’s hands off as much of your hard-earned benefits as possible!

What’s next isn’t just answers. It’s knowledge you can use, all aimed at one thing: giving you the power to really get the tax side of things.

Understanding Social Security Benefits and Taxation

The world of Social Security benefits can be a complex maze. Navigating the complexities of Social Security benefits involves more than just receiving payments; one must also take into account their tax implications. Let me help untangle the confusion.

The Social Security Administration states that up to 85% of your benefits could be considered taxable income if your “combined income” exceeds certain thresholds – $25,000 for individuals and $32,000 for joint filers. You might ask what combined income is? Well, it includes adjusted gross income plus nontaxable interest and half of the social security benefits.

This means that some people will have part or most of their social security payments subject to federal tax return obligations each year depending on their total earnings from all sources including other retirement accounts or even a part-time job in addition to these payouts.

In reality though, many folks don’t end up paying taxes on these checks because their overall incomes are too low once deductions get factored into the equation, which reduces taxable liability below where this kicks in, at least for now given current IRS rules regarding taxation rates applicable here as well as standard deduction amounts available under recent changes enacted by Congress through its latest major overhaul known commonly among professionals like myself dealing regularly with such matters called The Tax Cuts Jobs Act (TCJA).

A simple rule applies: more money coming in usually equals more tax owed out, but remember everyone’s financial situation differs greatly, so the best bet is always to consult someone who knows before taking action based solely on general advice found online, especially when making big decisions affecting personal finances potentially years down the line due to large impacts associated with various factors involved in calculation methodologies used to determine final outcomes related to this topic. It is particularly important to understand fully ahead of time to avoid unpleasant surprises later.

Key Takeaway:

Navigating the maze of Social Security benefits and taxes can be tricky. Up to 85% of your benefits might be taxable if you’re over certain income thresholds. But, don’t panic. Many folks with lower incomes escape this tax after deductions are factored in. Yet, remember – everyone’s financial situation is unique, so it pays to seek expert advice before making any major decisions about your finances.

Is Social Security Income Taxable?

You’ve been working hard, paying into social security like a champ. Now you’re wondering, “Is my social security income taxable?” Well, it depends on your total benefits and other incomes.

The rule of thumb is that if your combined income (which includes adjusted gross income, tax-exempt interest and half of your Social Security benefits) exceeds certain limits, part of your benefits might be considered taxable. The limit for individuals filing taxes is $25k, while joint filers have a cap of $32k. Learn more about how this works here.

Fun fact: If you’re married but file separately from your partner without any unusual circumstances… well let’s just say Uncle Sam might have some questions for you. In most cases these folks will likely end up paying taxes on their Social Security Benefits.

Different Strokes For Different Folks

We all know life isn’t one-size-fits-all – the same goes for taxation rules. How much of your benefit becomes subject to federal tax can vary based on factors such as additional income sources and marital status. As we mentioned before (and yes we’re repeating ourselves because it’s super important), things like earned income from a part-time job or withdrawals from retirement accounts can bump up what portion of those precious checks gets taxed.

If thinking about all these numbers makes you dizzy – don’t worry. Our friendly pals at the IRS provide an interactive tool called an IRS Free File Program. It helps people figure out the taxable amount by answering simple questions.

Final Thoughts

Nobody enjoys being taken aback, particularly when it relates to taxes. So understanding whether your social security benefits are taxable and how much you might owe can save a lot of headaches come tax season.

Don’t sweat it if all this chatter about income, shared earnings, and filing status is making you antsy. It’s totally normal to feel a bit swamped when dealing with money matters. What really counts is that you’re not afraid to ask questions and seek help.

Key Takeaway:

Your social security income might be taxable, depending on your total benefits and other incomes. If your combined income exceeds $25k as an individual or $32k when filing jointly with a spouse, some of your benefits could be taxed. Other factors like additional income sources and marital status also play a role in how much of your benefit is subject to federal tax. But remember, it’s important not to overlook these details when planning for taxes.

How Social Security Benefits are Taxed

Your social security benefits might feel like a safe harbor in the stormy seas of retirement. But did you know Uncle Sam might want a piece of your golden years pie? Yes, that’s right – depending on certain factors, you may have to pay taxes on your social security income.

The Role of Federal Income Tax in Social Security Benefit Taxation

Federal tax is an important factor to consider when determining the amount of taxes you owe. Your overall tax liability is influenced by your combined income which includes half of your total social security benefit.

If this number exceeds $25,000 for individuals or $32,000 for those filing jointly then up to 85% could be subject to federal income tax according to the Social Security Administration (SSA). Think about that as potentially paying taxes twice: once when contributing and again upon withdrawal.

Estimated Taxes and Owing Taxes

You’re probably wondering “Do I need an army of accountants just so I won’t end up owing taxes?” Thankfully no. There’s actually an easier way.

The IRS provides Form SSA-1099 each January detailing what portion was paid back over the past year. This helps figure out if any estimated payments will be necessary during the current year.

But remember folks – even though we all love receiving extra money from part-time jobs or Roth IRA distributions these can push us into higher brackets causing more our benefits taxed.

Lastly don’t forget about state taxes too – some states give SS payouts free pass others not so much.

It’s complex but hey – who said adulting would easy?

As they say life certainties death…and well you know rest. Let’s make sure we’re prepared for both.

Reporting Social Security Benefits on Tax Returns

Come tax season, you’ll need to report your social security benefits. It’s like high school algebra all over again – but don’t worry.

Expect to receive a Form SSA-109 soon.

Key Takeaway:

While social security benefits may seem like a retirement safe haven, they can be taxed. Federal tax plays a big role in this, with up to 85% of your benefits taxable if your combined income exceeds certain limits. But don’t stress about needing an army of accountants for this task. The IRS has you covered with Form SSA-1099 – it gives you the scoop on what was paid back and helps you figure out your potential tax liability.

Determining the Taxability of Social Security Benefits

Knowing if your social security benefits are taxable is a vital piece of information. Let’s dig into how you can calculate that.

The key factor in this equation is your “combined income”. But what does combined income include? It consists of your adjusted gross income, tax-exempt interest income, and half of your Social Security benefits. For example, if one has a retirement income of $20,000 from Social Security and another $30,000 from other sources (like pension payments), their combined income surpasses the thresholds for both individual ($25k) and joint filers’ ($32k).

If we take an example where a retiree receives $20,000 annually in Social Security and another $30,000 from other sources (like pension payments), their total combined income equals $50,000. This falls above both individual ($25k) and joint filers’ threshold ($32k). So some portion would be considered as taxable by IRS guidelines.

Total Income vs Total Benefits

In understanding taxability better let’s consider these two terminologies: ‘total income’ and ‘total benefits’. The former refers to all earnings including tax-exempt interests while the latter solely focuses on received SS benefits.

For instance having additional non-taxable interest adds up in increasing overall “combined” incomes which could exceed limits set for determining taxation levels.

Taxable Portion based on Combined Incomes

Your level of combined incomes plays a significant role when calculating taxable portions within given thresholds.

If filing individually with combined totals less than $25K then no parts are taxed but once exceeded between 50% to 85% might become subject depending upon exceeding amounts respectively.

Married and filing jointly? Then your benefits remain tax-free until hitting $32K combined income. Above that, similar rules apply as individual filings.

Armed with these insights, you’re all set to plan for a more financially secure retirement. Don’t forget, it’s always wise to talk things over with a financial advisor or check out the Social Security website.

Key Takeaway:

including Social Security, while benefits refer specifically to what you receive from Social Security. Grasping this distinction can help you anticipate whether your benefits will be taxed or not. This way, you’re better prepared and can plan accordingly.

Taxation of Different Types of Social Security Benefits

Not all social security benefits are equal; some may be taxed more heavily than others. Some types may be taxed more heavily than others.

The Reality for Disability Benefits

If you’re receiving disability benefits from the Social Security Administration (SSA), your taxation could vary based on total income and filing status. If married filing jointly with a combined income exceeding $32,000 or single earning over $25,000 annually – expect taxes.

Navigating Survivor Benefits Taxation

Survivor benefits face similar rules as disability payouts. They too can end up in Uncle Sam’s pocket if crossing those aforementioned earnings thresholds.

Riding Out Retirement Benefit Taxes

Retirement benefits? You guessed it. Same rules apply here. But let’s remember that ‘combined income’ isn’t just your salary; It includes adjusted gross income, tax-exempt interest and half of your social security payments.

Take note though: these rules don’t touch Supplemental Security Income (SSI) payments at all – they always remain tax-free.

Lump-Sum Payment – A One-Time Deal?

A lump-sum payment might seem like a one-time deal but this is also subject to taxation under specific conditions outlined by the SSA.

Publication 915, details everything you need to know about such situations.

Social Security and Retirement Plans

Planning for retirement can be a bit like trying to hit a moving target. Balancing Social Security benefits with your other retirement accounts requires careful thought, particularly when it comes to taxation.

Impact on Roth IRA

Your Roth IRA can be a key factor in the equation since its taxation is not like that of classic retirement accounts. While you contribute post-tax dollars, withdrawals are generally tax-free in retirement. But did you know receiving Social Security could affect your contributions?

If your total earnings, which encompass Social Security benefits, surpass certain limits, the amount you’re allowed to add could be cut or even wiped out. This interplay between Roth IRAs and Social Security benefits can impact how much money is available to you in later years.

This interaction isn’t as straightforward as saying “Social security will reduce my Roth contribution.” The IRS considers many factors including adjusted gross income (AGI), filing status, and more when determining eligibility for direct Roth IRA contributions.

Navigating Tax Implications With Retirement Accounts

Tax planning doesn’t end there though. Traditional 401(k)s and IRAs may give rise to what’s known as the ‘tax torpedo.’ Distributions from these accounts add up towards combined income—which determines whether—and how much of—your social security benefit becomes taxable.

The last thing anyone wants is their hard-earned savings taking a surprise hit just when they need them most. It’s crucial therefore, not only understanding this interaction but also knowing strategies that can help mitigate such effects—a topic we’ll delve into deeper in future sections.

Remember, a good retirement plan doesn’t just consider how much you have saved. It also takes into account the tax implications of your withdrawals and Social Security benefits—so be sure to include this in your strategy.

Key Takeaway:

Planning for retirement goes beyond just saving—it’s a smart game of tax management too. It can be complex to balance Social Security with other retirement plans like Roth IRAs, as your total income might influence contributions and taxes. Beware of the ‘tax torpedo’ when pulling money from traditional 401(k)s and IRAs. To dodge any surprise financial blows, it’s essential to grasp how these elements interact.

Strategies to Minimize Taxes on Social Security Benefits

Trimming the tax bite from your social security benefits can feel like a tough task. But, with the right strategies, it’s totally doable. Let’s chat about some ways to help you keep more of your money.

The Roth IRA is one tool you might want to consider using. Unlike traditional retirement accounts, Roth IRAs offer tax-free withdrawals during retirement and don’t count towards taxable income calculations for Social Security purposes.

For those not ready for full-time retirement or needing extra income beyond Social Security, supplementing with a part-time job may be beneficial to spread out income over multiple years and reduce the percentage of benefits that are taxable. This will allow you to spread out your income over multiple years and possibly reduce the percentage of benefits considered taxable each year.

Mind Your Income Level From Previous Years

You also want to pay attention to how much other income – including interest and dividends – you received in previous years as this can affect how much of your social security benefit becomes subject to taxation.

Rethink Your Filing Status

Filing status plays an important role too. If possible and appropriate given your personal circumstances, filing separately rather than jointly when married may lower overall taxes on combined incomes because it changes how these are calculated by IRS rules.

All these tactics take planning ahead but they could potentially save thousands in unnecessary taxes over time.

Reporting Social Security Benefits on Tax Returns

Navigating tax returns can be a daunting task, particularly when reporting social security benefits; let’s make the process simpler by understanding how to accurately report these benefits. Let’s simplify the process and get right into understanding how you should report these benefits accurately.

The Social Security Administration (SSA) issues Form SSA-1099 at the start of each year. This form outlines all the benefits you received in the previous tax year and is crucial for accurate reporting.

Tax Year: Why It Matters

The “tax year” refers to the 12-month period that your federal income taxes pertain to – typically from January 1st through December 31st. Any changes made during this time can affect how much of your social security benefits are considered taxable income.

If you receive additional income such as wages or self-employment earnings, interest, dividends or other taxable income that must be reported on your return – this could push up what’s known as ‘combined income’ which may result in more of your Social Security being subject to taxation.

Navigating The IRS Guidelines

Publication 554 by IRS, specifically designed for seniors’ benefit provides detailed instructions about filing procedures related with retirement incomes including social security benefit information. Don’t worry if some terms sound intimidating. Remember ‘adjusted gross’, ‘total benefits’, they’re just fancy words pointing towards aspects of our total annual financial intake.

Take note though; not everyone will owe taxes on their Social Security payments. For example, individual filers whose combined incomes fall below $25k usually escape any tax liability while joint filers have slightly higher limit at $32k. Realizing there’s more to it, taking into account the tax implications of Social Security benefits is essential for making sure your filing is precise and avoiding potential problems in the future.

Understanding these aspects will help you report accurately and avoid potential headaches down the line.

Key Takeaway:

those from Social Security. If you’ve got other sources of income, this can bump up your tax bracket and lead to more of your benefits being taxed. But don’t worry, resources like IRS Publication 554 are here to guide seniors through the complex world of retirement incomes taxation. It’s a handy tool that gives detailed instructions on how it all works.

Understanding Filing Statuses in Relation to Social Security Benefit Taxation

Filing status can be a key factor in deciding the taxability of your Social Security benefits, not just what you earn. The filing status of a married couple jointly or separately, as well as single individuals, can have an important influence on the portion of social security benefits subject to taxation.

If you file a joint return with your spouse, for instance, and together make over $32,000 – which includes half of the social security benefits received – then up to 85% of these total benefits might be taxed. But if you are married yet choose to file separately without living apart from each other at any time during the year, chances are high that some part of those hard-earned retirement payments will be siphoned off as federal income taxes.

As we dig deeper into this issue using information from Tax Topic 423, it becomes evident why so many people ask “is my social security taxable?” The answer isn’t always straightforward because factors such as additional income from part-time jobs or Roth IRA distributions may push one’s combined income above certain thresholds defined by IRS rules.

The Impact Of Different Filing Statuses On Social Security Taxes

Your chosen method for filing has direct implications on whether and how much tax gets levied on your supplemental security payment checks. For example:

- A person who files an individual return would only need to worry about their earnings exceeding $25k per annum before seeing up to half their SSI payments become subject years taxable liability.

- In contrast though when couples decide upon a ‘married filing jointly’ approach they’ll find themselves safe until hitting twice this amount ($50k).

Now, what if you’re married but decide to file separately? In this case, the IRS assumes that your income exceeds the base amount and so up to 85% of your social security benefits may be taxed. This shows why it’s crucial to get a good understanding of these tax implications before choosing how to file.

Understanding The Role Of Additional Income

The calculation plays a crucial role in this scenario. We need to make sure it’s done right for accurate results.

Key Takeaway:

Understanding whether your social security benefits are taxable isn’t just about checking your earnings. It’s also tied to filing status and other income streams. If you’re married and together make more than $32k, up to 85% of your benefits might be taxed. However, even if you file separately, you could still face taxes unless you live apart from each other. For those flying solo in their tax journey, the taxman may come knocking once they exceed a certain threshold.

FAQs in Relation to Is Social Security Taxable

At what age is Social Security no longer taxable?

Taxes on Social Security don’t hinge on age. They’re based instead on your total income and filing status.

How do I avoid paying taxes on Social Security?

To sidestep taxes, keep combined income low by controlling withdrawals from retirement accounts and considering Roth conversions.

Which states do not tax Social Security income?

A majority of states – 37 to be exact – don’t tax social security benefits including Florida, Texas, and Nevada among others.

Is Social Security considered earned income?

Nope. The IRS views social security benefits as unearned income which means they aren’t subject to the same rules as wages or self-employment earnings are.

Table of Contents:

- Understanding Social Security Benefits and Taxation

- Is Social Security Income Taxable?

- How Social Security Benefits are Taxed

- Determining the Taxability of Social Security Benefits

- Taxation of Different Types of Social Security Benefits

- Social Security and Retirement Plans

- Strategies to Minimize Taxes on Social Security Benefits

- Reporting Social Security Benefits on Tax Returns

- Understanding Filing Statuses in Relation to Social Security Benefit Taxation

- FAQs in Relation to Is Social Security Taxable

- Conclusion

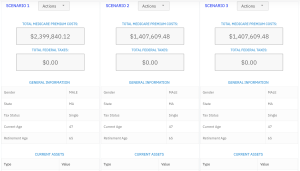

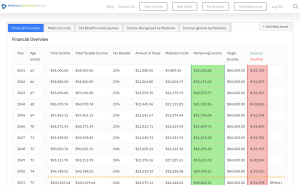

Streamlining the Medicare Surcharge Calculation Process.

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.