Ever feel like you’re playing an endless game of hide-and-seek, trying to find that perfect client? Well, welcome to the world of Lead Generation for Financial Advisors.

Finding new clients is one of the trickiest aspects for financial professionals to tackle. But what if I told you there are strategies and tools out there designed just for this task?

We’re not talking about cold calling or chasing leads anymore. Nope! We’ve got methods up our sleeve involving paid advertising channels with maximum ROI potential – think Facebook and Instagram.

Curious how TikTok ads could offer cheaper alternatives when buying exclusive leads? Or maybe exploring SEO strategies on platforms like YouTube and Google is more your style? We’ll delve into all these tactics plus more!

Our ship has made it to the shores and is all set, eagerly awaiting its next great adventure.

The Rising Importance of Lead Generation for Financial Advisors

Financial professionals today face a landscape that’s rapidly changing. It’s not just about the fluctuating market trends, but also the increasing need to generate leads in this digital era.

The National Association of Personal Financial Advisors (NAPFA), a leading professional association, reports an interesting shift: between March and August 2023, online searches for “financial advisor” jumped nearly 20%. This indicates people are actively seeking financial advice amid economic uncertainty brought on by COVID-19. More surprisingly is that almost 60% of these prospects have expressed willingness to work with an advisor remotely. This implies there are more possibilities than ever before if you know the correct approaches and how to connect.

Embracing New Lead Generation Strategies

The traditional ways financial advisors got their leads – networking events, cold calling or referrals from current clients – aren’t enough anymore because they don’t scale well in our digitally-connected world. Today’s successful financial advisors use innovative lead generation strategies such as search engine optimization (SEO), social media marketing and email campaigns.

Digital marketing allows them not only to expand their client base but also improve efficiency since it automates parts of the process while ensuring they’re reaching a wider audience effectively.

A Shift Towards Quality Over Quantity

In past years, many professionals focused solely on quantity – get as many names as possible and hope some turn into actual clients. But now we see a trend towards prioritizing quality over sheer numbers when generating leads.

This strategy aims at identifying potential clients who will be good fits for your service offerings instead of trying hard sell everyone you come across which can dilute your brand message & trustworthiness. It’s about building relationships and providing value first, making the selling part natural and easier.

The Future of Lead Generation

With advancements in technology such as artificial intelligence (AI) & big data analytics, lead gen is becoming more sophisticated and targeted than ever before. These tools can analyze huge amounts of data quickly to identify patterns or trends that might indicate someone could be a good fit for your services.

By doing so, financial advisors can concentrate more on their main tasks and responsibilities.

Key Takeaway:

As the digital era reshapes financial advising, lead generation is no longer about sheer quantity but quality. Today’s successful advisors use innovative strategies like SEO, social media marketing and email campaigns to find potential clients who align with their services. And with advancements in AI and big data analytics, identifying these prospects becomes more precise and efficient than ever.

Paid Advertising Channels for Exclusive Leads

For financial advisors, paid advertising can be a gold mine of exclusive leads. But with an array of platforms to choose from, where should you focus your budget? The answer is social media.

Let’s talk about Facebook ads. According to Emparion, the cost per lead on Facebook for financial advisors varies between $5 and $50. On average though, it hovers around the sweet spot of $10-$20. That’s affordable when compared to other methods. What’s more important is that this small investment could lead you towards a big payoff – gaining new clients.

Maximizing ROI on Paid Advertising

You may wonder if investing in Facebook ads will really pay off? Rest assured, investing in Facebook ads can yield returns of up to $500 per appointment booked. appointments booked via these campaigns typically range from just $50 up to as much as $500. However, most fall within the reasonable range of $200-$300 each.

The real game-changer comes when we look at client acquisition costs using these same ad campaigns; while they can reach highs of up to $5k per client gained (depending on targeting strategies), most commonly they stay within the realm of approximately 2-3 grand apiece—pretty fair pricing for adding potentially high net worth individuals into your clientele.

Your message resonates better through trust-building posts which not only help attract potential clients but also keeps them engaged over time because they feel comfortable interacting with you – a great strategy for both generating and maintaining quality leads.

Harnessing TikTok Ads for Cost-Effective Lead Generation

When you think of social media platforms to generate leads, TikTok might not be the first one that comes to mind. But with its soaring popularity and cost-effective ad options, it’s becoming a powerhouse in digital marketing.

TikTok ads have been reported to perform 2x to 5x better than Facebook ads when it comes down to costs per lead, appointment, and client acquisition. These stats make them an enticing option for financial advisors looking at buying exclusive leads without breaking the bank.

You may ask how does this happen? The answer lies in understanding what makes TikTok’s advertising platform unique compared to others.

The Magic Behind Tiktok Ads

Firstly, unlike other platforms where users can choose who they follow or what content they see, on TikTok algorithms rule supreme. It’s like having your own personal DJ who understands your taste in music – but instead of songs; we’re talking about videos tailored specifically towards user preferences based on their previous interactions.

This means every time a potential client opens up their app, there is a chance they’ll stumble upon your ad if it matches their interests which are gauged by machine learning models. This increases visibility tremendously leading to more effective lead generation strategies using targeted advertisements on this platform.

Audience Engagement That Delivers Results

In addition, because users typically spend hours scrolling through video after video – each only seconds long – you’re given ample opportunity as an advertiser trying to win clients over via short clips showcasing services offered by great financial advisors like yourself.

The audience engagement rate also contributes heavily toward the effectiveness of TikTok ads. Unlike Facebook, where viewers can scroll past your ad without a second glance, on TikTok users often watch videos multiple times and even share them with their friends. This multiplies visibility, thereby increasing chances for lead generation.

Setting Up Your Campaign

Finally, setting up a campaign on TikTok is easy peasy lemon squeezy.

Key Takeaway:

Don’t overlook TikTok as a powerhouse for lead generation. Its cost-effective ads, powered by algorithms and high user engagement rates, can deliver 2x to 5x better results than Facebook. Plus, setting up a campaign is simple. This platform could be your secret weapon in winning over more clients.

Leveraging SEO for Free Lead Generation

When it comes to lead generation, many financial advisors often overlook the power of Search Engine Optimization (SEO). However, savvy professionals know that using effective SEO strategies can be a game-changer in their business.

On-Page and Off-Page Optimization

The two key elements of an effective SEO strategy are on-page and off-page optimization. On-page refers to all the actions you take directly within your website to improve its position in search rankings. This includes things like keyword research and placement, meta tags, responsive design, etc.

In contrast, off-page optimization involves improving your site’s reputation through backlinks from other reputable sites. It’s about getting these digital votes of confidence that tell search engines your content is valuable and trustworthy.

A well-executed mix of both techniques not only boosts your visibility but also makes sure potential clients find you when they’re searching online for financial advice or services.

Riding High with Google Search Results

You might think YouTube is just a place for cat videos or cooking tutorials; however, it has become one more platform where financial advisors generate leads thanks to its massive user base coupled with effective SEO strategies. When done right, “YouTube SEO”, as we call it, could rank high not just on YouTube but even Google searches too.

This dual-platform ranking ability offers incredible reach because prospective clients actively looking for solutions tend to convert faster compared to those coming across passive ads while scrolling through social media feeds. In fact, statistics reveal that Google SEO generates higher-quality leads. They are quicker conversions since users are actively searching for solutions.

SEO: A Cost-Effective Strategy

Perhaps the best part about SEO is that it’s essentially free. Unlike paid advertising channels, you don’t have to shell out cash every time someone clicks on your link in search results. Of course, creating and optimizing content takes effort and time, but once done right, the payoff can be huge. If done right, this commitment to SEO could bring considerable rewards for your business in the long run.

Key Takeaway:

SEO Mastery: Unleash the power of SEO for lead generation. Focus on both on-page and off-page optimization to improve your site’s search rankings. Use YouTube to tap into a massive user base and rank high in Google searches too. The best part? It’s cost-effective, with significant returns over time.

Content Marketing as a Lead Generation Tool

In the realm of lead generation, content marketing holds immense power. It’s like an open secret in financial advisor marketing – one that smart advisors are using to generate quality leads.

The crux of content marketing lies in creating valuable content that appeals to your potential clients. You don’t just throw out sales pitches; instead, you offer helpful insights and advice – kind of like giving out free samples at a grocery store.

But what does ‘valuable’ mean? For starters, it means providing solutions or answering questions your target audience might have about financial services. When done right, this not only helps attract prospects but also builds trust with them.

Thought Leadership Content

Becoming a thought leader is more than just having expertise on topics related to finance; it involves sharing that knowledge regularly through various forms of content such as blog posts or short videos. But why should you invest time and resources into becoming a thought leader?

Well, according to The Annuity Expert, when prospective clients see you offering expert advice consistently over time, they start seeing you as an authority figure who can help navigate their financial journey effectively.

This not only positions you as someone knowledgeable but also instills confidence in potential clients making them feel comfortable enough to take the next step: engaging with your business directly for further consultation or assistance.

You’re probably wondering how blogging fits into all this? Well for one thing, National Association of Personal Financial Advisors (NAPFA) suggests blogging can be used strategically by financial advisors to provide consistent value while simultaneously generating new leads. Remember though- creating high-quality blog content isn’t just about writing well; it’s also about choosing the right topics and ensuring your posts are SEO-friendly to reach a wider audience.

Another effective strategy is social selling, where you use platforms like LinkedIn not only for networking but also for sharing valuable insights through posts or articles. The more useful your shared content, the higher the chances of generating leads from this platform.

To wrap things up, remember this key point from our discussion on content.

Key Takeaway:

Content marketing, when done right, is a powerful lead generation tool for financial advisors. It’s not about making sales pitches but offering valuable insights and solutions to your audience. This builds trust and positions you as an authority figure in finance. Blogging and social selling can also be strategic tools if used correctly – they offer consistent value while attracting new leads.

The Power of Social Selling in Lead Generation

It’s no secret that social selling is becoming a key player in lead generation for financial advisors, especially for financial advisors. But what exactly does it mean to use “social selling”?

In essence, it’s about building relationships and trust with your target audience on platforms like LinkedIn. It’s not just pushing out promotional content or cold calling potential clients. Instead, it involves sharing valuable insights and engaging in meaningful conversations.

Social Selling: The Art of Building Trust Online

To get the ball rolling with social selling, start by creating an optimized profile on platforms such as LinkedIn. Make sure you come across as approachable and professional – remember first impressions count.

Then, dive into relevant discussions within groups related to finance or retirement planning. Share your expertise freely; don’t be shy. When people see how knowledgeable you are without feeling pressured to buy anything immediately – they’ll feel more comfortable reaching out when they need help.

Nurturing Relationships Through Valuable Content Sharing

An important aspect of social selling is sharing useful information regularly. For instance, if there’s new legislation affecting retirement plans which might increase IRMAA costs – share an article explaining its implications along with some tips for mitigating those effects.

This way you’re providing value while subtly demonstrating your understanding of the field. People appreciate this kind of insight because it helps them make informed decisions.

Turning Conversations Into Leads: A Case Study

A case study illustrating the power of social media can be found at Emparion(source), where their team has been using LinkedIn effectively to generate quality leads. By sharing regular, insightful content and engaging with their audience on a personal level, they’ve seen an increase in inbound inquiries.

It’s about nurturing authentic relationships and building credibility. When executed properly, this strategy can generate a consistent stream of high-quality leads genuinely intrigued by your offerings.

Key Takeaway:

Mastering the art of social selling means building trust online, especially for financial advisors. This is not about cold calls or self-promotion but nurturing relationships through sharing valuable insights and joining meaningful conversations on platforms like LinkedIn. The goal? Transform these digital interactions into high-quality leads by demonstrating your expertise and understanding in finance-related discussions.

FAQs in Relation to Lead Generation for A Financial Advisor

Where do financial advisors get leads?

A financial advisor find leads from various sources such as networking events, referrals, social media platforms, SEO strategies, and paid advertising.

How do you generate financial services leads?

You can generate financial service leads by utilizing SEO tactics, creating valuable content for thought leadership, and leveraging both paid ads and social selling.

Can financial advisors pay for leads?

Absolutely. A financial advisor can often use paid ad channels like Facebook or TikTok to acquire exclusive quality prospects efficiently.

How do financial advisors find new clients?

New clients are usually found through a blend of lead generation techniques – think about social media marketing, email campaigns, search engine optimization (SEO), and word-of-mouth referrals.

Table of Contents:

- The Rising Importance of Lead Generation for Financial Advisors

- Paid Advertising Channels for Exclusive Leads

- Harnessing TikTok Ads for Cost-Effective Lead Generation

- Leveraging SEO for Free Lead Generation

- Content Marketing as a Lead Generation Tool

- The Power of Social Selling in Lead Generation

- FAQs in Relation to Lead Generation for Financial Advisors

- Conclusion

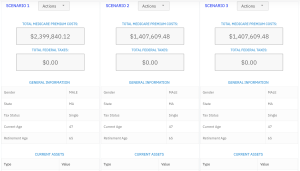

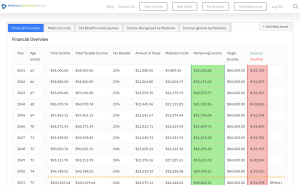

Streamlining the Medicare Surcharge Calculation Process.

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.