Ever felt like you’re wandering through a maze, only to realize it’s the confusing world of Medicare? The twists and turns can be overwhelming, especially when penalties for late enrollment are involved. But what if there was a tool that could help navigate this labyrinth?

Welcome to your new ally: the Medicare penalty calculator.

This practical device is more than just numbers and percentages—it’s your personal guide helping you avoid pitfalls in your healthcare journey. It shines light on those murky areas where costly mistakes often hide.

You’ll discover how eligibility dates affect potential penalties, why base beneficiary premiums matter in calculations, and even learn from real-life examples. That cliff edge of uncertainty about initial enrollment periods or prescription drug coverage impact? Consider them bridged!

into clarity. Stick around and you’ll find yourself armed with insights that can turn the complex into simple, clearing away any confusion.

Understanding the Medicare Penalty Calculator

If you’ve ever wondered how much a late enrollment in Part D could cost, then meet your new best friend: the Medicare penalty calculator. It’s a tool that helps calculate potential penalties based on when you start your Medicare coverage.

The Functionality of a Medicare Penalty Calculator

This handy tool estimates potential penalties by considering two crucial factors – eligibility and enrollment dates. “Eligibility” here means when one initially qualified for Medicare benefits. On the other hand, “enrollment date” is simply when you actually enrolled in Part D or another form of creditable prescription drug coverage.

By calculating the gap between these two dates, this clever little helper can give an estimate of any late enrollment penalty costs which may apply. This calculation might sound complicated but don’t worry; our aim here is to make things simpler for folks like us who aren’t actuaries.

Implications of Late Enrollment

Late enrollment doesn’t just mean delayed access to health benefits—it can also hit where it hurts most: your wallet. Penalties are calculated as 1% of the national base beneficiary premium times each month without sufficient coverage after becoming eligible (source). So if one delays their plan selection process even by a few months, they’re potentially adding dollars onto their monthly premiums indefinitely.

In conclusion, using tools like a Medicare penalty calculator, not only provides insight into what future healthcare costs could look like but also encourages timely decision-making for selecting appropriate plans – ensuring both financial well-being and peace of mind.

How to Calculate Medicare Penalties

Medicare penalties can be a real bummer. But don’t fret. Grasping the way they’re computed can give you an advantage and maybe even save some of your cash.

Role of Base Beneficiary Premium in Penalty Calculation

The base beneficiary premium plays a crucial role in calculating these penalties. It’s like the main ingredient in this financial recipe, if you will. This figure is set by the federal Medicare program each year, acting as a national base for all Part D premiums.

The penalty calculation itself? Pretty straightforward: 1% of the “national base beneficiary premium” gets multiplied by every full month without coverage after your initial enrollment period ended – yikes.

Check out more details here.

This means that even though we’d rather watch paint dry than calculate our potential future healthcare costs (I mean who wouldn’t?), understanding how to calculate them could make all the difference when it comes time to start using those benefits we’ve been paying into all these years.

To put it simply, think about your plan’s monthly premium being directly affected by both your late enrollment decisions and any changes made annually to that sneaky national base beneficiary number – because let me tell ya’, she does change.

All things considered, knowing where numbers come from gives us control over them – well at least somewhat… We might not have power over what happens within our government-run health programs but hey, knowledge is still power right?

Here’s how you can challenge a penalty decision.

So, grab that calculator and let’s make sense of these numbers.

Real-life Examples of Calculating Penalties

Understanding Medicare penalties can be tricky, but real-world examples can make it more clear. Let’s take the case of Mrs. Martinez, a retiree who didn’t enroll in a Part D plan or have creditable prescription drug coverage after her initial enrollment period ended.

In 2023, she decided to join a Medicare Drug Plan. But because she went without coverage for some months, there was an enrollment penalty that got added to her plan’s monthly premium.

The penalty calculation is based on the national base beneficiary premium which changes every year. In 2023, this amount was $33.06 and her late enrollment lasted for ten full months without coverage.

To calculate Mrs.Martinez’s monthly penalty cost: Multiply 1% of the national base beneficiary ($0.3306) by the number of full uncovered months (10). The result – $3.306 – gets rounded to the nearest $.10 resulting in a monthly penalty of $9.70.

Surprising developments ahead. In 2024 when our hypothetical beneficiary continued with her Medicare drug plan pay premium – and yes you guessed right – another surprise awaited Mrs.Martinez.

The national base had increased to $34 hence pushing up her part B premiums slightly higher due to previous delay in enrolling during that critical month period post retirement. Her new calculated fine came out at approximately one dollar extra i.e., around $10 per month now instead over previous year’s charges against same duration lapse rate.

Navigating Through Medicare Enrollment Periods

Decoding the jargon of Medicare enrollment periods can feel like trying to solve a Rubik’s cube blindfolded. Fear not, we are here to ensure you have a comprehensive understanding of the Medicare enrollment periods.

Understanding Initial Enrollment Period

Your initial enrollment period is a seven-month span that begins three months prior to your 65th birthday and concludes three months after. This time frame lets you sign up for Parts A, B, C or D of Medicare without facing any late enrollment penalties.

If you delay signing up past this point though – say because you still have employer coverage or are hanging onto your youthfulness – beware. Once your initial enrollment period has ended, some parts of Medicare may hit you with a penalty for late enrollment.

Imagine forgetting about an important date and having to pay extra as punishment. Not ideal, right? The same goes for delaying your medicare signup beyond the initial period.

Avoiding Late Penalties Like Procrastination at Work

To dodge these pesky penalties, there’s another handy timeframe called the Special Enrollment Period (SEP). If you had health insurance coverage from an employer when turning 65 but now need to switch over to Medicare – SEP is your get-out-of-jail-free card.

You can also use SEPs if major life changes occur such as moving locations or losing current coverage unexpectedly. Remember: staying informed helps keep those unnecessary costs at bay just like how knowing where every coffee shop in town helps avoid morning grumpiness.

The Impact of Prescription Drug Coverage on Medicare Penalties

Prescription drug coverage plays a crucial role in navigating the sea of potential Medicare penalties. The concept is simple – if you’re covered, your boat stays afloat; but without it, you could be sailing into stormy waters.

Importance of Creditable Drug Coverage

Creditable prescription drug coverage is like the compass guiding your ship through those storms. It’s defined as health insurance that provides benefits at least as good as standard Medicare Part D coverage.

If you have this type of cover from another source, such as an employer or union, then there’s no need to worry about enrolling in a Medicare drug plan. You won’t face any late enrollment penalties even if you join later down the line because creditable coverage keeps those pesky fees at bay.

In contrast, let’s imagine what happens when there’s no compass – meaning no creditable prescription drug plan. Here comes trouble. For every month after your initial enrollment period ended that you don’t have adequate coverage for prescription drugs under either Part D or another creditable source, the federal Medicare program can charge a penalty cost added to your monthly premium once you do enroll.

This is where our trusty friend – the Medicare penalty calculator – steps in handy by calculating how many months were spent uncovered and multiplying it with 1% of the national base beneficiary premium for each one. It sounds complex but think about it like figuring out how much water got into your boat while navigating rough seas and determining how long until we’re back on dry land again.

Moral? Stay covered with appropriate prescription plans during all eligible periods to avoid any late enrollment penalties. So, get that compass and keep your ship steady through the Medicare sea.

Key Takeaway:

Prescription drug coverage is your lifesaver in the Medicare penalty sea. With creditable cover, you dodge late enrollment fees. But without it, each uncovered month costs you a penalty on top of your premium – that’s where our pal, the Medicare Penalty Calculator comes to help. So stay covered and keep sailing smoothly.

Challenging and Avoiding Late Enrollment Penalties

Have you ever felt like a deer caught in the headlights when it comes to Medicare late enrollment penalties? Well, don’t worry. We’ve got some practical tips on how to challenge these penalty decisions and strategies to help avoid them altogether.

Disagreeing with a Penalty Decision

If you’re scratching your head at an unexpected penalty decision, remember that all is not lost. You can ask for reconsideration if you disagree. So where do we start?

The first step is simple: gather evidence showing why you believe there was no lapse in creditable prescription drug coverage or prove that exceptional circumstances led to your delay. Once done, submit this along with this form. Remember, accuracy matters.

Proactive Measures to Avoid Penalties

Surely prevention is better than cure – especially when it involves dodging financial penalties. How about using some smart strategies upfront?

- Paying attention during the initial enrollment period (once your seven-month window opens) will be our number one advice.

- Maintain consistent health insurance coverage so as not lose out on crucial months without cover.

Avoid being penny-wise but pound-foolish by skipping Part D Prescription Drug Plans just because they seem expensive now; those late-enrollment fees could end up costing more.

Here’s a handy resource that goes into the details of how to avoid late enrollment penalties. Link

In short, knowledge is power. So stay informed and stay ahead.

FAQs in Relation to Medicare Penalty Calculator

How to calculate my Medicare penalty?

You can estimate your penalty using the Medicare Penalty Calculator. It factors in uncovered months and base beneficiary premiums.

What is the penalty for not taking Medicare?

If you delay enrolling into Part B or D after eligibility, you’ll face a late enrollment fee that increases with time.

What happens if you don’t pay Medicare Part B?

If unpaid, your coverage could be terminated. You’d need to wait until general enrollment to get back on and possibly incur penalties.

Is there a maximum Medicare Part D penalty?

No cap exists for the Part D late enrollment fee—it keeps growing based on how long you’ve been without credible drug coverage.

Conclusion

Understanding the Medicare maze is a challenge, but remember, you’re not alone. With tools like the Medicare penalty calculator, it’s easier to avoid late enrollment penalties.

You’ve learned how base beneficiary premiums and months without coverage impact your potential fines. We looked at how the scenarios we discussed would develop over time.

We dove into initial enrollment periods, their importance, and consequences if missed. We explored the role prescription drug plans play in avoiding extra costs.

Above all else: don’t panic! Armed with knowledge about creditable drug coverage or strategies for challenging decisions, you are now equipped to navigate Medicare confidently!

Table of Contents:

- Understanding the Medicare Penalty Calculator

- How to Calculate Medicare Penalties

- Real-life Examples of Calculating Penalties

- Navigating Through Medicare Enrollment Periods

- The Impact of Prescription Drug Coverage on Medicare Penalties

- Challenging and Avoiding Late Enrollment Penalties

- FAQs in Relation to Medicare Penalty Calculator

- Conclusion

Streamlining the Medicare Surcharge Calculation Process.

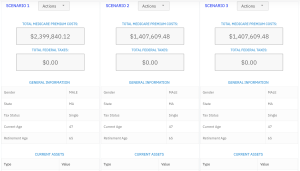

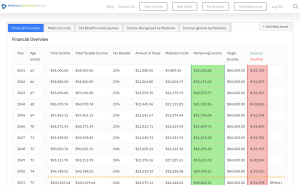

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.