The Leading IRMAA Software...

We Make Retirement Planning Simple!

Proven Platform, from Education to Planning to Lead Generation

What is IRMAA?

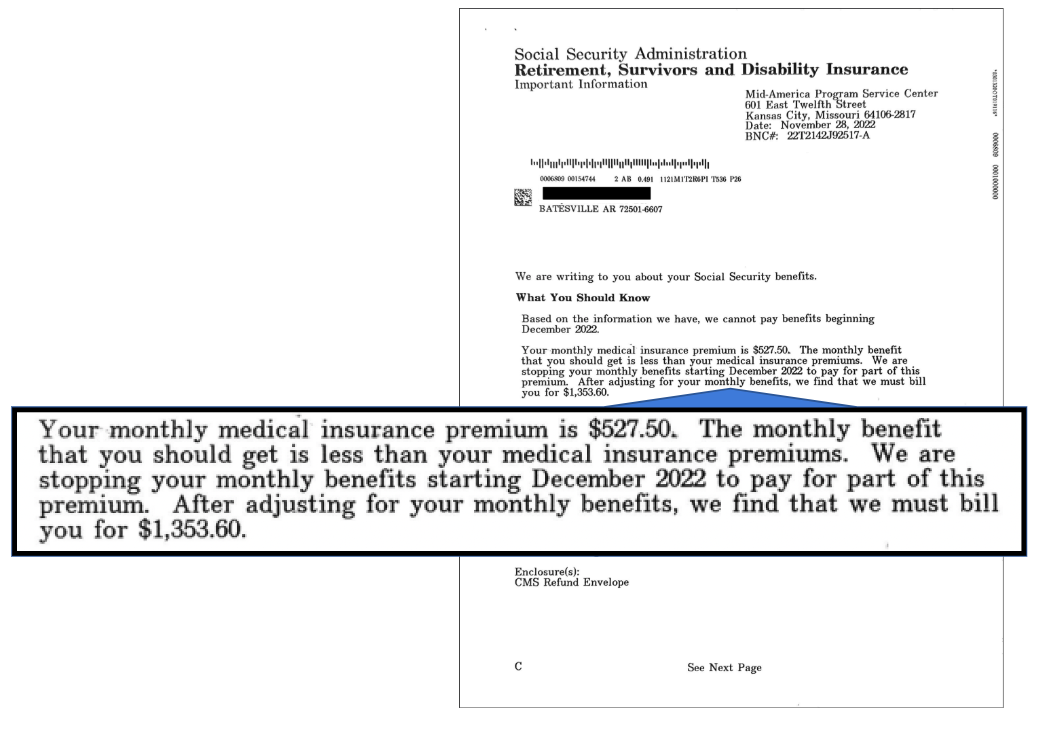

Many Americans retire only to discover Medicare premiums and surcharges exceed their monthly Social Security Benefit payouts.

IRMAA stands for Income Related Monthly Adjustment Amount. It’s a surcharge on Medicare’s base premium for parts B and D.

The government uses information from the IRS to determine if you must pay more for Medicare as well as IRMAA surcharges and how much to take out of your Social Security.

Here are three things everyone must know about IRMAA:

- Medicare calculates premiums and IRMAA surcharges based on your income. The higher your income, the more adjustment amount you pay.

- Medicare automatically deducts premiums and surcharges from your monthly Social Security Benefit.

- You can use your assets to reduce your Medicare premiums.

While everyone else is having the same conversations, you can now offer IRMAA solutions to more people, solve real retirement problems and Grow Your Practice Exponentially with the IRMAA software.

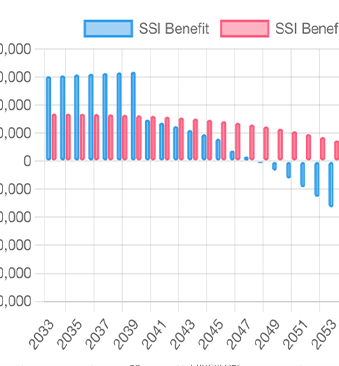

Impact on Social Security and Overall Income

See the impact of IRMAA surcharge deductions on Social Security Benefit amount.

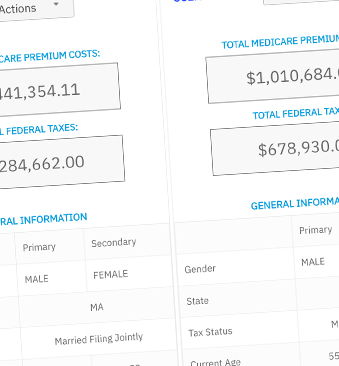

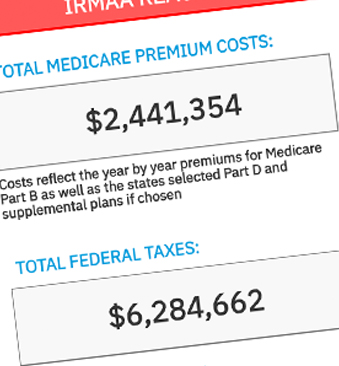

Comparison Reports

Compare scenarios side by side to find the best solution for Medicare costs and IRMAA surcharges

IRMAA and Tax Implications

The only software that show the impact of taxes along with premiums and surcharges.

Personalized Downloadable Reports

Two types of PDF reports to send to your clients of distribute during seminars.

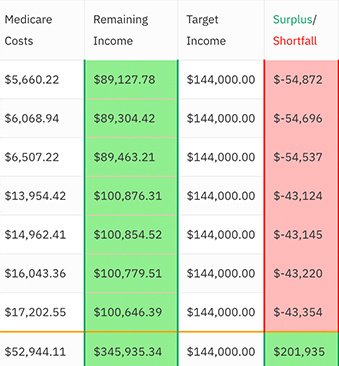

Effect on Target Monthly Income

Choose your target yearly income and see how close you come to the goals after expenses and IRMAA surcharges are calculated.

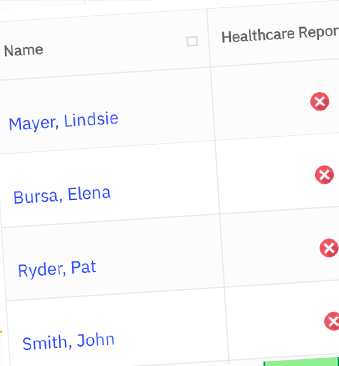

Unlimited Clients and Reports

Use the software for unlimited clients and reports for one low monthly investment amount

...And Many More Features

Medicare Will Collect Over 23 Billion in IRMAA Surcharges in 2024

Millions of hardworking Americans received a letter from Medicare notifying them of IRMAA surcharges being deducted from their Social Security benefit via Income Related Monthly Adjustment Amount (IRMAA) premiums.

Many types of retirement income affect IRMAA surcharges, including mandatory disbursement of RMDs, which Medicare uses this information to determine surcharges and premiums.

Medicare Premiums and IRMAA surcharges impact millions of retirement plans, and many don’t know if they’re affected until they retire—sadly when it’s already too late.

We don't like to brag, but we're changing the game

“The IRMAA certification program and HCP software is not only an eye opener but a game changer. The unknown things in life are what cause the most pain, IRMAA is one of those hidden pains. The TRUE cost of the IRMAA surcharge plus medical expenses are unknown by most and dismissed by others is concerning.”

Mark ClarkPrestige Planning - Managing Partner CFP CKA

“The Certified IRMAA program will separate you from others by giving you the practice management knowledge of Medicare and its costs to my clientele. The topic of IRMAA has opened my eyes on how the majority of Pre Retirees/Retirees in America know very little to nothing about the risk. Would highly recommend every advisor take this course.”

John McEachranLifeMark Securities - Registered Representative

“What an AMAZING IRMAA education. I have been a life insurance agent since I was 28 years old, and have always worked with safe money concepts. The IRMAA Certified Professional Course has now opened a World of clients to me. If you are looking for a way to stand out from the crowd, then this course is a must! It is the best money I have ever spent in my business career!!!”

Ira KlebanCertified Planner