Medicare’s IRMAA Surcharges impacts every retirement plan.

First Lets Start with What Is IRMAA?

IRMAA stands for Income Related Monthly Adjustment Amount. It is A surcharge above and beyond Medicare’s base premium for Parts B and D. The government determines which Medicare beneficiaries are subject to the surcharges.

Three things to Note:

-

Amount of your Medicare premiums and surcharges are based on your Income. the more you make the higher your premiums and surcharges.

-

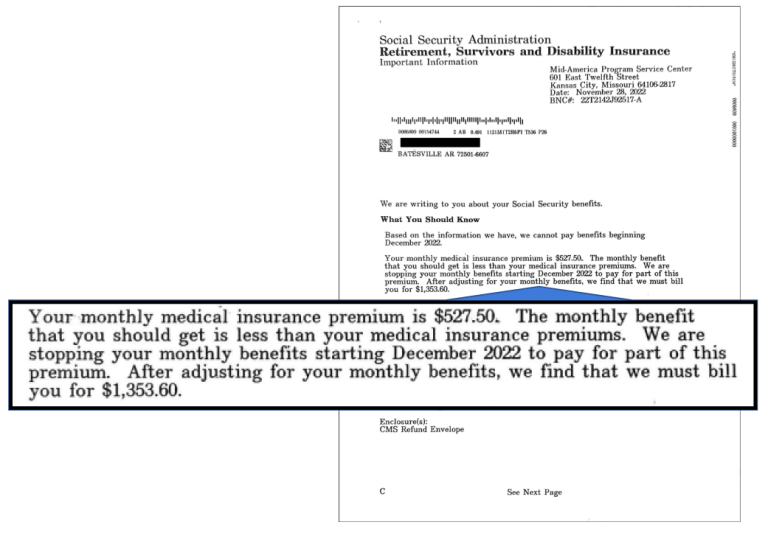

Your Medicare premiums and surcharges are automatically deducted from your monthly Social Security Benefit.

-

There are assets that contribute to increasing Medicare premiums and those that help lower those premiums.

Financial Professionals Pay Hundreds of Dollars for Access to this Information

Did You Have a 401k, IRA or Other Retirement Assets Like Those?

With the mandatory disbursement of RMDs, Medicare Looks at these types of retirement income assets and uses them to determine if you will be assessed a surcharge on your Medicare premiums. Do you know how much that will be when you retire?

You Have a Financial Professional…

They Have Already Factored This in, Right?

Unfortunately less than 1% of Financial professionals know about this

and an an even smaller number actually help plan for it. So, no… most likely it was not factored in.

What does the Personalized IRMAA Stress Test Do?

Every retirement plan may be at risk of being impacted by Medicare’s IRMAA, however until now there has not been a way to see that impact. This IRMAA Stress Test, gives you the same tools a high end financial advisor has to see how big of an impact IRMAA Has on your retirement plan.

See Medicare Premium and Surcharge Impact on Total Income

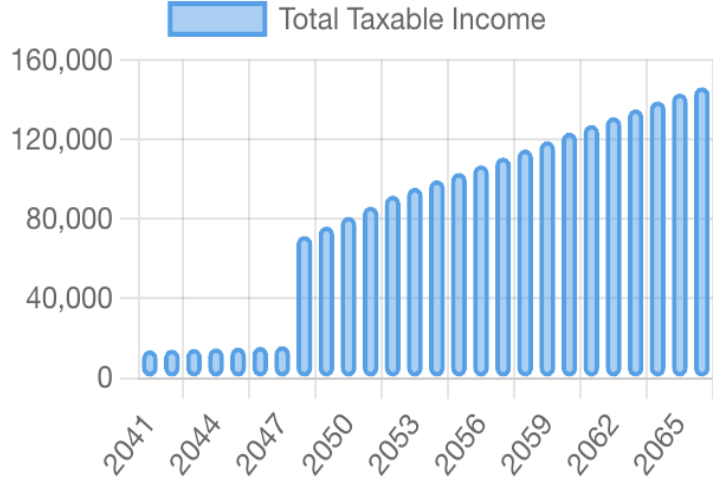

See How Much Modified Adjusted Gross Income Medicare Uses to Determine Your IRMAA Surcharges.

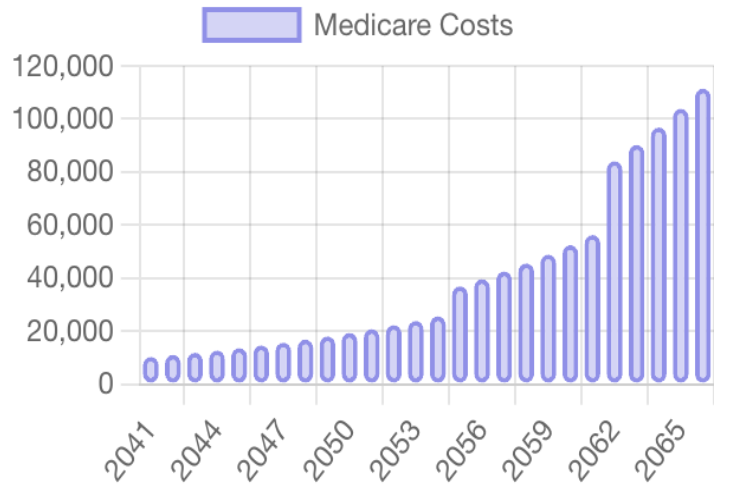

See How Your Medicare Premiums and Surcharges Will Grow Throughout Your Retirement.

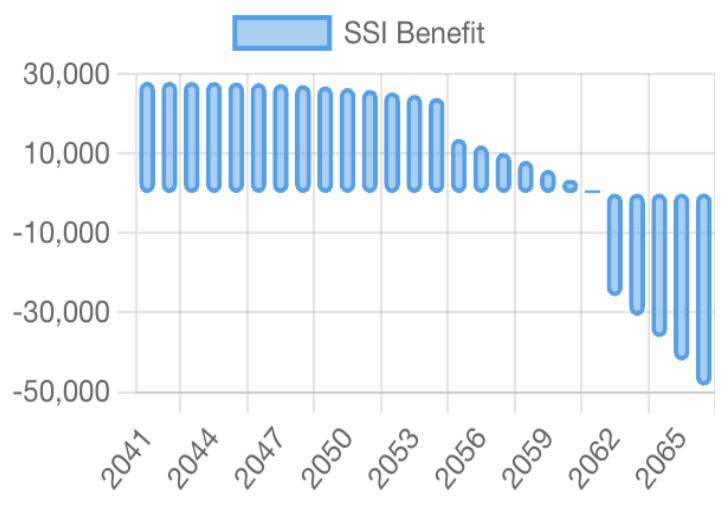

See The Impact of Medicare Premiums and Surcharges Have on Your Social Security Benefit.

What is Included in the Personalized IRMAA Stress Test?

Every retirement plan may be at risk of being impacted by Medicare’s IRMAA, however until now there has not been a way to see that impact. This IRMAA Stress Test, gives you the same tools a high end financial advisor has to see how big of an impact IRMAA Has on your retirement plan.

Downloadable 35 Page report that includes your Personalized Stress Test.

Year by Year Breakdowns of Your Income and Your Medicare Premium and Surcharge Costs.

Projection if you may be paying any Medicare Premiums or Surcharges Out Of Pocket.

List of the Types Of Income Medicare Uses to Determine Your IRMAA Surcharges.

Guide to Starting an IRMAA Appeal with links to the correct forms required.

Ability to Access the Online Report and downloadable reports from anywhere.

See Where and When you Hit a Medicare IRMAA Bracket which Increases Your Premiums.

List of the Types Of Income Medicare Ignores When Calculating Your IRMAA Surcharges.

The Results of Thousand of Hours of Research and Planning, All Done by Our Staff is Now Available to you!

Financial Professionals are Paying Hundreds of Dollars per Year for these Reports. We are now allowing individuals like you to run them yourself.

Financial Professionals are paying

$1000’s of Dollar for these report.