Indexed Universal Life Insurance (IUL Insurance) is a complex product in the life insurance industry that offers both a death benefit and potential cash value growth linked to an equity index. As financial professionals, it’s essential to have a deep understanding of these policies, their features, benefits, and risks.

In this blog post, we’ll explore how IULs link to equity indexes and delve into premium flexibility and adjustable death benefits offered by these types of insurances. We will also discuss the allocation options for policy’s cash value component and strategies for risk management.

Furthermore, we’ll dissect the complexity and risks associated with an IUL policy such as capped coverage fees and consequences related to premature termination. The regulatory environment surrounding indexed universal life insurance will be examined along with criticisms faced by providers offering these plans.

We’ll provide insight into customer satisfaction ratings among insurers offering IUL plans while highlighting factors considered during ranking. Lastly, longevity planning considerations using indexed universal life insurance will be discussed followed by weighing pros cons before making purchase decision.

Understanding Indexed Universal Life Insurance

Indexed universal life insurance (IUL) is like regular life insurance, but with a twist. It’s like having a death benefit and a secret stash of cash value. Sneaky, huh?

What Makes IUL Policies Special?

IULs are flexible, just like a yoga instructor. You can adjust your premiums and death benefits to fit your needs. Plus, they’re linked to stock indexes, so you can potentially earn some sweet returns.

How Do IULs Work?

Think of IULs as a rollercoaster ride. When the stock index goes up, your cash value goes up too. Rest assured, your money is securely tethered. If the Stock Market Index takes a nosedive, your cash value won’t go down. It’s like having a bungee cord attached to your money.

But remember, IULs aren’t all rainbows and unicorns. There are fees and limitations to consider. So, do your homework before jumping on the IUL bandwagon.

Premium Flexibility and Adjustable Death Benefits in IUL Policies

You can tailor your payments to suit your own financial circumstances with and IUL, unlike other types of insurance. It’s like having a flexible gym membership, but for life insurance.

Comparing Premium Flexibility Between Different Types of Insurances

With IUL, you can lower your premiums when money is tight and increase them when you’re rolling in dough. It’s like having a financial superhero that adapts to your needs. Other life insurance policies can’t do that. Sorry, not sorry.

Table of Contents:

- Understanding Indexed Universal Life Insurance

- Premium Flexibility and Adjustable Death Benefits in IUL Policies

- Cash Value: The Secret Sauce of IUL Policies

- Complexity and Risks Associated With IUL Policies

- Regulatory Environment Surrounding Indexed Universal Life Insurance

- Customer Satisfaction Ratings And Complaint Data For Insurers Offering These Plans

- Longevity Planning Considerations With Indexed Universal Life Insurance

- Weighing Pros and Cons Before Making a Purchase Decision

- FAQs in Relation to Iul Insurance

- Conclusion

Impact Of High Costs On Overall Returns

But wait, there’s a catch. IUL ins. policies come with some hefty fees and charges. These sneaky expenses can eat into your returns faster than a hungry squirrel at a picnic. Be sure to check the small print and calculate before jumping in.

The NAIC suggests being informed and familiarizing yourself with the particulars, dangers, and advantages of a policy prior to settling on a choice. It’s like studying for a life insurance exam, but without the stress.

To sum it up: flexible premiums in IULs are like a double-edged sword. They offer you freedom, yet it comes with a cost. So, be a smart cookie and evaluate everything before jumping into bed with an insurance company.

Cash Value: The Secret Sauce of IUL (Indexed Universal) Insurance Policies

Indexed universal life policies have a nifty little feature called the cash value component. It’s like a savings account on steroids, growing based on interest rates and market performance. The insurance company gives you two options to allocate your policy’s cash: fixed or indexed accounts.

Where to Stash Your Cash

In the fixed account, you get a guaranteed minimum return, no matter how the stock index behaves. In the indexed account, your cash can ride the rollercoaster of a specific equity index, like the S&P 500. But beware, there are caps on the maximum returns.

With these options, you can flex your investment strategy muscles and tailor it to your risk tolerance and financial goals.

Playing It Safe or Going for Gold?

Both allocation strategies have their perks, but they also come with risks. So, before you go all-in on your IUL cash, think it through.

- Fixed Account: It’s like a cozy blanket, offering guaranteed returns no matter what. But don’t expect sky-high growth because of those pesky low interest rates.

- Indexed Account: This one’s a bit of a daredevil. It can give you higher returns when the market is on fire, thanks to its link with equity indexes. But if the market tanks, you might end up with zilch, even though you’re protected from direct losses.

To play it smart with your Universal Life policies, diversify your cash between both accounts. That way, you can manage the risks and chase those sweet gains.

Complexity and Risks Associated With IUL Policies

The complexity of indexed universal life policies can be overwhelming. Before investing, ensure that you are cognizant of all the particulars. One important detail is the capped coverage fees, which can eat into your potential gains.

Understanding Capped Coverage Fees

Capped coverage fees are limits set by the insurance company on how much you can earn from your equity index-linked investment. While they protect you from market downturns, they also limit your gains during good market years. Over time, increasing fees can significantly reduce your returns.

Risks of Premature Termination

Ending an IUL policy early comes with risks. If you stop paying premiums, you could lose all the money you’ve already put in. Unlike traditional savings or investments, there’s no guarantee of capital preservation.

Maintaining a reliable source of income is essential to ensure continued payment of premiums. The National Association of Insurance Commissioners (NAIC) and other experts recommend consulting with financial professionals before diving into complex products like IUL policies.

Regulatory Environment Surrounding Indexed Universal Life Insurance

In spite of federal exemption from regulation since 2010, insurers offering these products still need to adhere to rules set by the National Association of Insurance Commissioners (NAIC). Despite being profitable within the insurance industry, indexed universal life policies are often criticized as poor investment products. They’re bundled with expensive coverages that neither beat inflation nor provide substantial wealth-building opportunities due to their inherent structure coupled with high charges.

Role NAIC Plays in Regulating This Product Despite Federal Exemption

The NAIC plays a crucial role in regulating this product despite its federal exemption. The association sets standards and best practices for the insurance industry, ensuring consumer protection and fair competition among insurance companies. It also provides guidelines on policy details such as flexible premiums, death benefit amount, and interest rates associated with IULs.

Criticisms Faced By Providers Offering These Plans

- Lack of Transparency: Critics argue that many consumers don’t fully understand how IULs work because of their complexity. The lack of transparency can lead to unexpected surprises like sudden increases in premium costs or decreases in cash value accumulation.

- Poor Investment Returns: Another common criticism is that returns on IULs are generally lower than other financial products available on the market. This is mainly due to caps placed by the insurer on potential gains linked to stock index performance.

- High Costs: Lastly, critics point out that fees associated with maintaining an IUL policy can eat into any potential earnings over time, making it less attractive compared to traditional term or whole life insurance policies.

To make informed decisions about whether an indexed universal life policy fits your needs requires careful consideration and understanding all aspects involved, including the regulatory environment surrounding them. Remember, being informed is essential to navigating the intricate realm of finance.

Key Takeaway:

Indexed Universal Life Insurance (IUL) policies are subject to regulations set by the NAIC, despite being exempt from federal regulation. Critics argue that IULs lack transparency, offer poor investment returns compared to other financial products, and have high costs associated with maintaining the policy. It is important for consumers to fully understand these aspects before deciding if an IUL policy is right for them.

Customer Satisfaction Ratings And Complaint Data For Insurers Offering These Plans

The NerdWallet ratings show that many customers are not happy with insurers offering these plans. Consider this when deciding on an IUL plan.

Factors considered when ranking customer satisfaction levels among insurers

NerdWallet considers financial strength, pricing, coverage options, and customer satisfaction ratings from surveys conducted by J.D Power or Consumer Reports.

- Financial Strength Rating: Reflects the insurer’s ability to pay claims and meet financial obligations.

- Pricing: Compares rates to others in the insurance industry.

- Coverage Options: Considers the variety of policies offered.

- Satisfaction Ratings from Customers: Provides insights into policyholders’ experiences.

It’s also important to review complaint data compiled by state insurance departments overseen by the National Association of Insurance Commissioners (NAIC). This information gives valuable insight into potential issues with insurers or specific policies like indexed universal life insurance.

Remember to look at both positive and negative reviews to get a comprehensive picture of customer satisfaction. Do a comprehensive investigation prior to settling on a buying choice so you get the most for your cash.

Longevity Planning Considerations With Indexed Universal Life Insurance

The cost of owning indexed universal life insurance (IUL) increases as you age, making it less affordable for older folks who might benefit more from a traditional whole-life plan with lower guaranteed growth rates. That’s a bummer.

Potential drawbacks using this strategy, especially for older individuals

- Increasing Premiums: As you get older, your premiums go up. It’s like aging is a crime or something.

- Risk of Losing Investment: If you buy an IUL when you’re young and then lose your job or get sick, you could lose all the money you’ve put into the policy. Talk about a double whammy.

- Limited Death Benefit Amount: Unlike other types of permanent life insurance, IULs have adjustable death benefits that can decrease over time. It’s like they’re playing with your emotions.

Before recommending indexed universal life policies as part of a retirement plan, financial professionals should carefully consider whether they’re the right fit. These items might have some appealing qualities, but they also carry potential hazards and expensive fees that could diminish your profits. It’s like a sneaky hidden fee.

To make informed decisions about IULs, you need to understand all the ins and outs of this complex product offered by the insurance industry. It’s like diving into a rabbit hole, but with less fluffy bunnies.

Weighing Pros and Cons Before Making a IUL Purchase Decision

Before deciding, it’s important to evaluate the potential risks associated with IUL.

With IUL, you have the potential to earn interest tied to stock indexes. It’s like riding a rollercoaster – thrilling, but with ups and downs. Market volatility can seriously impact your policy’s cash value accumulation, so buckle up.

But wait, there’s more. A IUL policy often come with hefty price tags. Premiums and fees can make your wallet cry. Be prepared to fork out the cash if you decide to go ahead with an IUL policy.

- Risk vs Reward: IULs offer the potential for high returns, but remember, with great rewards come great risks. Market performance can make or break your policy’s cash value.

- Cost: Brace yourself for higher premiums compared to other life insurance options. The investment component comes at a price.

- Fees: Watch out for sneaky additional costs like surrender charges or loans against your policy’s cash value. They can be like hidden monsters under your bed.

Oh, and don’t forget about interest rates. They can play a game of tug-of-war with your coverage costs. When rates rise, you might need to dig deeper into your pockets to maintain that guaranteed death benefit amount.

IULs do offer some perks, like flexible premiums and adjustable death benefits. It’s like having a life insurance plan that can do the cha-cha. Think twice before you take the plunge with this long-term commitment.

FAQs in Relation to IUL

Is it a good idea to have an Indexed Universal Life Insurance (IUL)?

An IUL can be a smart long-term investment and provide a death benefit, but it’s important to understand the details.

How does money grow in an IUL?

In an IUL policy, the cash value grows based on the performance of a specified equity index, with limits set by the insurer.

How much money can I put in an IUL?

The amount you can contribute to an IUL policy depends on factors like age, health, premiums, and the insurance company’s guidelines.

Does an IUL grow tax-free?

IULs offer tax-deferred growth, meaning you won’t owe taxes until you withdraw funds from the policy’s cash value.

“`

Conclusion

Indexed universal life insurance policies offer flexibility and growth potential, allowing policyholders to benefit from market gains while still having a guaranteed death benefit.

The cash value component of IULs provides allocation options and risk management strategies, making it a unique financial product.

However, it’s important to understand the complexity and risks associated with these policies, such as capped coverage fees and potential consequences of premature termination.

When choosing an insurer, it’s wise to consider customer satisfaction ratings, complaint data, and longevity planning considerations.

Regulated by state insurance commissioners, IUL plans have faced criticisms, but with proper research and understanding, they can be a valuable addition to a financial portfolio.

To learn more about Healthcare Retirement Planner click here.

Streamlining the Medicare Surcharge Calculation Process.

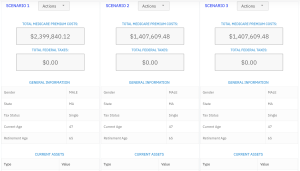

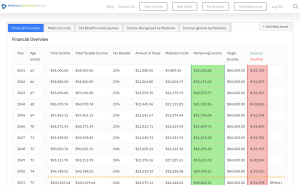

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.

Frequently asked questions

How can I Learn More about IRMAA as a financial professional

If you would like to learn more you can go to www.irmaacertifiedplanner.com for certification and designation to be an IRMAA Certified Planner

What is IRMAA?

The Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an amount you may pay in addition to your Part B or Part D premium if your income is above a certain level.

Does everyone have to pay IRMAA

How do I calculate my IRMAA exposure over the duration of a retirement?

Using the software provided by www.healthcareretirementplanner.com