Welcome to the world of Medicare Part B penalty waiver. The late enrollment penalties, premium hikes, and complex rules can feel like an enigma wrapped in a riddle makes this health policy tricky.

Why must it be so difficult?

You just want affordable health coverage without breaking your savings. But instead, you get hit with a maze of premiums and penalties. Feels unfair right?

Well, what if I told you there’s hope yet – even if you missed your initial enrollment period or delayed signing up for Medicare Part B after employer coverage ends? That relief could come from understanding how this mysterious ‘penalty waiver’ works…

Let’s unravel this complex puzzle together, step by step! We’ll cover everything from who can get penalty waivers to how you can appeal against Medicare.

Understanding Medicare Part B Late Enrollment Penalty Waiver

If you’re late enrolling in Medicare Part B, a penalty may loom over your monthly premium. But, here’s some good news: there’s such a thing as the Medicare Part B penalty waiver. Reminder this does not include drug coverage.

What constitutes late enrollment in Medicare?

The initial enrollment period is crucial to avoid penalties. It begins three months before turning 65 and ends three months after your birthday month. If you miss this window, it’s considered late enrollment.

Late enrollees face an additional 10% on their base premium ($164.90 in 2023) for each full 12-month period they were eligible but didn’t join Part B or have job-based insurance that counts as creditable coverage.

This can get costly fast if health plan delays continue. And these aren’t one-time fines; they stick with you by being added to every monthly premium payment during your time on Medicare.

You might be thinking “But I had employer coverage through my spouse’s current job.”. Good news – if you delayed because of having certain types of other health insurance (like from employment), then penalties may not apply.

Evidence Needed for an Medicare Penalty Appeal

If hit with a surprise penalty despite maintaining employer coverage until retirement, don’t panic yet. You can file an appeal within two months using SSA’s request for reconsideration form (Form SSA-561).

Included should be proof like pay stubs showing continuous health care cover via work even past the age of eligibility for social security. In this case, it’s possible to have the penalty waived.

Options to Avoid Medicare Part B Penalty

Don’t worry if you’ve missed the enrollment dates window for Medicare Part B – there are ways to avoid the penalty. There are ways to avoid the penalty.

How Job-Based Insurance Can Help Avoid Penalties

You can delay enrollment if you have job-based insurance or COBRA coverage, as these count as creditable coverages. However, it’s important to enroll within eight months of when your employer coverage ends or else risk a late enrollment penalty.

A lesser-known fact is that if your spouse still works and has an active health plan, this counts too. This rule applies even if they aren’t on Medicare yet. So hang onto that spouse’s current job.

Bear in mind though: penalties could still occur for those who miss their initial enrollment period without having any other form of valid insurance like from an employer plan. But wait…there’s more.

The government also offers equitable relief which may waive off the premium penalty under certain conditions such as proving misinformation or misleading advice was given about benefits.

Remember:Misinformation should never cost you extra.

| Premium Penalty Eliminator | Description |

|---|---|

| Job-based Insurance Coverage | No need to rush into Medicare until after retirement or end of COBRA coverage |

| Equitable Relief Appeal | File an appeal with Social Security to potentially avoid penalties |

| Medicare Savings Program (MSP) Eligibility | If you qualify, MSP can eliminate the penalty. Now that’s what we call a real lifesaver. |

Enrolling in Medicare Part B without Penalty

Avoiding the Medicare Part B penalty can seem like a daunting task. But, don’t fret. With some careful planning and understanding of your options, you can enroll without attracting any penalties.

Calculating Your Premium Penalty

The first step is to know what’s at stake if you delay enrollment. The base Part B premium for 2023 is $164.90. If late-enrollment comes into play, expect an additional charge of 10% per every 12-month period delayed after your initial eligibility expires.

This means that for each year you put off enrolling in Original Medicare past the Initial Enrollment Period (IEP), this Late-Enrollment Penalty gets tacked on top of your monthly premium cost – and it stays there as long as you have Part B coverage.

If this seems overwhelming, take heart: there are ways to avoid these charges altogether.

- Maintain job-based insurance:

- If you or your spouse currently has employer health coverage through work or union membership when turning age 65 – keep it. You may not need to pay premiums until either employment ends or employer coverage terminates.

- Savings Programs:

- The Federal Government offers assistance via Affordable Care programs such as Medicaid and other state-sponsored plans that help low-income seniors with their medical costs.

Appealing Medicare Part B Penalty

You’ve got a penalty letter from the Social Security Administration (SSA) for late enrollment in Medicare Part B, but don’t fret. You have a period of two months to present your argument and validate it. Let’s explore how.

Evidence Needed for an Appeal

To make a strong appeal, you need evidence that shows why you delayed enrolling or that proves coverage by job-based insurance during the initial enrollment period. Gather up documents like letters from past employers confirming your health coverage or tax returns showing employment during this time.

Your spouse’s current employer can also provide useful proof if their plan covered you. And remember: when it comes to appeals, more is better – every piece of paper strengthens your claim.

The next step? File SSA’s request for reconsideration form. This simple yet crucial document lets you state your reasons and submit supporting evidence.

If appealing seems daunting or confusing, seek help at places like the Medicare Rights Center, which provides guidance on navigating through these processes effectively.

Penalties are not pleasant surprises in retirement planning, but with proper knowledge and tools at hand – they’re manageable hurdles rather than insurmountable obstacles.

Seeking Assistance for Medicare Penalty Waiver

Dealing with a Medicare Part B penalty waiver can feel like navigating through murky waters. But, you’re not alone in this journey. The Medicare Rights Center, your trusted partner, is here to lend a hand.

Utilizing the Services of the Medicare Rights Center

The beauty of turning to the Medicare Rights Center lies in its expertise and firsthand experience with situations just like yours. They offer help that’s rooted in understanding what it feels like to be caught up in such complexities.

This organization provides comprehensive guidance on avoiding penalties related to delayed enrollment or resolving issues if your employer coverage ends unexpectedly. You might even get tips about how an MSP (Medicare Savings Program) could potentially waive off these penalties altogether.

You don’t need any prior knowledge when seeking their help – they will explain everything from A-Z so you won’t feel lost anymore.

Contacting Social Security for Your Current Job Situation

If you’re still employed, don’t worry. It’s important that social security understands your current job situation too; hence making contact with them is crucial as well. Also check Medicare Open enrollment.

Remember: accurate information helps make sure no one has got it wrong regarding premium calculations and potential waivers based on employment status.

- Note down details about your spouse’s employer too if applicable since every little detail matters.

Bonus tip:Be persistent yet polite – let them see why getting this penalty waived off means so much to you personally.

Contacting Social Security for Medicare Penalty Waiver

Reaching out to the Social Security Administration (SSA) about your Medicare Part B penalty waiver might feel like a daunting task. Let’s break it down into achievable steps.

FAQs in Relation to Penalty Waiver

Can Medicare Part B penalty be waived?

Yes, a waiver can be used to ditch the Medicare Part B late enrollment penalty if you meet specific conditions like having job-based insurance.

How to calculate Medicare Part B late enrollment penalties?

To calculate Medicare Part B late enrollment penalties, multiply 10% of the base premium by each full year you were eligible but didn’t enroll. The total gets tacked onto your monthly payment.

Can you avoid paying for Medicare Part B?

Avoiding payment for Medicare Part B isn’t possible, but you can avoid penalties by taking advantage of timely or special enrollment periods and maintaining credible coverage through work.

Is there a cap on the Medicare penalty?

No, there is no upper limit on the Medicare penalty. Penalties stick around as long as you’re enrolled in Part B, so it’s vital to enroll when first eligible.

Table of Contents:

- Understanding Medicare Part B Penalty Waiver

- Eligibility for Medicare Part B Penalty Waiver

- Options to Avoid Medicare Part B Penalty

- Enrolling in Medicare Part B without Penalty

- Appealing Medicare Part B Penalty

- Seeking Assistance for Medicare Part B Penalty Waiver

- Contacting Social Security for Medicare Part B Penalty Waiver

- FAQs in Relation to Medicare Part B Penalty Waiver

- Conclusion

Streamlining the Medicare Surcharge Calculation Process.

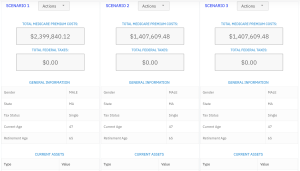

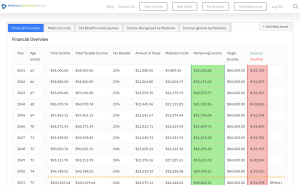

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.