It is essential for financial professionals to stay informed about changes in the Medicare Part B premium landscape. In this post, we’ll investigate the causes of these alterations and give a complete summary of what you can anticipate from Part B premiums in 2023.

For a breakdown of the 2023 Medicare costs click here.

We will begin by discussing the various outpatient services covered by Medicare Part B and its relationship with other parts of the program, such as Parts A and D insurance premiums. Next, we’ll explore how standard monthly premiums and deductibles are changing in 2023, including an analysis of factors leading to decreased costs for beneficiaries.

Furthermore, our discussion will cover income-based surtaxes affecting higher-income individuals enrolled in Medicare Part B. We’ll also guide you through key enrollment period dates and strategies for optimizing your coverage during open enrollment periods. Lastly, we’ll examine the increasing popularity of Medicare Advantage plans compared to Original Medicare while shedding light on legislative efforts impacting prescription drug costs under Part D enrollees.

Stay tuned as we navigate through these crucial topics surrounding Part B premium 2023 updates that every financial professional should be aware of.

Understanding Medicare Part B

Medicare Part B is an essential component of the overall Medicare program, covering outpatient services such as doctor visits, lab tests, and preventive care. It works alongside Part A (hospitalization coverage) and Part D (prescription drug coverage). For those enrolled in a Medicare Advantage plan instead of original Medicare, the Part B premium still applies.

Outpatient services covered by Medicare Part B

- Clinically necessary medical services:

- – Doctor visits – Lab tests – X-rays – Mental health care

- Durable medical equipment:

- – Wheelchairs – Walkers

- Ambulance services:

- Mental health care:

- Vaccinations and immunizations:

The relationship between Parts A, B, and D

In order to have comprehensive healthcare coverage through the Medicare program, beneficiaries typically need to be enrolled in both Parts A and B known collectively as Original Medicare and may also choose to enroll in a separate prescription drug plan or opt for a bundled package through private insurers known as Medicare Advantage plans.

For a comparison of Original Medicare verse Medicare Advantage Plans click here.

Understanding Medicare Part B is an important part of retirement planning and requires careful consideration. Financial advisers must be aware of the alterations to typical premiums and deductibles in 2023, as this will have a significant impact on their customers’ strategies.

2023 Changes to Standard Monthly Premiums and Deductibles

In 2023, most Medicare beneficiaries will see a decrease in their standard monthly premiums for Part B due to a surplus generated by lower-than-anticipated spending on Aduhelm. Additionally, the deductible for this part will also be reduced from its previous amount to $226.

- Factors contributing to decreased premiums: The Centers for Medicare & Medicaid Services (CMS) has announced that the average Part B premium will decrease in 2023as a result of cost savings from changes made within the program. This includes lower drug prices and an increase in competition among private insurers offering coverage under the Medicare Advantage plans.

- Reduced deductibles for beneficiaries: Along with lowered monthly premiums, CMS has confirmed that the annual deductible associated with Part B coverage is set to decrease from its current level. In 2023, enrollees can expect their out-of-pocket costs related to outpatient services like doctor visits and lab tests covered by Part B to decrease, making healthcare more affordable overall.

Overall, the 2023 changes to standard monthly premiums and deductibles are beneficial for most Part B beneficiaries. Nevertheless, those with higher incomes could face an income-based surcharge that might lead to a noteworthy rise in their premium expenses. IRMAA brackets are as follows:

| Individual MAGI | Couple MAGI | Part B | Part D (per/mo) |

|---|---|---|---|

| < $97,000 | < $194,000 | $164.90 | Premium (varies) |

| $97,000 - $123,000 | $194,000 - $246,000 | $230.80 | Premium + $12.40 |

| $123,000 - $153,000 | $246,000 - $306,000 | $329.70 | Premium + $32.10 |

| $153,000 - $183,000 | $306,000 - $366,000 | $428.60 | Premium + $51.70 |

| $183,000 - $500000 | $366,000 - $750,000 | $527.50 | Premium + $71.30 |

| >$500,000 | >$750,000 | $560.50 | Premium + $77.90 |

The Impact of Income-Based Surtax on Higher-Income Individuals

In 2023, some higher-income individuals may experience an increase in their Medicare Part B premiums due to the implementation of a new income-based surtax. This surtax will apply to those with modified adjusted gross incomes above $500,000 or married couples with combined incomes exceeding $750,000.

Criteria for being subject to income-based surtax

- Individuals with a modified adjusted gross income (MAGI) over $500,000 per year

- Married couples filing jointly with a combined MAGI over $750,000 per year

Calculating your potential increased premium costs

To estimate how much your Medicare Part B premium might increase due to the new surtax, you can use online tools like the Centers for Medicare & Medicaid Services’ Premium Calculator. By inputting your relevant financial information and selecting appropriate options from dropdown menus, this calculator will provide an estimated monthly premium based on current rates and any applicable additional charges.

Grasping the consequences of an income-based surtax on Part B premiums is essential for those with higher incomes. With this in mind, it’s equally important to consider key dates and strategies when navigating open enrollment periods to optimize your coverage.

Open Enrollment Period Considerations

The Open Enrollment period is a crucial time for Medicare beneficiaries, as it allows them to make changes to their health insurance plans. Running from October 15 through December 7 each year, this window offers the opportunity to switch between Original Medicare and Medicare Advantage plans or enroll in a standalone prescription drug plan. As costs change annually based on factors like inflation rates, staying informed about potential savings opportunities is essential.

Key Dates for Enrollment Periods

- Annual Open Enrollment: October 15 – December 7

- Medicare Advantage Open Enrollment: January 1 – March 31 (source)

- Special Enrollment Periods: Vary depending on circumstances (e.g., moving out of service area)

Strategies for Optimizing Your Medicare Coverage

To ensure you’re getting the most out of your coverage during open enrollment, consider comparing different options such as Original Medicare vs. Advantage plans or evaluating whether adding additional Part D prescription drug coverage would be beneficial. Additionally, consult with financial professionals who specialize in healthcare retirement planning and can help calculate IRMAA costs tailored to your specific situation.

When considering Part B premiums for 2023, it is important to understand the key dates and strategies available during open enrollment periods. Additionally, exploring the benefits of a Medicare Advantage plan can be beneficial in understanding out-of-pocket expense limits and comparing coverage with Original Medicare.

The Popularity and Benefits of Medicare Advantage Plans

Approximately 45% of all eligible recipients choose Medicare Advantage Plans over traditional fee-for-service programs offered under Parts A & B respectively. These alternative offerings typically provide additional benefits beyond what the basic package offers while maintaining caps on out-of-pocket expenses related to medical treatment received from network providers.

Comparing Medicare Advantage plans with Original Medicare

- Original Medicare: Consists of Part A (hospital insurance) and Part B (medical insurance), provided by the federal government.

- Medicare Advantage: Also known as Part C, these plans are offered by private insurers approved by the Centers for Medicare & Medicaid Services (CMS). They include both Parts A and B coverage, often with added benefits such as prescription drug coverage or dental care.

Out-of-pocket expense limits for beneficiaries

Most Medicare Advantage plans provide a cap on out-of-pocket costs, unlike Original Medicare which has no limit. The expenditure ceiling for beneficiaries can be notably advantageous, particularly when necessitating recurrent health care or treatments that may otherwise produce pricey bills in conventional fee-for-service plans.

Beneficiaries can take advantage of Medicare Advantage plans due to the out-of-pocket expense limits they offer. With new legislation impacting Part D enrollees, it’s important to understand how prescription drug costs may be affected in the future.

Legislative Efforts Impacting Part D Enrollees

Legislation passed by Congress, such as the Inflation Reduction Act, is set to take effect next year, positively impacting Part D enrollees by lowering the cost of some medications. This development suggests that overall popularity and enrollment in Medicare Advantage plans may continue to rise in the near future.

How New Legislation Will Affect Prescription Drug Costs

- The Inflation Reduction Act aims to reduce out-of-pocket expenses for beneficiaries with high prescription drug costs.

- This act caps annual increases on certain medication prices at inflation rates, ensuring more affordable access for those enrolled in Medicare’s prescription drug coverage program.

Projected Trends in Enrollment Numbers

A combination of lower premiums and deductibles for Parts A and B along with decreased medication costs due to legislative efforts could lead more individuals towards enrolling into Medicare Advantage plans. As a result, it is expected that an increasing number of beneficiaries will choose these alternative options over Original Medicare or standalone Part D programs provided by private insurers like UnitedHealthcare or Humana.

Conclusion

Understanding the changes to Part B premiums in 2023 is crucial for financial professionals. Most beneficiaries will see a decrease in their premiums due to various factors, but higher-income individuals may be subject to a new surtax. It’s important to consider Open Enrollment Period options and the benefits of Medicare Advantage plans when advising clients on their healthcare options.

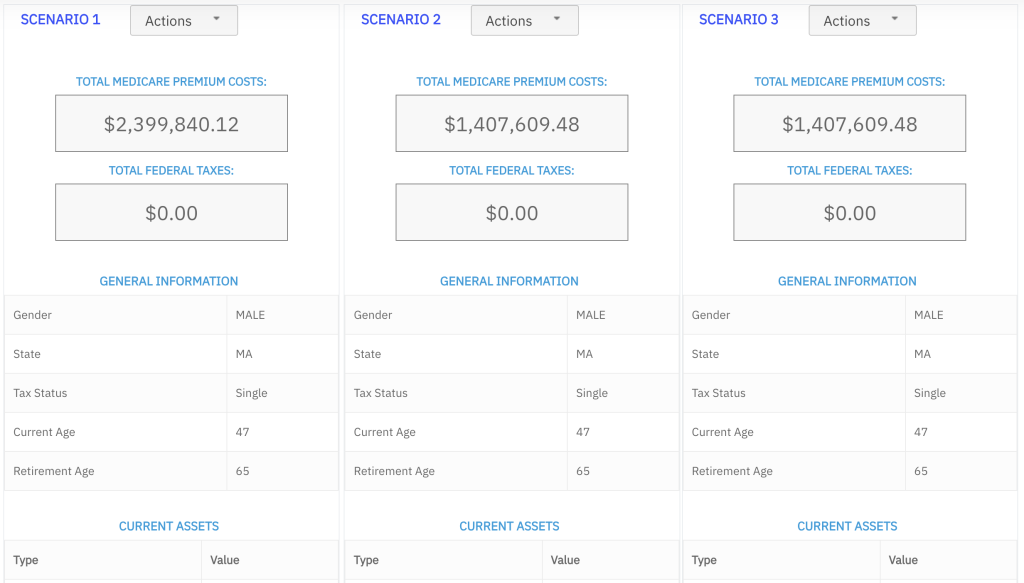

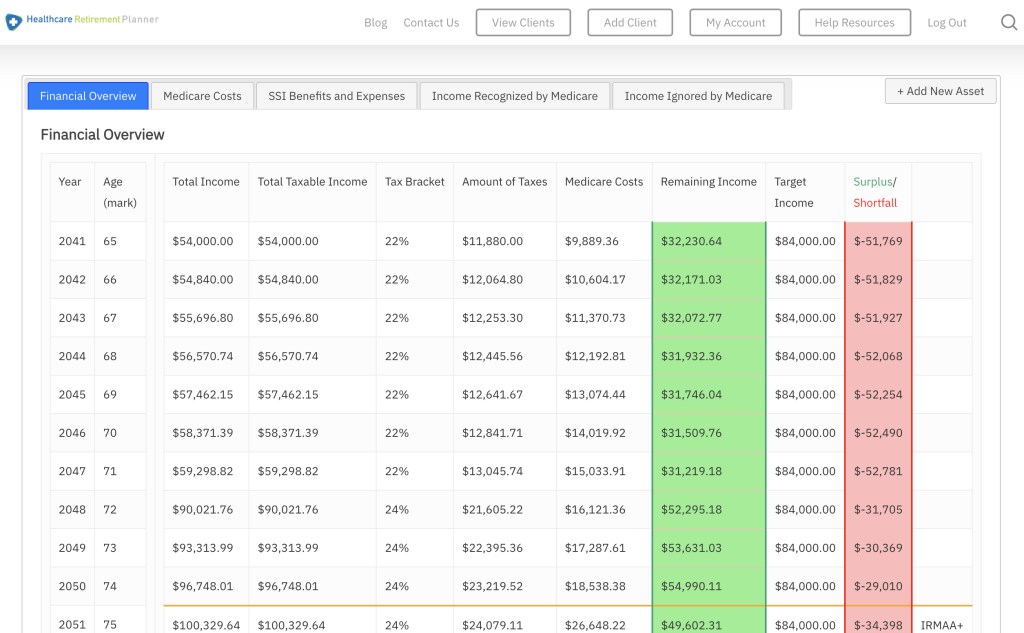

At Healthcare Retirement Planner, we understand the significance of staying informed about changes to Medicare and other healthcare policies. Our Healthcare Retirement Planner tool can help you guide your clients through these complex decisions and ensure they get the best coverage for their needs. Try it out today!