Imagine yourself staring at a stack of tax forms, feeling like you’ve wandered into a foreign language class? One form in particular might have caught your eye – Form 8959. Sounds mysterious, right?

If the name alone doesn’t get your heart racing, its purpose surely will. You see, Form 8959 is no ordinary document; it’s the gatekeeper to understanding and managing Additional Medicare Tax. Picture this: It’s like that one jigsaw puzzle piece you’ve been searching for to complete the complex picture of your taxes.

The question is – do you know how to tackle it without losing sleep or pulling out all your hair? Well folks, consider this blog post as stepping onto a magic carpet ride destined for stress-free navigation through Form 8959 land.

Let’s dive into this exciting journey, as we unravel the secrets of what truly matters.

Understanding Form 8959 and the Additional Medicare Tax

If you’re making a decent income, Uncle Sam wants to make sure he gets his cut in taxes. The taxman uses Form 8959, or as we like to call it, “the bill for the extra slice of your Medicare wages pie”. This form helps calculate if you owe any additional Medicare tax.

Defining the Additional Medicare Tax

The Regular Joe’s guide to understanding this is simple: imagine regular Medicare tax as your basic cable subscription – everyone pays that. But if you want those premium channels (i.e., earn more than certain threshold amounts), there’s an extra fee involved – here enters our star of the show: Additional Medicare Tax.

This isn’t just some arbitrary number pulled out of a hat; it’s specifically calculated at a rate of 0.9% on certain types of income which exceed set limits including self-employment income and RRTA compensation.

Key Components of Form 8959

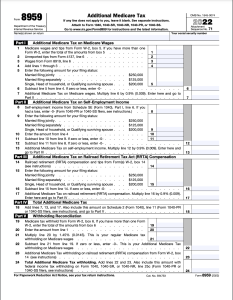

We all know filling out forms can feel like navigating through a maze blindfolded while juggling flaming torches but let me help break down this one for you into three manageable parts:

- Your W-2 income,

- Your Self-Employment Income,

- RRTA Compensation (Yes. It includes Railroad Retirement folks too.).

Who is Required to File Form 8959?

The necessity to file Form 8959 revolves around your income and filing status. Specifically, the form needs attention when wages or Railroad Retirement Tax Act (RRTA) compensation exceed certain thresholds.

Impact of Filing Status on Requirement to File

Filing status plays a significant role in these threshold amounts. For instance, if you’re single, head of household, a qualifying widow(er), or married filing separately (and lived apart from your spouse all year), you need to file this form if your Medicare wages reach $200k within the calendar year.

If you’re married and opt for joint return i.e., ‘married filing jointly’, that figure jumps up – you’ll have to fill out Form 8959 once those earnings surpass $250k.

Note: If you’re living with your spouse at any point during the tax year but choose ‘married filing separately’, that wage cap plummets down dramatically – it’s just $125k.

All this started back in tax-year 2013 according to TurboTax Live . So don’t let self-employment income slip through either. It counts towards these caps too.

Download your Form 8959 Below

Table of Contents:

Step-by-step Guide to Filing Form 8959

Filing the Form 8959 may seem daunting, but it’s actually straightforward if you follow these steps.

Downloading Form 8959

To start, download Form 8959 from the IRS website. This is your first step towards reporting additional Medicare tax on your return.

Instructions for Completing Form 8959

The form consists of three sections: W-2 income, self-employment income, and RRTA compensation. Fill out the applicable section(s) of Form 8959 based on your income type for the calendar year, and if uncertain about any aspect or how to calculate additional Medicare tax owed, consult a financial expert or use an online service such as TurboTax Live Full Service.

Reporting Additional Medicare Tax on Form 1040

Your total calculated additional Medicare tax should be reported on line nine in Section two (Additional Taxes) of your Federal Income Tax Return (Form 1040).

Note: Always double-check all entries before filing. Mistakes can lead to delays in processing and possible penalties.

Calculating and Paying the Additional Medicare Tax

Let’s demystify how to calculate the Additional Medicare Tax. This tax is an extra 0.9% that’s applicable when your income surpasses specific cutoff points, for instance $200k in one year for people filing individually.

Impact of Withholding on Additional Medicare Tax

Your employer plays a big role here. They’re required to withhold this additional tax from your wages once they surpass $200k within a year. But what if you’re self-employed? You’ll need to factor this into your estimated tax payments throughout the year.

TurboTax Live Assisted, among other resources, can provide guidance about these calculations. If it turns out that too much has been withheld by your employer or paid through estimated taxes, don’t worry – any overpayment will be applied against the overall income tax liability on your annual filing.

Bear in mind though, underpaying could result in penalties so always ensure accuracy while calculating this Additional Medicare Tax (Form 8959).

Consequences of Mismanaging Form 8959 and the Additional Medicare Tax

The consequences for not correctly handling Form 8959 can be quite serious. If you owe more due to this additional tax, it’s crucial that arrangements are made to pay extra in the following year through estimated payments or added withholding.

Overpayments on your annual income tax filing, for instance, could lead to a potential refund being applied against any outstanding taxes owed. This IRS audit consideration is an important aspect of managing your Additional Medicare Tax obligations properly.

But what if you underpay? The Underpayment Penalty for Additional Medicare Tax might apply, causing even more financial headaches down the line.

Filing Form 8959 accurately also means avoiding unnecessary interactions with compliance considerations like dealing with refunds from excess Additional Medicare Taxes paid out previously – a process which can be tedious and time-consuming at best.

FAQs in Relation to Form 8959

What is form 8959 for?

Form 8959 is used to calculate and report Additional Medicare Tax. This tax applies if your income exceeds certain limits.

Who needs to fill out form 8959?

If you’re a single filer earning over $200k, or filing jointly with income over $250k, you need to complete Form 8959.

Why does Turbotax say I have form 8959?

TurboTax may flag Form 8959 if it detects your earnings surpass the threshold for Additional Medicare Tax liability.

Who is subject to the additional Medicare tax?

The Additional Medicare Tax affects folks whose wage, self-employment or RRTA compensation exceeds specified amounts based on their filing status.

Conclusion

Mastering Form 8959 is like unlocking a secret code in your tax journey. By now, you should know the nuts and bolts of this form and Additional Medicare Tax.

Check your filing status – it could determine whether or not you have to submit Form 8959. So check those income thresholds closely.

Navigating through each section might seem daunting at first but with patience and focus, it’s manageable. Make sure to pay special attention when calculating and paying that additional tax too.

Mismanaging this process could lead to penalties or even an audit scare – something nobody wants!

In essence, approach Form 8959 as a puzzle waiting for its pieces to fall into place rather than an intimidating roadblock on your path towards successful tax filing!

Streamlining the Medicare Surcharge Calculation Process.

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.