Deciding between a Roth vs Traditional 401k can feel like navigating through a financial maze.

The choices you make today will impact your future, specifically your retirement lifestyle. It’s essential to understand the differences and benefits of each option.

A Roth 401k provides the potential for tax-exempt withdrawals when you retire, as opposed to a traditional 401k which permits pre-tax contributions but taxes your retirement distributions.

This might seem straightforward at first glance, but choosing between a Roth vs Traditional 401k requires considering several factors such as current income level, expected future tax bracket and employer matching policies among others.

Decoding the Roth vs. Traditional 401(k) Debate

The decision between a Roth 401(k) and traditional 401(k) can often seem like navigating through an intricate maze for many investors. Each of these retirement accounts brings its unique set of benefits to the table, but understanding their key differences is paramount in making an informed choice.

A Roth 401(k) may be an attractive option for younger investors in lower tax brackets due to its taxation of contributions with after-tax dollars, allowing withdrawals during retirement to remain tax-free. The allure lies within how contributions are taxed – with after-tax dollars, meaning that although you pay taxes now, your withdrawals during those golden retirement years will be completely tax-free.

This could potentially lead to significant savings if you foresee being catapulted into a higher tax bracket upon reaching your retirement age due to career advancement or other similar factors. As such, it’s no surprise that nearly all employer-sponsored plans offer this alongside regular options today.

In contrast, the Traditional IRA and regular (or conventional) 401(k) stand where contributions are made using pretax dollars – giving immediate relief on current income by reducing it by the contributed amount up front. However, unlike Roth IRAs which allow untaxed withdrawals post-retirement, distributions from these types would then fall under federal income taxes based on applicable rates depending on earnings and deductions at that time period.

This essentially boils down to paying taxes either now versus later: If your future self might land in lower tax brackets than what applies presently because of reduced earning potential or planned relocation, etc., then opting for the traditional route may prove financially prudent since any withdrawal-related taxation would end up less burdensome overall compared to having paid them upfront under the Roth arrangement.

To wrap things up: While both investment vehicles bring their own merits depending on individual circumstances including age, expected lifetime earnings trajectory, etc., one thing remains clear regardless: careful planning combined with a thorough understanding of each type’s distinct features helps maximize long-term gains while minimizing associated risks when reaping the rewards earned through disciplined saving over decades’ worth of a working life span.

Key Takeaway:

Choosing between a Roth and Traditional 401(k) is like picking your way through a maze. Younger investors in lower tax brackets may favor the Roth’s after-tax contributions, ensuring tax-free withdrawals during retirement. Conversely, those anticipating lower future taxes might opt for the immediate relief of pre-tax contributions offered by traditional plans. In either case, understanding these accounts’ unique

The Nuts and Bolts of Contributions and Withdrawals

Contributions to Roth 401(k) and Traditional 401(k) accounts differ significantly in terms of tax implications. With a Roth account, contributions are made with after-tax dollars. This implies that the income is taxed before it’s funneled into your retirement savings.

In contrast, when contributing to a Traditional 401(k), pre-tax dollars are used. These funds lower your taxable income for the current year but will be subject to taxes upon withdrawal during retirement years.

Understanding Early Withdrawal Penalties

Counseling clients about their financial future involves discussing potential penalties linked with early withdrawals from both types of accounts. For instance, individuals who start withdrawing from either type of account prior to reaching the age of 59½ without qualifying exceptions may face an additional penalty on top of federal income taxes on withdrawn amounts.

This IRS guideline on early distributions offers comprehensive information about various scenarios where penalties apply – a valuable tool when guiding clients through this complex topic.

Focusing now on withdrawals during post-retirement: there exist key differences between these two investment options which can considerably impact net retirement savings depending upon one’s tax bracket at the time they withdraw those funds.

- Roth accounts offer unique advantages as far as taxation goes – since many retirees find themselves falling within lower tax brackets due to reduced earnings compared to working years; having already paid taxes upfront could result in significant overall tax benefits by avoiding higher rates applicable earlier.

- In comparison, while the immediate benefits offered by reducing current taxable incomes via pre-tax deductions might seem attractive initially, however, considering the fact that all future withdrawals would then become liable for whatever rate applies based on total cumulative inflows including employer contributions plus other sources like pensions, etc., choosing the regular over Roth option could potentially land contributors within a higher bracket, thus resulting in increased liabilities later down the line if not planned carefully ahead.

Key Takeaway:

Contributing to a Roth 401(k) means paying taxes upfront, potentially benefiting retirees in lower tax brackets. On the other hand, Traditional 401(k)s use pre-tax dollars that can reduce current taxable income but may result in higher future liabilities if not strategically planned. Beware of early withdrawal penalties on both accounts.

Unraveling Investment Options within Retirement Accounts

Weighing up between a Roth 401(k) and conventional 401(k) can have a major impact on the investment alternatives open to you. Both retirement accounts offer numerous opportunities for portfolio diversification and risk management.

Roth and Traditional 401(k)s typically allow investments in mutual funds, which are collections of stocks, bonds, or other securities that provide an easy way to spread out your holdings across different sectors and companies. This approach helps mitigate the risks associated with investing in individual stocks.

Diversifying Your Portfolio: A Key Risk Management Strategy

Diversification is not just about reducing risk; it’s also about optimizing potential returns over time. By having assets that react differently to market conditions some may perform well when others do not you create balance within your portfolio.

This balanced mix allows for more consistent growth while minimizing the impact of any single poor-performing investment on overall performance. The ultimate goal here? Aiming for continual long-term growth by blending high-risk/high return investments with low-risk/low yield ones.

Bond Funds: An Essential Element

Another common feature found in both Roth and traditional 401(k) plans is bond funds a type of fixed-income security known for its stability compared to equities (stocks). These make them attractive options, especially if you’re seeking stable income streams during retirement years.

In essence, bonds represent loans made by investors like yourself to borrowers such as corporations or government entities who promise regular interest payments until maturity at this point, they repay the principal amount initially invested.

Navigating Target-Date Funds

A popular choice among many retirement savers is target-date funds which are a specific kind of mutual fund designed around the expected retirement age.

The allocation between various asset classes changes automatically as one approaches their targeted date the idea being younger workers have room for more early-on risk but need increased stability closer towards retiring.

Key Takeaway:

Choosing between a Roth and Traditional 401k significantly impacts your investment options. Both provide opportunities for diversification through mutual funds, bonds, and target-date funds. The goal is to balance high-risk/high-reward investments with lower-risk ones for steady long-term gains.

How Your Current Income and Tax Bracket Affect Your Choice

Your present income level, coupled with your tax bracket, are pivotal factors in the Roth vs. The taxation of each account type is a key factor to consider when weighing the options between Roth and Traditional 401(k) savings plans, given your income level and tax bracket. Understanding how these variables interact with retirement savings can significantly impact long-term financial planning.

The crux of this matter lies within the taxation structure of each account type. With a Roth, contributions made from after-tax dollars allow for tax-free withdrawals during retirement years which is a stark contrast to traditional 401(k)s where pre-tax dollar contributions result in taxes due upon withdrawal at future rates.

Projecting Future Tax Brackets

Predicting one’s future tax brackets plays an integral role when choosing between a Roth or Traditional account. If you anticipate being placed into higher tax brackets by the time you retire than those currently applicable, it might be beneficial to pay taxes upfront through contributing towards Roth 401(k)s now rather than later, thus potentially saving significant amounts via federal income taxes once qualified distributions commence as they would then be completely free from further levies.

Keep in mind that with Traditional accounts any withdrawal will count as ordinary income.

This ordinary income can lead to the taxation of Social Security benefits as well as higher Medicare costs due to IRMAA,

In contrast, if predictions lean more towards lower post-retirement earnings compared to current figures which could likely place you into less taxing basis it may prove advantageous opting for Traditional IRAs instead; deferring payment until such times when overall cost reductions over longer periods become substantial thanks largely due reduced taxable incomes right away…

Key Takeaway:

Your current income and tax bracket are key in choosing between a Roth or Traditional 401k. A Roth, with after-tax contributions, allows for tax-free withdrawals during retirement unlike the taxed withdrawals of a Traditional 401k. Predicting future tax brackets is crucial; higher future taxes favor Roths while lower ones lean towards traditional accounts.

Employer Contributions – A Key Factor in Decision Making

When evaluating Roth 401(k) and Traditional 401(k), the role of employer contributions cannot be overstated. Both retirement accounts can receive these inputs, but they come with different tax implications.

In a traditional 401(k), employers make their contributions using pre-tax dollars. This reduces your current taxable income, resulting in immediate tax savings. However, when you start withdrawing from this account during your retirement years, both your original contribution and any earnings are subject to federal income taxes.

Roth accounts tell a slightly different story; while employees’ Roth contributions into Roth 401(k) are made after-tax, allowing them to grow tax-free over time for potential tax-free withdrawals at retirement age, the employer’s part still goes in as pre-taxed funds which will then be taxed upon withdrawal during the post-retirement period.

The Influence of Matching Contributions

A feature common among many companies is matching employees’ investments up to certain limits – either percentage or dollar-based, like five percent of an individual’s salary perhaps. This essentially equates to free money towards securing one’s future. But it also comes bundled with some taxation considerations that differ between regular and Roth accounts.

Vesting Schedules: Another Crucial Aspect

Beyond just the matching component itself lies another key element known as vesting schedules dictating how long you must stay employed before gaining full ownership rights over these matched funds from your company. Vesting schedules, typically range from immediate vesting where all matched funds belong outrightly to you once deposited into your account – through graded or cliff-vested arrangements where either proportional ownership increases yearly until fully vested after several years (graded); or no ownership conferred until after a specified period has elapsed (cliff).

In conclusion, understanding thoroughly about aspects such as early withdrawal penalties alongside factors discussed so far – contributions, withdrawals, current income level, predicted future tax bracket – helps make informed decisions on whether choosing options like Roth IRAs versus more conventional ones would better serve financial goals for individuals planning ahead for the golden days post-retirement

Key Takeaway:

Choosing between Roth and Traditional 401(k) isn’t just about taxes; employer contributions, matching policies, and vesting schedules play vital roles too. Remember: in a traditional 401(k), both your contribution and earnings are taxed upon withdrawal while only the employer’s part is taxable for Roth accounts. Don’t overlook ‘free money’ from matches or ownership rights via

Social Security Benefits and Your Retirement Savings Strategy

When devising a plan for retirement savings, taking into consideration Social Security benefits is essential. These government-funded resources can provide a consistent income stream during your golden years.

The type of retirement account you select could potentially influence the amount received from Social Security. For example, withdrawals from Traditional 401(k) or IRA accounts are considered taxable income, which might impact Social Security due to specific taxation rules.

Roth accounts offer an alternative with tax-free withdrawals at retirement age. This means that these distributions don’t contribute towards determining if part of your Social Security benefit is subject to federal taxes.

Leveraging Roth Accounts for Optimizing Social Security Benefits

Distributions from Roth IRAs and 401(k)s are not considered in the IRS’s provisional income calculations, thus they won’t increase a person’s tax burden on Social Security payments. This unique feature makes them appealing options, particularly for those expecting higher tax brackets during their post-work era or foreseeing significant increases in earnings over time.

Navigating Traditional Account Withdrawals’ Impact on Taxes

If Traditional accounts like regular 401(k)s or IRAs appeal more than Roth ones because of factors such as employer contributions matching schemes, then understanding how withdrawal impacts Social Security taxes becomes crucial. Your required minimum distributions (RMDs), starting at age 73 and or 75 under current law with these types of plans, would be factored into calculating whether some portion of your Social Security benefits become taxable – something worth considering while planning comprehensively for financial stability after retiring. The official website provides further insights here.

Making Strategic Choices To Optimize Retirement Income

To optimize both private savings and public entitlements requires strategic choices around saving vehicles, including but not limited to deciding between Roth vs traditional investment products based on individual circumstances.

This includes evaluating projected future earning potential, current lifestyle needs, expected expenses post-retirement, among other factors.

Finding Professional Guidance

An IRMAA Certified Professional is well versed with these nuances and can provide valuable

Key Takeaway:

When planning for retirement, consider how your choice of savings account could affect Social Security benefits. Traditional 401(k) or IRA withdrawals may be taxable and impact these benefits. On the other hand, Roth accounts offer tax-free withdrawals that don’t factor into federal taxation on Social Security payments. Strategic choices based on individual circumstances can optimize both private savings and public entitlements.

Making an Informed Decision – Weighing All Factors

When deciding between a Roth 401(k) and Traditional 401(k), one must consider their current income, anticipated future tax bracket, contributions from both the employee and employer, withdrawal rules applicable to each account, as well as available investment options in order to make an informed decision. These include your current income, anticipated future tax bracket, contributions made by you and your employer, withdrawal rules applicable to both accounts, as well as available investment options.

In essence, choosing the right type of account depends heavily on personal circumstances and long-term financial objectives. For example, if you are currently in a lower tax bracket but expect to be in a higher one during retirement years, then contributing towards a Roth account could offer significant tax advantages since withdrawals will be exempt from taxes at that time.

Consulting With Financial Professionals

The complexities involved necessitate seeking professional advice for personalized insights. Expert advisors have deep knowledge about Roth 401(k) and Traditional IRA accounts, including their respective pros and cons.

- A comprehensive evaluation of all aspects such as Social Security benefits or additional savings strategies like mutual funds can ensure effective planning for retirement needs.

- An advisor’s expertise extends beyond understanding how different types of accounts affect current income taxes or what happens when withdrawing from them – they can also assist with predicting potential changes over time which may significantly influence decisions.

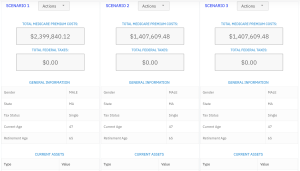

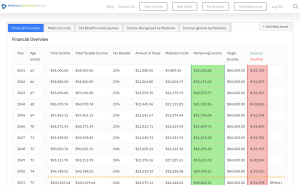

We Assist Financial Professionals To Calculate IRMAA Costs In A Client’s Retirement Plan

Besides helping individuals understand their options regarding Roth vs traditional accounts, we also aid financial professionals in calculating Income-Related Monthly Adjustment Amount (IRMAA) costs within clients’ retirement plans. This calculation plays a vital role in forecasting healthcare expenses during later life stages.

This service, combined with our expert advice, ensures holistic support towards achieving secure retirements across varying income levels catering to diverse lifestyle requirements.

Key Takeaway:

Choosing between a Roth 401(k) and Traditional 401(k) isn’t one-size-fits-all; it’s about your income, expected tax bracket at retirement, contributions, withdrawal rules and investment options. Don’t fly solo – professional advice can help navigate these waters for personalized insights that factor in all aspects of your financial landscape.

FAQs in Relation to Roth vs Traditional 401K

Is it better to do a Roth 401k or Traditional?

Your tax bracket, both current and projected for retirement, should guide your choice. If you anticipate being in a higher tax bracket during retirement, consider the Roth 401k.

Should I split my 401k between Roth and Traditional?

Diversifying contributions can be beneficial as it provides flexibility with taxable income in retirement. However, this strategy depends on individual circumstances like income level and future tax predictions.

Why should I do a Roth instead of a 401k?

Roth accounts offer potential tax-free withdrawals at retirement if certain conditions are met. This could be advantageous if you expect higher taxes upon retiring.

Why should I choose Roth over Traditional?

If you’re currently in a lower tax bracket but expect to move into a higher one by retirement time, choosing the Roth option might provide more benefits due to its unique taxation structure.

Conclusion

Decoding the Roth vs Traditional 401k debate is a journey.

You’ve discovered key differences between these retirement savings options.

The nuances of contributions and withdrawals have been laid bare, including early withdrawal penalties.

Your current income level and tax bracket play significant roles in this decision-making process, as do projected future tax brackets.

Employer contributions are not to be overlooked either; they’re vital cogs in this financial machine.

Social Security benefits? Yes, they too factor into your overall retirement strategy alongside your chosen account type.

Informed decisions require weighing all factors – from contribution types to employer matching policies – it’s about finding what suits you best for a comfortable retirement life.

And remember: You don’t have to navigate this complex landscape alone! At Healthcare Retirement Planner, we assist financial professionals calculate IRMAA costs in clients’ retirement plans which can help make more informed decisions on choosing between Roth or Traditional 401k based on individual circumstances and goals for retirement savings. Get started today!

Table of Contents:

- Decoding the Roth vs. Traditional 401(k) Debate

- The Nuts and Bolts of Contributions and Withdrawals

- Unraveling Investment Options within Retirement Accounts

- How Your Current Income and Tax Bracket Affect Your Choice

- Employer Contributions – A Key Factor in Decision Making

- Social Security Benefits and Your Retirement Savings Strategy

- Making an Informed Decision – Weighing All Factors

- FAQs in Relation to Roth vs Traditional 401K

- Conclusion

Streamlining the Medicare Surcharge Calculation Process.

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.