Gazing out from the precipice, one is met with a landscape of unknowns. That’s what figuring out your 2024 irmaa brackets can feel like – intimidating and somewhat mystifying. You might ask yourself, “How does my income impact my Medicare premiums? Can life-changing events affect these costs?” But don’t worry! We’re here to act as your compass.

In this exploration, we’ll venture through the labyrinth of IRMAA premiums (Income-Related Monthly Adjustment Amount), deciphering its complexities. Together we will unearth how it influences your monthly adjustment and medicare premium amounts based on modified adjusted gross income from two years ago.

But we’re not stopping there. We’ll guide you through possible life-changing situations that might make you eligible for an appeal against higher Medicare premiums. Plus, we’ll delve into strategies like Roth conversions which could potentially help cut those costs down.

2024 Brackets

| Individual MAGI | Couple MAGI | Part B | Part D |

|---|---|---|---|

| < $103,000 | < $206,000 | $174.70 | Premium (varies) |

| $103,000 to $129,000 | $206,000 to $258,000 | $244.60 | $12.90 |

| $129,000 to $161,000 | $258,000 to $322,000 | $349.40 | $33.30 |

| $161,000 to $193,000 | $322,000 to $386,000 | $454.20 | $53.80 |

| $193,000 to $500,000 | $386,000 to $750,000 | $559.00 | $74.20 |

| > $500,000 | > $750,000 | $594.00 | $81.00 |

Compare to 2023 Brackets

| Individual MAGI | Couple MAGI | Part B | Part D (per/mo) |

|---|---|---|---|

| < $97,000 | < $194,000 | $164.90 | Premium (varies) |

| $97,000 - $123,000 | $194,000 - $246,000 | $230.80 | Premium + $12.40 |

| $123,000 - $153,000 | $246,000 - $306,000 | $329.70 | Premium + $32.10 |

| $153,000 - $183,000 | $306,000 - $366,000 | $428.60 | Premium + $51.70 |

| $183,000 - $500000 | $366,000 - $750,000 | $527.50 | Premium + $71.30 |

| >$500,000 | >$750,000 | $560.50 | Premium + $77.90 |

Understanding 2024 IRMAA

The landscape of Medicare premiums is largely shaped by the Income-Related Monthly Adjustment Amount (IRMAA Thresholds). Understanding the Medicare costs and how they’re influenced by your income level can seem daunting, but it doesn’t have to be.

What is IRMAA?

Let’s break down what this acronym means. The term ‘IRMAA‘ stands for Income-Related Monthly Adjustment Amount. It’s an extra charge added to your standard Part B premium if your Modified Adjusted Gross Income (MAGI) exceeds a certain threshold.

In 2024, that standard Part B premium sits at $174.70. However, not everyone will pay this amount due to their MAGI from two years ago – yes, you read right. Your current year’s Medicare premiums are based on tax returns filed two years prior.

Impact of MAGI on IRMAA

MAGI plays a critical role in determining where you fall within the 2024 IRMAA brackets. This figure combines your adjusted gross income (AGI) and any non-taxable interest earned during the year – so it goes beyond just taxable earnings when considering eligibility for higher Medicare premiums.

If you’ve been wondering why Social Security benefits matter in this context – here’s why: some part or all of these benefits may be included as taxable income depending upon other sources of revenue during that fiscal year which might bump up one into another bracket unexpectedly.

Familiarizing yourself with these aspects helps avoid unpleasant surprises come tax season because being proactive now can save headaches later down line while ensuring better healthcare planning for retirement life ahead.

For example, let’s say your MAGI in 2023 was $110,000. Come 2024, you’ll find yourself within the IRMAA thresholds requiring a higher premium because of that past income level.

Navigating The Brackets

So, these brackets the government has put together are all about fairness. They’re there to make sure everyone chips in for Medicare costs based on what they can afford.

Key Takeaway:

Understanding the 2024 IRMAA Brackets: The amount you’ll pay for your Medicare premiums in 2024 hinges on your Modified Adjusted Gross Income (MAGI) from two years ago. A higher income might mean a steeper premium. But it’s not just about fairness – grasping these brackets can help dodge unexpected costs and plan more effectively.

Table of Contents:

- Understanding 2024 IRMAA Brackets

- How Life-Changing Events Affect Your IRMAA

- Reviewing Changes in the 2024 IRMAA Brackets

- Strategies to Reduce Your IRMAA Surcharges

- Navigating the Process of Appealing Your IRMAA Surcharges

- Impact of Filing Status on Your Medicare Premiums

- FAQs in Relation to 2024 Irmaa Brackets

- Conclusion

FINANCIAL PROFESSIONALS!

SEE HOW YOUR PRACTICE CAN GROW WITH 80% APPOINTMENT RATES AT SEMINARS WITH THE IRMAACP .

How Life-Changing Events Affect Your IRMAA

Life has a way of throwing curveballs, and these sudden shifts can impact your Income-Related Monthly Adjustment Amount (IRMAA). You might be asking yourself: “What does marriage or divorce have to do with my Medicare premiums?” Well, let’s unravel this together.

The Social Security Administration takes into account major life events when determining your IRMAA appeal. For instance, tying the knot or untangling it through a divorce could cause fluctuations in your income bracket. This change could result in an increased monthly premium if you’re not careful.

Work Stoppage or Reduction – More than Just Lost Wages?

A work stoppage/reduction is another significant event that can influence your IRMAA amount surcharges. If you’ve had to reduce your hours of work or stop working altogether due to health issues or other circumstances, it could have a drastic effect on your AGI and thus place you in a lower IRMAA bracket, resulting in reduced payments for Medicare Part B and prescription drug coverage.

This shift would place you in a different IRMAA bracket potentially lowering what you pay for Medicare Part B and prescription drug coverage. The good news? These changes make beneficiaries eligible for an IRMAA appeal.

Pension Puzzles – How Does Loss of Pension Impact My Premiums?

Losing certain types of pension income is another crucial life-changing event recognized by the Social Security Administration. Say goodbye to those golden years if losing this source lands you into higher tax brackets.

It’s worth noting, though, that there may be solutions accessible. By filing an appeal and providing documentation of the change in income, you might get your Medicare premiums adjusted.

The Unforeseen Effects

Life’s curveballs, like getting married or divorced, or experiencing changes in your job situation can significantly alter your income. These shifts could potentially catapult you into a higher IRMAA bracket.

Key Takeaway:

Life’s sudden shifts, like marriage, divorce or job changes can impact your IRMAA. These events might push you into a higher income bracket, upping your Medicare premiums. But don’t worry. You have options – file an appeal and provide proof of income change to potentially adjust those pesky premiums.

Reviewing Changes in the 2024 IRMAA Brackets

Changes are afoot, but not to worry. We’ve got you covered on the alterations happening with 2024’s IRMAA brackets. What alterations have been made to IRMAA brackets for 2024?

Understanding the Changes in IRMAA Brackets

The short answer? Not much. In fact, if we compare this year’s numbers to last year’s figures for both Part B and D surcharges, it’s like looking at identical twins. This means that your Medicare premiums might not see significant hikes.

In other words, don’t sweat too much over potential increases due to changes in these income-related monthly adjustments or standard premiums. But remember – knowledge is power.

This is where our analysis of the “Income-Related Monthly Adjustment Amount”, or more simply known as “IRMAA”, comes into play. Let me share some exciting stats here (well, they’re probably more ‘reassuring’ than ‘exciting’). If you recall from last year – brace yourself for déjà vu – because yes indeed: “The income brackets and Part D IRMAA surcharges are unchanged between 2023 and 2024.”

You might be asking why there were no major shifts? Well my friends, think about it like baking a cake; just as adding extra sugar doesn’t always make things sweeter (sometimes it can turn cloyingly sweet), changing thresholds every so often won’t necessarily equate to better results either.

To give an analogy — consider traffic signals which remain consistent regardless of whether roads change slightly over time. It provides familiarity while ensuring smooth navigation for drivers. The same principle applies to these IRMAA brackets, providing a stable reference point for Medicare beneficiaries.

So if you’re seeing red thinking about higher Medicare premiums due to changes in the 2024 IRMAA Brackets, breathe easy. But remember, stay alert because change is always on the horizon.

Key Takeaway:

Don’t stress about 2024 IRMAA bracket changes – they’re more like doppelgangers to the previous year’s. This means your Medicare premiums probably won’t spike due to these income-related adjustments. However, keep an eye out because change is always lurking around the corner.

FINANCIAL PROFESSIONALS!

SEE HOW YOUR PRACTICE CAN GROW WITH 80% APPOINTMENT RATES AT SEMINARS WITH THE IRMAACP .

Strategies to Reduce Your IRMAA Surcharges

Looking for ways to lessen your Medicare premiums? One effective method is managing your MAGI through Roth conversions. You may ask, “How can a Roth conversion impact my MAGI?” Well, let’s break it down.

Understanding Roth Conversions

A Roth conversion, in simple terms, lets you transfer money from a traditional IRA or 401(k) into a tax-free Roth account. This move results in paying income taxes on the transferred amount during the year of the conversion. But why pay taxes now when you could delay them?

The answer lies in how these conversions can potentially lower future taxable income and thus affect your IRMAA income and bracket.

In fact, using strategies like this might help keep those pesky higher Medicare premiums at bay. With proper planning and execution, controlling income via methods such as capital gains management or pension distribution decisions could prove beneficial.

Moving onto some key stats – did you know that managing income through these techniques might prevent triggering higher Medicare premiums? Now that’s something worth considering.

If there are life-changing events such as marriage or divorce impacting your earnings though; don’t fret just yet. Such occurrences qualify beneficiaries for an IRMAA appeal – basically requesting Social Security Administration (SSA) to use more recent tax return data instead of figures from two years ago while calculating their premium adjustment.

But remember – not all who wander into retirement financial planning are lost; but they sure need good guidance. After all, keeping track of your IRMAA surcharges, and knowing how to keep them in check can go a long way in ensuring that retirement is the relaxing period of life it’s meant to be. So let’s get started with those Roth conversions.

Key Takeaway:

premiums by strategically managing your MAGI. Use smart methods like Roth conversions, capital gains control, and pension distribution decisions. And don’t forget – if life’s curveballs have hit your earnings hard, you can appeal IRMAA surcharges using recent tax return data. So go ahead, start tackling those pesky premiums with savvy strategies.

Navigating the Process of Appealing Your IRMAA Surcharges

Feeling unfairly burdened by your Income-Related Monthly Adjustment Amount (IRMAA) surcharges? You’re not alone. Don’t fret; there’s a way to challenge the IRMAA charges if you think they’re unjust.

Your Right to Appeal

You have every right to question your Medicare costs. This is especially true when it comes to Form SSA-44, which is used in appealing IRMAA income assessments. The key here lies in understanding what qualifies as a life-changing event and how it can affect your AGI.

The Social Security Administration acknowledges several events that might lead you into an unjustly higher Medicare premium bracket. These include work stoppage or reduction, marriage, divorce, or loss of certain types of pension income among others.

Gathering Required Documentation

To kick-start the appeals process for your 2024 IRMAA brackets adjustment, you’ll need proof. That means gathering relevant documentation about any significant changes in your financial situation since filing joint tax returns two years ago.

This could be anything from job loss papers to documents showing property loss due to unforeseen circumstances like natural disasters. Remember: solid evidence goes a long way towards winning this battle against hefty Medicare premiums.

Filing Your Appeal

Once all necessary documents are compiled, submit them alongside Form SSA-44 through mail or personally at the nearest social security office. Explain why current records do not accurately reflect expected earnings due likely factors such as retirement plan adjustments after work stoppage/reduction etcetera within Part III Section C on the form itself.

Keep in mind that IRMAA is re-evaluated annually as income changes. So, if there’s no life-changing event and you end up paying higher Medicare premiums for one year, don’t despair. You can still take action next time around to ensure a more fair assessment of your situation.

Awaiting the Decision

After submission, patience becomes key.

Key Takeaway:

the Social Security Administration’s response. Don’t just sit and wait, though. Use this time to double-check your documentation, making sure it’s bulletproof. It might seem like a hassle now, but putting in the work could save you big bucks down the line.

Impact of Filing Status on Your Medicare Premiums

Your tax filing status can greatly impact your Medicare premiums. Let’s take a look at how this plays out, especially for joint filers.

The Connection Between Tax Returns and IRMAA Brackets

It all starts with your IRS tax return. The Social Security Administration uses the MAGI reported on it to determine where you fall in the IRMAA brackets. Higher income means higher IRMAA Medicare surcharges and more costly monthly premiums.

A married couple who opts for filing a joint tax return will have their combined incomes considered when calculating these charges. But here’s the kicker: If one spouse earns significantly less than the other, they could end up paying a hefty premium due to being lumped into a higher income bracket together.

Marrying Up… In More Ways Than One?

If you marry someone whose earnings put them in an upper-tier IRMAA bracket while yours keep you comfortably below that threshold, tying the knot could mean tying yourself to their elevated rates. Dreaming of ‘marrying up’ isn’t what most people imagine when they think about tying the knot.

This is because as far as Uncle Sam is concerned, two become one – financially speaking – once those vows are exchanged. So even if your individual income would qualify you for standard Medicare costs or lower-income-related monthly adjustments under single-filer rules, hitching your wagon to someone else’s star might land both of you with heftier healthcare expenses after retirement.

The Impact On Standard Medicare Premiums And Surcharges

In 2024, individuals with a MAGI of $103,000 or less pay the standard Medicare Part B premium. For joint filers, this limit is set at double that amount – $206,000.

But remember, even going over these limits by just a single dollar could land both partners in the next bracket. This would mean facing an IRMAA surcharge on top of their existing payments.

Key Takeaway:

Your tax filing status can pack a punch on your Medicare premiums. Married and filing jointly? Your combined incomes could push you into higher IRMAA brackets, leading to heftier monthly payments. Tying the knot with a high earner may unexpectedly elevate your healthcare costs post-retirement.

FAQs in Relation to 2024 Irmaa Brackets

What is the Medicare Irmaa for 2024?

The 2024 IRMAA varies based on income. It impacts how much you pay for Medicare Part B and D premiums.

What year is 2024 Irmaa based on?

Your 2024 IRMAA will be determined by your Modified Adjusted Gross Income (MAGI) from two years prior, in this case, 2022.

What will Medicare premiums be in 2024?

In 2024, the standard premium for Medicare Part B sits at $174.70 monthly but could rise depending on your MAGI.

What is the projected Part B premium for 2024?

The projected standard premium of Medicare Part B in 2024 has been set at $174.70 per month.

FINANCIAL PROFESSIONALS!

SEE HOW YOUR PRACTICE CAN GROW WITH 80% APPOINTMENT RATES AT SEMINARS WITH THE IRMAACP .

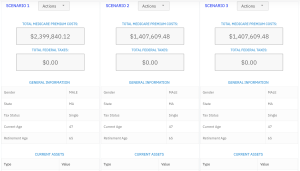

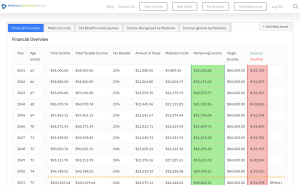

Streamlining the IRMAA Surcharge Calculation Process.

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.

![Navigating the Medicare 2024 IRMAA Brackets: [UPDATED PREMIUMS]](https://www.healthcareretirementplanner.com/wp-content/uploads/2023/07/2024-IRMAA-Brackets.png)