Modified Adjusted Gross Income (MAGI) Calculation Method

To understand how IRMAA is calculated, we need to familiarize ourselves with the Modified Adjusted Gross Income (MAGI) method.

This calculation helps determine whether a Medicare beneficiary qualifies for additional charges.

So, what exactly constitutes MAGI?

- Gross income: This includes wages, salaries, tips, and other forms of compensation before deductions like taxes or retirement contributions.

- Tax-exempt interest: Interest earned from investments that are not subject to federal income tax. Examples include municipal bonds and certain savings accounts.

- Social Security benefits: The portion of your Social Security benefits that is taxable at the federal level also contributes to your MAGI calculation.

The reason behind using MAGI for determining IRMAA eligibility lies in its ability to provide an accurate representation of one’s financial status while enrolled in Medicare Parts B and/or D plans. Essentially, it ensures high-income earners contribute more towards funding our healthcare system through increased premium payments – keeping things fair.

Determining Eligibility for IRMAA Charges

If you’re wondering about your own potential IRMAA status – worry not. We’ve got you covered with some key factors used by the government when making their initial determination:

- Your most recent tax return: Your adjusted gross income (AGI) plus any untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest.

- Income thresholds: In 2023, IRMAA applies to individuals with incomes exceeding $97,000 or married couples filing jointly with incomes above $194,000.

Remember that your eligibility for IRMAA can change over time due to fluctuations in income levels or life events such as retirement or job loss. It is critical to stay on top of any alterations in order to avoid paying additional fees and preserve your funds.

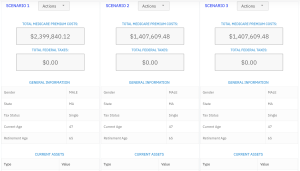

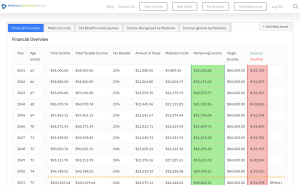

Looking for a tool that helps financial professionals calculate their clients’ potential IRMAA costs? Check out the Healthcare Retirement Planner.

Key Takeaway:

The Modified Adjusted Gross Income (MAGI) method is used to determine IRMAA charges for Medicare beneficiaries. MAGI includes gross income, tax-exempt interest, and taxable Social Security benefits. Eligibility for IRMAA charges depends on income thresholds and can change over time due to fluctuations in income levels or life events such as retirement or job loss.

Origins of IRMAA Legislation

Let us review the past to understand how IRMAA legislation came into existence.

IRMAA, or the Income Related Monthly Adjustment Amount, was born out of the 2003 Medicare Modernization Act. This legislation had one key goal in mind: fairness.

Key Components of the 2003 Medicare Modernization Act

The act introduced several essential changes to Medicare. For starters, it created Part D – a prescription drug benefit program for seniors and disabled individuals. But that wasn’t all. The legislation also established income-based adjustments for Parts B and D premiums – hello, IRMAA.

Effects of Introducing Income-Based Adjustments on Healthcare Financing

You might be wondering why this change was necessary? In short: financial stability within the U.S healthcare system. Before 2003, everyone paid similar premium amounts regardless of their income level. With IRMAA, higher-income beneficiaries now contribute more towards funding healthcare through increased premium payments.

It’s important to note that IRMAA applies to individuals with higher incomes. If you’re wondering whether you fall into this category, you can check your IRMAA status by reviewing your most recent Social Security statement. This statement will show your initial IRMAA determination and any changes to your IRMAA status.

It’s also worth noting that you can avoid paying IRMAA charges. One way to do this is by keeping your income below the threshold for IRMAA-based premiums. Another way is to appeal your IRMAA determination if you believe it was calculated incorrectly.

It’s essential to be aware that IRMAA may shift in the future. In fact, the IRMAA thresholds are adjusted annually based on inflation. For example, the IRMAA calculated for 2023 will likely be different from the IRMAA calculated for 2023.

Need assistance with calculating IRMAA costs in retirement plans? Contact Healthcare Retirement Planner today.

FAQs in Relation to What is Irmaa:

What is IRMAA?

IRMAA, or Income-Related Monthly Adjustment Amount, is an additional charge added to Medicare Part B and Part D premiums for beneficiaries with higher incomes. It’s based on the Modified Adjusted Gross Income (MAGI) reported on tax returns from two years prior. The purpose of IRMAA is to help cover the costs of healthcare services for all Medicare beneficiaries.

What are the current IRMAA brackets?

The following are the brackets for 2023

| Individual MAGI | Couple MAGI | Part B | Part D (per/mo) |

| < $97,000 | < $194,000 | $164.90 | Premium (varies) |

$97,000 - $123,000

| $194,000 - $246,000 | $230.80 | Premium + $12.40 |

| $123,000 - $153,000 | $246,000 - $306,000 | $329.70 | Premium + $32.10 |

| $153,000 - $183,000 | $306,000 - $366,000 | $428.60 | Premium + $51.70 |

| $183,000 - $500000 | $366,000 - $750,000 | $527.50 | Premium + $71.30 |

| >$500,000 | >$750,000 | $560.50 | Premium + $77.90 |

Do both spouses have to pay IRMAA?

Yes, if both spouses are enrolled in Medicare and their combined income exceeds the specified threshold, they may each be subject to individual IRMAA charges. This applies even if they file joint tax returns since Medicare premiums are determined separately per beneficiary.

Why was IRMAA enacted?

IRMAA was enacted as part of the Medicare Modernization Act in 2003. Its primary goal is ensuring financial sustainability within the Medicare program by requiring higher-income beneficiaries to contribute more towards their healthcare costs, thus helping to maintain the quality and accessibility of services for all Medicare participants.

It’s important to note that IRMAA applies to Medicare beneficiaries who have an initial IRMAA determination or a change in their IRMAA status. If you want to avoid paying IRMAA charges, it’s essential to understand how IRMAA is calculated and take steps to avoid it.

Overall, IRMAA is an important consideration for financial professionals who work with clients approaching retirement age. By understanding how IRMAA is based on income and how it applies to Medicare premiums, you can help your clients plan for their healthcare costs in retirement.