Retirees in Medicare that have too much income are finding out the hard way that IRMAA is not a good thing, and they will also realize that IRMAA surcharges in 2024 is most likely not going to be any better than IRMAA amount in 2023.

According to the Medicare Board of Trustees, who oversee the financial operations of Medicare, costs of Medicare as well as IRMAA determination and the income-related monthly surcharges are, in fact, going to be higher in the coming year.

The Trustees are projecting that when it comes to IRMAA premiums the surcharges will increase by over 6.00% for Medicare IRMAA-Part B and that IRMAA-Part D will inflate by 5.92% on average.

Both inflation rates are predicated on which specific income threshold a Medicare beneficiary will be in.

For IRMAA-Part B the highest rate of inflation will be in the first threshold of income as the IRMAA surcharge will grow by 6.07% while the 5th income threshold for IRMAA will only increase by 6.02%

However, this is not the same for Medicare prescription coverage, IRMAA-Part D premiums, as it will be the inverse.

Within the 1st IRMAA income threshold, the surcharge will only increase by about 5.70% while the highest income threshold for IRMAA will increase by over 6.00%.

When will Medicare Part B premiums for 2024 be announced? At the time of the Trustees Report the 2024 brackets for IRMAA Planning will be:

| IRMAA Brackets 2024 and Surcharges per month | |||||

| 1st IRMAA Threshold | 2nd IRMAA Threshold | 3rd IRMAA Threshold | 4th IRMAA Threshold | 5th IRMAA Threshold | |

| IRMAA-Part B | $69.90 | $174.70 | $279.60 | $384.40 | $419.40 |

| IRMAA-Part D | $12.90 | $33.30 | $53.80 | $74.20 | $81.00 |

As the IRMAA surcharges are increasing so will the premiums for Medicare Part B and D coverage too.

FINANCIAL PROFESSIONALS!

SEE HOW YOUR PRACTICE CAN GROW WITH 80% APPOINTMENT RATES AT SEMINARS WITH THE IRMAACP .

Medicare Part B Premiums 2024 and Part D premiums are expected to be:

-

- 6.00% increase in premiums for Medicare Part B premiums as the premium will be $174.80 a month.

- 6.00% increase, on a national average for Medicare Part D plan premium for medicare prescriptions.

Medicare Part D premium inflation rate:

Language within the Inflation Reduction Act of 2022 (IRA) places a cap on how high private health insurers who administer Part D coverage can increase premiums between the years of 2024 to 2029 regardless of market conditions.

The IRA states that starting in 2024 the premiums for Part D prescription drug coverage can only increase “by 6 percent or (by) the base beneficiary premium computed that would have applied if this paragraph had not been enacted”.

Again, regardless of what happens in terms of costs that the private health insurers, the maximum increase that Part D prescription drug plans can increase by is 6.00%.

Thankfully, Part D premiums do not influence the IRMAA-D surcharges as the Centers for Medicare Services (CMS) determines what they will be annually, but please note that your costs, regardless of you reaching IRMAA (income-related monthly Adjustment Amount) or not will be increasing annually.

Medicare Income Related Adjustment Amount, 2024 – will you reach it?

The answer to whether you will breach IRMAA in 2024 is all dependent on how much income you have earned in 2022. If you exceed the income thresholds then, yes, you will be in IRMAA, but keep in mind that the Trustees are projecting and also need many of you to remain in IRMAA to keep Medicare solvent.

In the Trustees 2022 report they, the Trustees, are projecting that about 6.8 million seniors will be in some part of IRMAA in 2023 and they will pay just over $20.0 billion in surcharges too.

These 6.8 million seniors being in IRMAA comprise roughly 15.4% of all eligible Medicare beneficiaries in the program. By 2024 this percent is expected to increase to over 16.55% and each year after there will be more and more people in IRMAA.

In fact, the Trustees are reporting that every other new enrollee for the next 8 years will enter into IRMAA and will be subject to higher costs.

What are the Medicare IRMAA brackets for 2024?

the following show what the brackets could possibly look like as of this time they are not decided

2024 IRMAA if CPI-U remains constant and legislation is not passed by Congress

| Individual | Couple | Part B | Part D |

|---|---|---|---|

| $102,500 | $205,000 | $174.80 | Premium (varies) |

| $102,500 - $130,000 | $205,000 -$260,000 | $244.70 | Premium + $12.90 |

| $130,000 - $162,000 | $260,000 - $324,000 | $349.60 | Premium + $33.30 |

| $162,000 - $193,500 | $324,000 - $387,000 | $454.40 | Premium + $53.80 |

| $193,500 - $500,000 | $387,000 - $500,000 | $559.20 | Premium + $74.20 |

| > $500,000 | > $750,000 | $594.20 | Premium + $81.00 |

FINANCIAL PROFESSIONALS!

SEE HOW YOUR PRACTICE CAN GROW WITH 80% APPOINTMENT RATES AT SEMINARS WITH THE IRMAACP .

Here is a breakdown of the percentage of Medicare beneficiaries expected to be in IRMAA and what their projected surcharges will be:

| Percent in IRMAA & Total Surcharges per year | |||

| Year | Part B | Part D | Total Surcharges (billions) |

| 2024 | 16.77% | 16.34% | $23.4 |

| 2025 | 17.86% | 17.33% | $27.4 |

| 2026 | 19.11% | 18.54% | $30.3 |

| 2027 | 20.32% | 19.74% | $37.8 |

| 2028 | 21.71% | 21.16% | $43.3 |

| 2029 | 23.06% | 22.32% | $49.8 |

| 2030 | 24.41% | 23.70% | $56.4 |

| 2031 | 25.79% | 25.12% | $63.8 |

Again, IRMAA is all about your income and if you can keep your income below the IRMAA income Thresholds then you should be fine.

But what income does IRMAA use?

When it comes to assessing IRMAA the Social Security Administration (SSA) will request your modified adjusted gross income (MAGI) from the Internal Revenue Service (IRS).

MAGI, according to the SSA, is your adjusted gross income (AGI) plus any tax-exempt interest you may have or everything on lines 2a and 11 of the 2022 IRS form 1040.

Some examples of income that will count towards IRMAA are monies from:

Wages, Interest, Capital Gains, Social Security benefits, Dividends and any distribution from tax-deferred investments like a Traditional 401(k), IRA, 403(b) and SEP accounts.

If you have assets in a Traditional 401(k) there is a real good chance that at some point in retirement you will reach an IRMAA Threshold.

Yes, again, there is a real good chance you will reach IRMAA because of your Traditional 401(k), 403(b) and/or IRA and the reason is simple: your RMD.

By law, people who invest into tax-deferred vehicles like a Traditional 401(k) are eventually required to make a minimum distribution (RMD) at some point in their lives.

This RMD will only increase as a person grows older which means there is MORE INCOME each year and this income will be:

-

- Taxed according to that your ordinary income tax rate.

-

- Counted with your Social Security benefit to ensure that your Social Security benefits will be taxable.

-

- Added back to your taxable Social Security benefit to ensure that at some point you enter into IRMAA.

Want to avoid IRMAA altogether?

That is simple, just speak with an IRMAA Certified Financial Professional and look to use Roth accounts as well as certain Annuities and Life Insurance policies. These are just a few of the financial instruments available to you that can generate an income that doesn’t count towards IRMAA.

But will the IRMAA Thresholds increase over time?

Legislation from Congress states that the IRMAA income thresholds are to adjust for inflation based on the consumer price index for urban consumers (CPI-U) from August to August each year.

If there is inflation then the IRMAA brackets should increase.

Since the implementation of IRMAA back in 2007 these brackets have only adjusted 6 out of the 15 years as Congress has consistently passed legislation blocking any increases in the IRMAA thresholds.

Currently, Congress has not addressed IRMAA or the subject of increasing/decreasing the income thresholds and if the rate of inflation remains constant the IRMAA income thresholds should increase by 6.00% in 2024.

What to expect for IRMAA in 2024:

Inflation is never a good thing, but in terms of IRMAA inflation may be a great thing as the income thresholds should increase because of it. The only thing possibly changing this outcome is if Congress, once again, steps in and passes legislation to stop it.

As for the surcharges, unfortunately, they will be going up and they are projected to continue going up for at least the next 8 years.

Remember, if you have assets in a Traditional 401(k), IRA, 403(b) or any tax-deferred vehicle you will eventually reach an IRMAA and that is all because of the RMD.

The plan for you now is very simple:

-

- Start working with an IRMAA Certified Financial Planner and avoid IRMAA or

- Bury your head in the sand with the belief that this will just go away and pay much more in IRMAA later when you can’t afford it.

The federal government has gone out of its way to explicitly inform the general public that Medicare is in fact heading to insolvency and it is going insolvent at a much quicker rate that even thought of.

The beauty of IRMAA for the federal government is that it is does two very specific things:

-

- IRMAA increases costs retirees must pay into Medicare. This means more revenue for the program.

- IRMAA is paid directly out of your Social Security benefit. This means that Social Security will have to pay out less and less as each year thus helping that program too.

Conclusion:

2024 IRMAA brackets will be worse than IRMAA 2023 and going forward IRMAA will simply become more and more of a problem for retirees.

The question you must ask yourself…

Do you want to control your Medicare costs, save your Social Security benefit and limit the amount of taxes you will pay in retirement?.

FINANCIAL PROFESSIONALS!

SEE HOW YOUR PRACTICE CAN GROW WITH 80% APPOINTMENT RATES AT SEMINARS WITH THE IRMAACP .

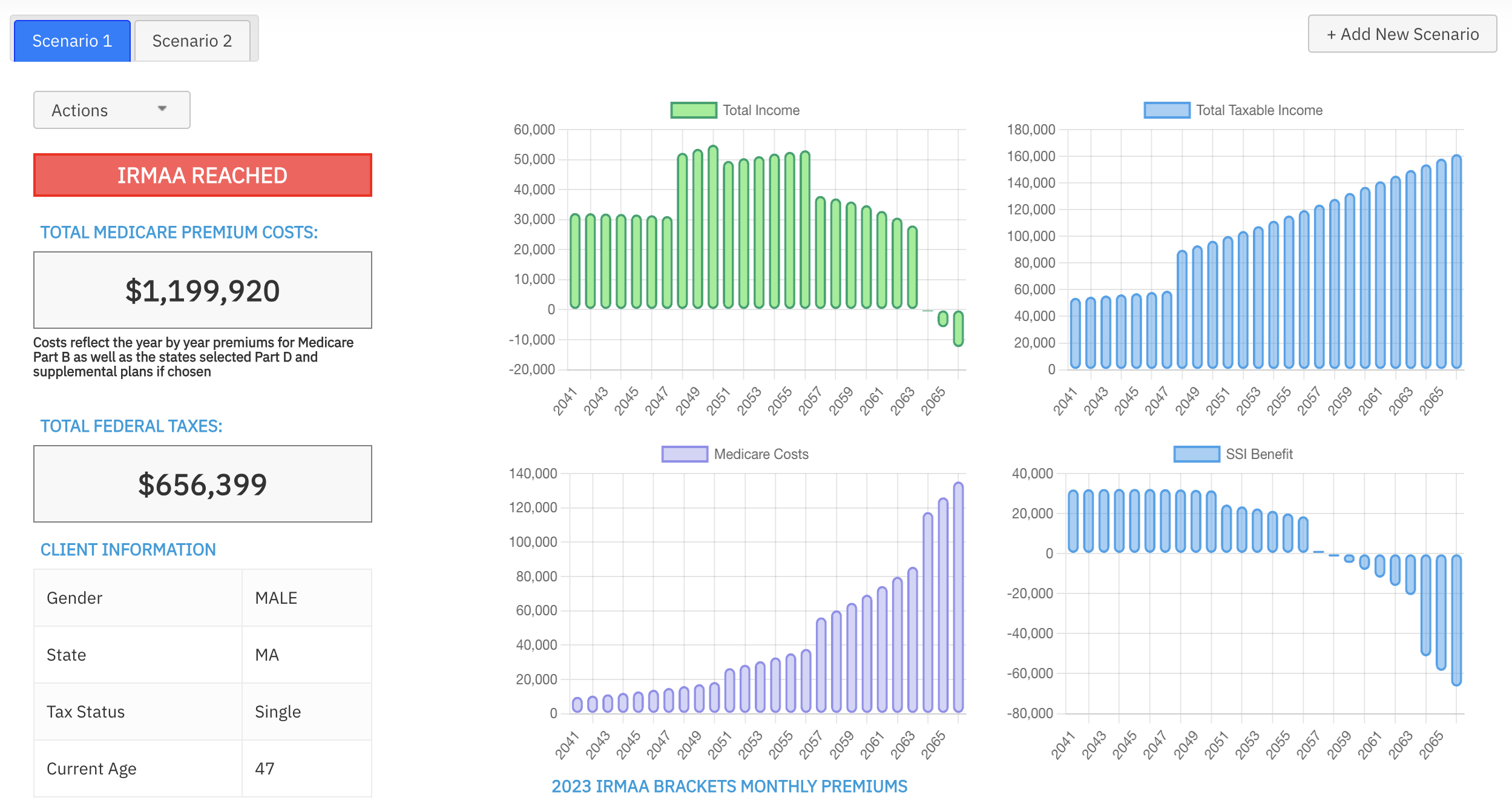

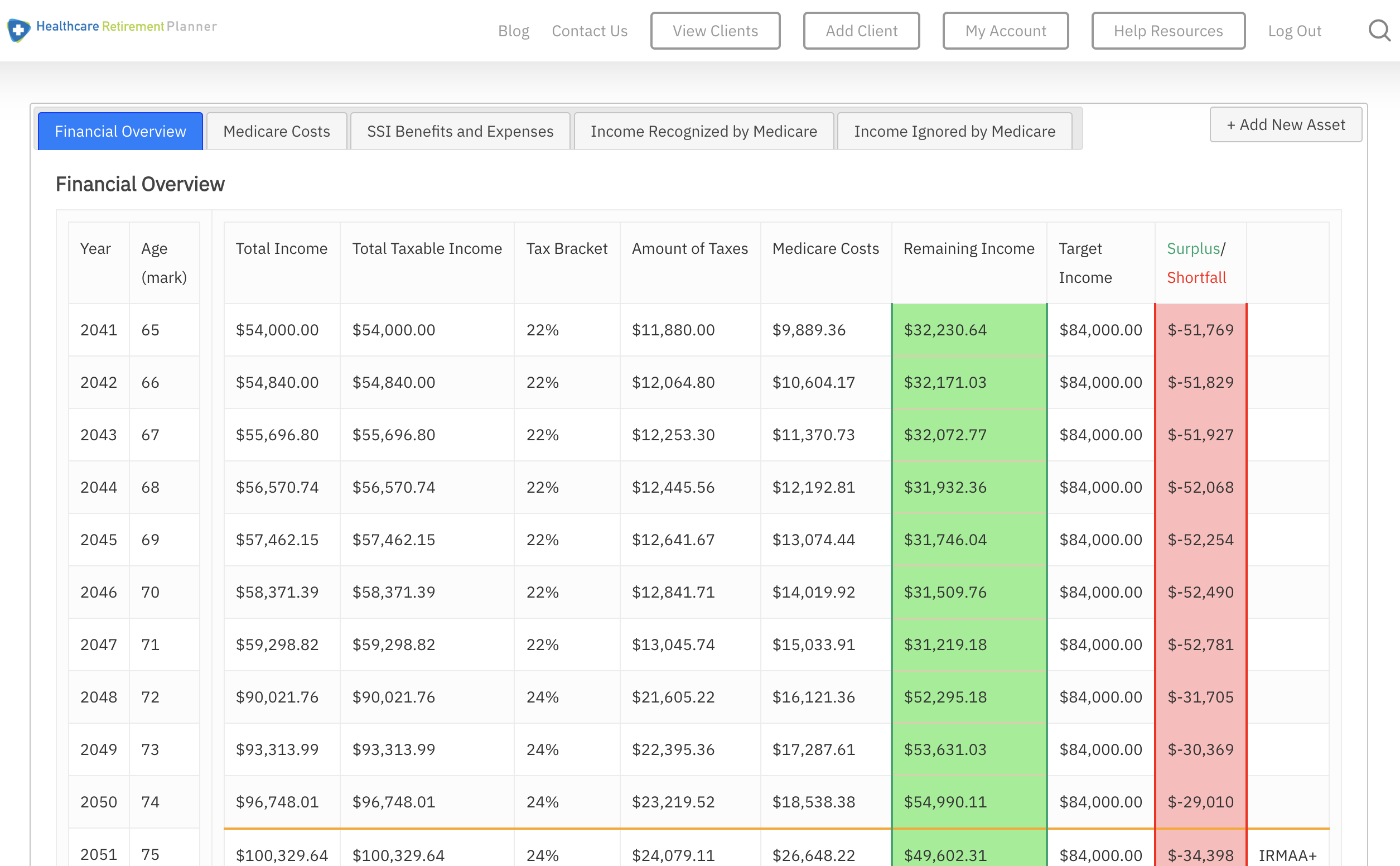

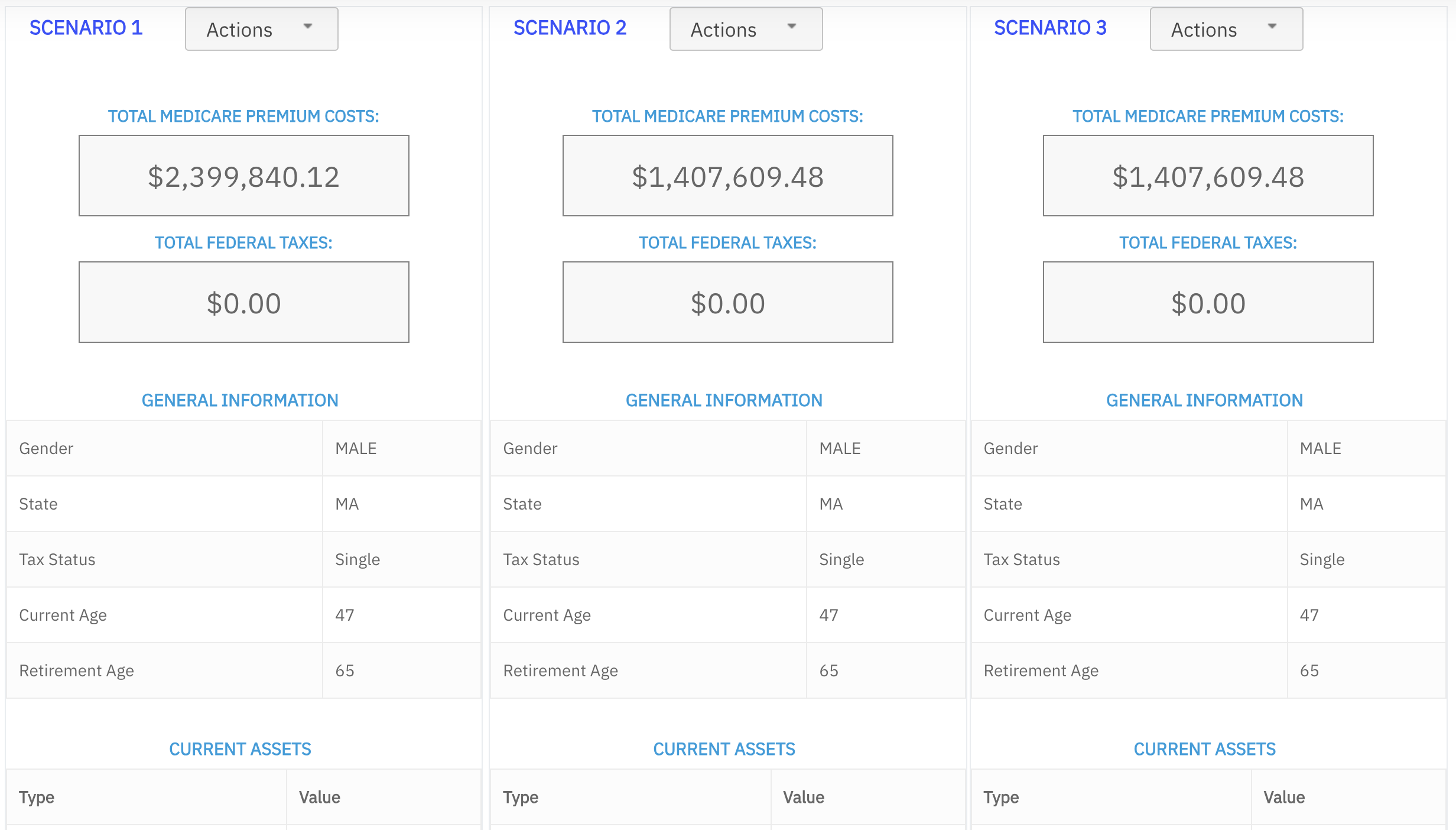

Streamlining the Medicare Surcharge Calculation Process.

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.

- Easy to Understand Overview

- Quick IRMAA Indicator

- SimpleTax and Surcharge Display

- Detailed year by year reporting of income and expenses

- Ability to Run multiple comparison reports

Frequently asked questions

How can I Learn More about IRMAA as a financial professional

If you would like to learn more you can go to www.irmaacertifiedplanner.com for certification and designation to be an IRMAA Certified Planner

What is IRMAA?

The Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an amount you may pay in addition to your Part B or Part D premium if your income is above a certain level.

Does everyone have to pay IRMAA

How do I calculate my IRMAA exposure over the duration of a retirement?

Using the software provided by www.healthcareretirementplanner.com