Understanding Roth IRA contribution limits is a critical aspect of retirement planning for financial professionals. These limits, which are adjusted periodically by the IRS, can significantly impact your clients’ long-term savings strategies.

In this comprehensive guide, we’ll delve into the intricacies of these Roth IRA contribution limits and explore factors that influence them. We will also compare the flexibility offered by Roth IRAs over Traditional IRAs, shedding light on conversion processes and withdrawal privileges.

Learn more about Traditional verse Roth by clicking here.

We will navigate high-income thresholds with backdoor options and discuss the importance of adhering to annual limits while emphasizing effective financial tracking in retirement planning. The article further explores tax-free distributions during retirement and potential taxation issues associated with early withdrawals from Roth IRAs.

Finally, we’ll share advanced planning strategies to avoid potential taxation problems and clarify eligibility rules governing participation in IRA accounts. By gaining a thorough understanding of Roth IRA contribution limits and related aspects, you can better serve your clients’ needs as they plan for their golden years.

Understanding Roth IRA Contribution Limits

Retirement planning can be a real headache, but understanding the contribution limits for a Roth IRA is a crucial step. 2023’s max could be $6,500, but these caps may fluctuate annually due to factors like income and marital status.

Projected Maximum Limit for Future Years

The IRS sets the maximum Roth IRA contribution limit each year based on inflation rates and other economic indicators. In 2023 the max is $6,500 or $7,500 if you’re 50 or older. Looking ahead to 2024 and beyond, there may be potential increases in these limits due to rising costs of living.

Factors Influencing Contribution Limits

Your ability to contribute to a Roth IRA depends on your modified adjusted gross income (MAGI). If your MAGI falls within certain ranges determined annually by the IRS, you might only be able to make partial contributions. And if your income exceeds these thresholds, you could be ineligible altogether (unless you use backdoor options, which we’ll discuss later). Filing status is also a critical factor – married individuals filing jointly have different income brackets compared to singles, while those filing separately face even stricter restrictions.

Flexibility of Roth IRAs Over Traditional IRAs

A Roth IRA is like a chameleon, adapting to your financial situation with ease. Unlike Traditional IRAs, it doesn’t discriminate based on your marital status or income. This flexibility gives you an edge in planning for your retirement.

Converting Traditional IRAs into Roths

If you’re married and your combined income exceeds the IRS limits for contributing directly to a Roth IRA, don’t worry. You can still contribute to a Traditional IRA and then convert those funds into a Roth account using the backdoor conversion strategy. Therefore, it is advisable to seek advice from a tax specialist before implementing the backdoor conversion strategy.

- Pro Tip: The backdoor conversion strategy works best if you don’t already have money in another Traditional IRA due to pro-rata taxation rules.

- Tax Implication: Although conversions are taxed as ordinary income, future withdrawals from the converted Roth will be tax-free provided certain conditions are met.

Withdrawal Privileges with No Penalties

Roth accounts offer more freedom when it comes time for withdrawal. You can withdraw your contributions (but not earnings) at any time without penalty or additional taxes. This makes them particularly attractive for younger investors who might need access to cash before reaching retirement age. However, keep in mind that early withdrawal of earnings may attract penalties unless specific exceptions apply.

In summary, a Roth IRA is an adjustable retirement investment vehicle that can be tailored to your financial circumstances. With the ability to convert traditional IRAs into Roth’s and withdrawal privileges with no penalties, it’s worth considering for your retirement planning.

Navigating High-Income Thresholds With Backdoor Options

Are you a high-income earner who wants to contribute to a Roth IRA but can’t due to IRS restrictions? Fear not, backdoor options are available. By making a non-deductible contribution to a traditional IRA and then converting it into a Roth, you can benefit from tax-free withdrawals during retirement despite the IRS restrictions on high earners.

Exploring Backdoor Options

Don’t let income thresholds hold you back from securing your financial future. With a backdoor Roth IRA, you can bypass restrictions and invest efficiently towards your golden years.

But be warned, the conversion process requires careful planning to avoid any rule violations or pro-rata rule implications. It’s always best to consult with financial advisors to guide you through each step.

Conversion Process From Traditional To Roth

Start by contributing money into your Traditional IRA account, then convert it into your Roth account. It’s that simple. Be sure to get expert guidance to prevent any potential problems.

Remember, even if you’re a high-income earner, you can still enjoy the benefits of a Roth IRA. Don’t let income thresholds hold you back from securing your financial future.

Importance of Sticking to Annual Limits and Tracking Finances

The IRS sets strict annual limits on Roth IRA contributions, and it’s crucial to adhere to these regulations. If you exceed the maximum allowable contribution, penalties can ensue unless excess funds are removed within six months of the due date for your tax return (not including extensions). Additionally, an amended return must be filed.

Implications of Exceeding Annual Limits

If you fail to rectify over-contributions in time, a 6% excise tax applies each year until the issue is resolved. This could significantly impact your retirement savings growth if not addressed promptly.

Role of Financial Tracking in Retirement Planning

In order to avoid exceeding contribution limits inadvertently, especially when contributing to multiple IRAs or other retirement accounts concurrently, diligent financial tracking becomes essential. Using appropriate tools and advice from specialists, you can make sure to stay within the rules while maximizing your prospects for growth in the long run.

- Maintain accurate records: Keep track of all transactions related to your Roth IRA(s), including contributions made during a particular year and any rollovers or conversions from traditional IRAs.

- Avoid last-minute contributions: Making contributions close to the deadline may lead to miscalculations and inadvertent over-contributions.

- Diversify wisely: While having multiple retirement accounts can offer diversification benefits, remember that total combined contributions across all IRAs should not exceed IRS-prescribed limits based on income level.

- Rely on professional guidance: Tax laws surrounding retirement plans are complex; therefore, consider consulting with a qualified advisor who specializes in this area.

To sum up, adhering strictly to annual contribution limits set by the IRS is paramount. Not only does it prevent unnecessary taxation, but it also ensures optimal utilization of one’s hard-earned money towards building a robust nest egg for golden years.

Key Takeaway:

The importance of sticking to annual Roth IRA contribution limits set by the IRS cannot be overstated. Exceeding these limits can result in penalties and excise taxes, which can significantly impact retirement savings growth. Diligent financial tracking and seeking advice from qualified professionals are essential for staying within legal boundaries while maximizing long-term growth potential.

Tax-Free Distributions And Potential Taxation Issues With Early Withdrawals

One of the most attractive features of a Roth IRA is the ability to take tax-free distributions during retirement. This provides valuable diversification benefits, especially for those in higher tax brackets.

Benefits Of Tax Free Distributions During Retirement

The beauty of a Roth IRA lies in its unique taxation structure. Unlike traditional IRAs where you pay taxes upon withdrawal, with a Roth IRA, your contributions are taxed upfront allowing all future withdrawals to be completely tax-free as long as certain conditions are met. This can significantly boost your net income during retirement and provide financial peace of mind.

However, it’s important not to overlook potential taxation issues related to early withdrawals from your account.

Understanding The Five Year Rule For Early Withdrawals

If you withdraw earnings from your Roth IRA before reaching age 59½ or if the account hasn’t been open for at least five years (known as the Five-Year Rule) , these earnings may be subject to both taxes and penalties unless an exception applies. It is crucial that investors understand this rule fully before making any premature distributions.

This is why it’s essential that individuals make careful decisions about when and how much they contribute towards their Roth IRAs each year – keeping track of contribution limits while also considering their projected income needs during retirement.

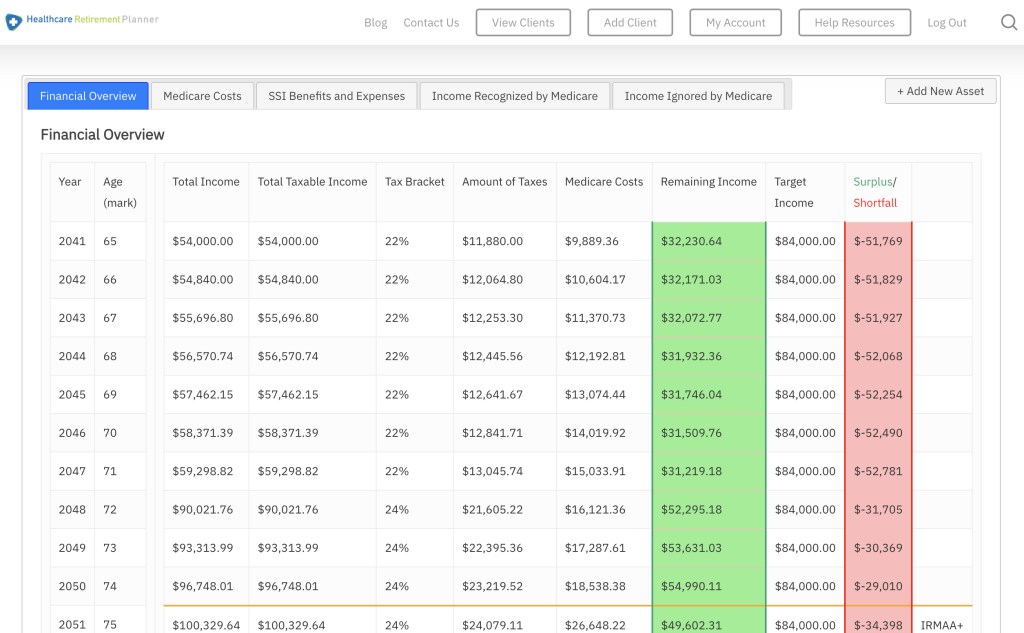

To avoid any potential pitfalls associated with early withdrawals or exceeding annual contribution limits, consider seeking advice from a qualified financial professional who specializes in retirement planning strategies like us here at Healthcare Retirement Planner . We assist financial professionals calculate IRMAA costs within clients’ retirement plans ensuring optimal utilization of resources without triggering unnecessary tax liabilities .

Key Takeaway:

The article discusses the benefits of tax-free distributions during retirement with a Roth IRA, but warns about potential taxation issues related to early withdrawals. It emphasizes the importance of understanding the Five-Year Rule for early withdrawals and seeking advice from qualified financial professionals to avoid any pitfalls associated with exceeding annual contribution limits or triggering unnecessary tax liabilities.

Advanced Planning Strategies To Avoid Potential Taxation Issues

Retirement planning isn’t just about saving money. It’s also about strategically avoiding potential taxation issues. This can be achieved through advanced planning strategies such as initiating conversions early enough to meet the five-year rule for Roth IRAs.

Initiating Conversions Early

The five-year rule for Roth IRAs states that account holders must maintain their account for at least five years before they can withdraw earnings tax-free. By initiating conversions from a Traditional IRA to a Roth IRA early on in your retirement plan, you ensure that by the time withdrawals become necessary, this requirement would have been met.

This strategy allows you to enjoy the benefits of tax-free distributions during retirement without worrying about potential taxes on withdrawn earnings due to non-compliance with the five-year rule.

Inheritance Transfers and The Five-Year Rule

Inheritors of Roth IRAs might still need to contend with this rule depending on the circumstances surrounding inheritance transfers. For instance, if an inheritor decides to convert inherited assets into a Roth IRA or make additional contributions after the inheritance transfer has taken place, they too will need to adhere strictly to IRS regulations, including the aforementioned five-year stipulation. Therefore, inheritors should consider seeking advice from financial professionals well-versed in inheritance rules governing RIA accounts.

Track Your Finances

Beyond these strategies, keeping track of your finances becomes even more critical when dealing with multiple accounts or high-income thresholds. Remember: exceeding annual limits attracts penalties unless excess contributions are removed within six months along with filing an amended return.

For more information on retirement planning and taxation strategies, check out IRS.gov.

Eligibility Rules Governing Participation in RIA Accounts

Understanding the rules that govern eligibility for Roth IRA accounts is crucial for retirement planning. These rules change annually and can significantly impact your ability to contribute to these accounts.

Married but filing separately? No Roth IRA contributions if you’re married but filing separately. This restriction also applies if your income exceeds certain limits set by the IRS each year. Check out the IRS guidelines for more detailed information on these income thresholds.

Remember, total contributions across multiple RIAs should not exceed your reported salary income. If this happens, you may face penalties from the IRS unless excess contributions are removed within six months along with filing an amended return.

The good news is that even if you fall between certain prescribed income brackets, there’s still hope. Taxpayers or spouses who aren’t covered by workplace plans could remain eligible for participation in a Roth IRA account.

Navigating Income Restrictions Like a Pro

Falling within specific income brackets doesn’t necessarily mean reduced contribution capabilities. It means adjusting how much you contribute accordingly. The key here lies in understanding where you fall under income bracket classifications, then making strategic decisions about your annual investments into your Roth IRAs based on those figures. It’s all about working smartly within given parameters while maximizing potential benefits.

Maintaining Eligibility Despite Workplace Coverage Scenarios

A common misconception surrounding RIA eligibility centers around workplace coverage scenarios. Just because either taxpayer or spouse might be covered through employer-sponsored retirement plans doesn’t automatically disqualify them from participating in Roths as well. Understanding the nuances involved here requires careful navigation through complex tax laws. Hence, seeking advice from seasoned financial professionals becomes imperative, especially when dealing with intricate matters like retirement planning strategies and related taxation issues.

For more information on Roth IRA eligibility rules, check out this IRS resource.

Key Takeaway:

Understanding the eligibility rules for Roth IRA accounts is crucial for retirement planning, as they change annually and can significantly impact contribution capabilities. Taxpayers or spouses who aren’t covered by workplace plans could remain eligible, even if their income falls between certain prescribed brackets; however, navigating complex tax laws requires seeking advice from seasoned financial professionals to maintain eligibility despite workplace coverage scenarios.

FAQs in Relation to Roth Ira Contribution Limits

Why is the Roth IRA contribution limit $6,000?

The IRS sets the limit to prevent tax abuse and ensure fairness, with an additional $1,000 catch-up amount for those aged 50 and over.

What are the income limits for Roth IRA contributions in 2023?

The IRS adjusts these annually, so check their guidelines for specifics.

Why can’t high earners contribute to a Roth IRA?

The IRS designed income eligibility restrictions to limit tax advantages primarily towards moderate-income taxpayers.

What are the new rules for Roth IRAs?

Stay updated via official Congressional records or Federal Register notices as new rules may vary each year.

Conclusion

Roth IRA contribution limits are a big deal for financial pros and their clients, so it’s important to know the projected maximum limit for future years, factors that influence contribution limits, and eligibility rules for RIA accounts.

Roth IRAs are more flexible than traditional IRAs, allowing for converting traditional IRAs into Roth’s and withdrawal privileges with no penalties, but high-income thresholds can be navigated with backdoor options and annual limits should be tracked to avoid potential taxation issues.

It’s also crucial to understand tax-free distributions during retirement and the five-year rule for early withdrawals when considering advanced planning strategies.