| Social Security Benefits | Distributions From: |

| Wages | Traditional 401(k) |

| Pensions and Rental Income | Traditional IRA |

| Interest | Traditional 403(b) |

| Capital Gains | Traditional Sep-IRA |

| Dividends | Qualified Investments and Annuities |

A Step-by-Step Guide:

How to Calculate IRMAA

USE OUR TOOLS AND EXPERTISE TO SHINE A LIGHT ON HOW TO CALCULATE IRMAA AND PLAN CORRECTLY

First: What is IRMAA?

IRMAA stands for the Income Related Monthly Adjustment Amount. What it is, is a surcharge that is added to your monthly Medicare costs, that is based on the amount of income you are receiving in retirement. Everyone in retirement earns some sort of income whether it is pension, Social Security, W2 wages, investments or a combination of these different types. However all income is not created equal when it comes to measurement by Medicare.

According to Medicare.gov if you fall into the higher income categories while enrolled in Medicare, federal law requires an adjustment to your monthly Medicare Part B and Part D premiums (drug coverage premium). Medigap policies do not fall under these adjustments This surcharge is known as the income related monthly adjustment amount added to your Medicare Part b and Part D costs.

Second: You need to know what types income is used to determine surcharges

Not all types of income are taken into consideration, however Medicare defines income for IRMAA to be “your adjusted gross income plus any tax-exempt interest you may have” or everything on lines 2a and 11 or the IRS form 1040 in tax-year 2022.This income is known as your Modified Adjusted Gross income or MAGI.

Third: The IRMAA Brackets

Currently Medicare's IRMAA has 6 income brackets. Each with its own escalating monthly premium surcharge. For the current year you can look at your MAGI from the previous year, from there simply find what bracket you are in to determine what your costs will be this year.

| Individual MAGI | Couple MAGI | Part B | Part D (per/mo) |

|---|---|---|---|

| < $97,000 | < $194,000 | $164.90 | Premium (varies) |

| $97,000 - $123,000 | $194,000 - $246,000 | $230.80 | Premium + $12.40 |

| $123,000 - $153,000 | $246,000 - $306,000 | $329.70 | Premium + $32.10 |

| $153,000 - $183,000 | $306,000 - $366,000 | $428.60 | Premium + $51.70 |

| $183,000 - $500000 | $366,000 - $750,000 | $527.50 | Premium + $71.30 |

| >$500,000 | >$750,000 | $560.50 | Premium + $77.90 |

Forth: Determine which bracket your income falls within

If you are able to look at how much income you will be receiving in a given year, you can then use that to determine which IRMAA bracket you will be placed in and in turn the amount of surcharge you will be charged. Note, each year you forecast out, you will need to ensure you are including in your calculations the yearly inflation rates of Medicare Part B and D along with the fluctuations in your income from year to year.

If previous year MAGI for an individual filing taxes as “Single”: $148,000

The bracket they would be in would be:

| Individual MAGI | Couple MAGI | Part B | Part D (per/mo) |

|---|---|---|---|

| $123,000 - $153,000 | $246,000 - $306,000 | $329.70 | Premium + $32.10 |

Total monthly Medicare Part B premium will be: $329.70 for 2023

How do you forecast these costs through the life of a retirement plan?

List Assets and Projected Growth Rates for each asset, for each year of the Retirement Plan

Each retirement plan is different and has different assets. List out all of the assets for the entire retirement plan, and calculate the income that will come from each asset for each year by using the projected growth rate.

Determine Projected MAGI Year by Year for the life of the Retirement Plan

Once you have determined the income from each asset for each year, make sure you only include only the income from assets recognized by Medicare when determining Premium Surcharges. This income is your MAGI or Modified Adjusted Gross Income.

Determine Medicare Premium Surcharges Year by Year based on Project MAGI Year by Year

Now that you have the MAGI for each year, you can now determine the brackets that the income will fall in year by year. To ensure you are using the correct calculation, make sure that you inflate the base cost of Medicare Premiums and the surcharges starting with the current year up through the year in retirement that you are identifying a premium and surcharge for.

Deduct the Medicare Premium expense from the Retirement plans Total income on a year by year basis.

Since these expenses are Social Security dependant, make sure you deduct them from the Social Security income only while making sure you are still taxing the entire Social Security benefit. What happens when the costs are more than the benefit?

Or using our software, we can show you how to complete hours of work

under five minutes.

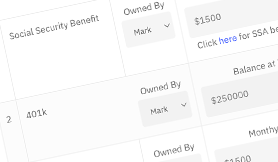

Add Your Assets

Each retirement plan is different and has different assets. List out all of the assets for the entire retirement plan, and calculate the income that will come from each asset for each year by using the projected growth rate.

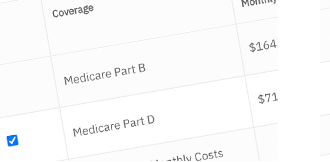

Choose your Coverage

Once you have determined the income from each asset for each year, make sure you only include only the income from assets recognized by Medicare when determining Premium Surcharges. This income is your MAGI or Modified Adjusted Gross Income.

Generate Your Report

Now that you have the MAGI for each year, you can now determine the brackets that the income will fall in year by year. To ensure you are using the correct calculation, make sure that you inflate the base cost of Medicare Premiums and the surcharges starting with the current year up through the year in retirement that you are identifying a premium and surcharge for.

Planning for Healthcare Through Retirement

Try our calculator and learn how to win at retirement.