As Seen In

What is IRMAA?

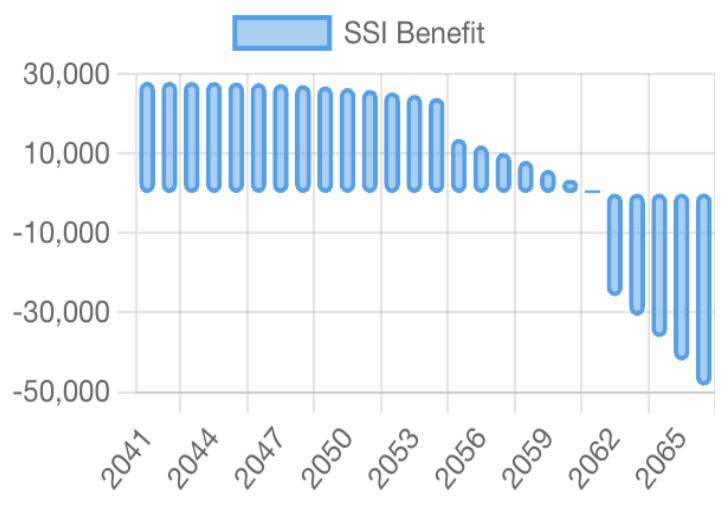

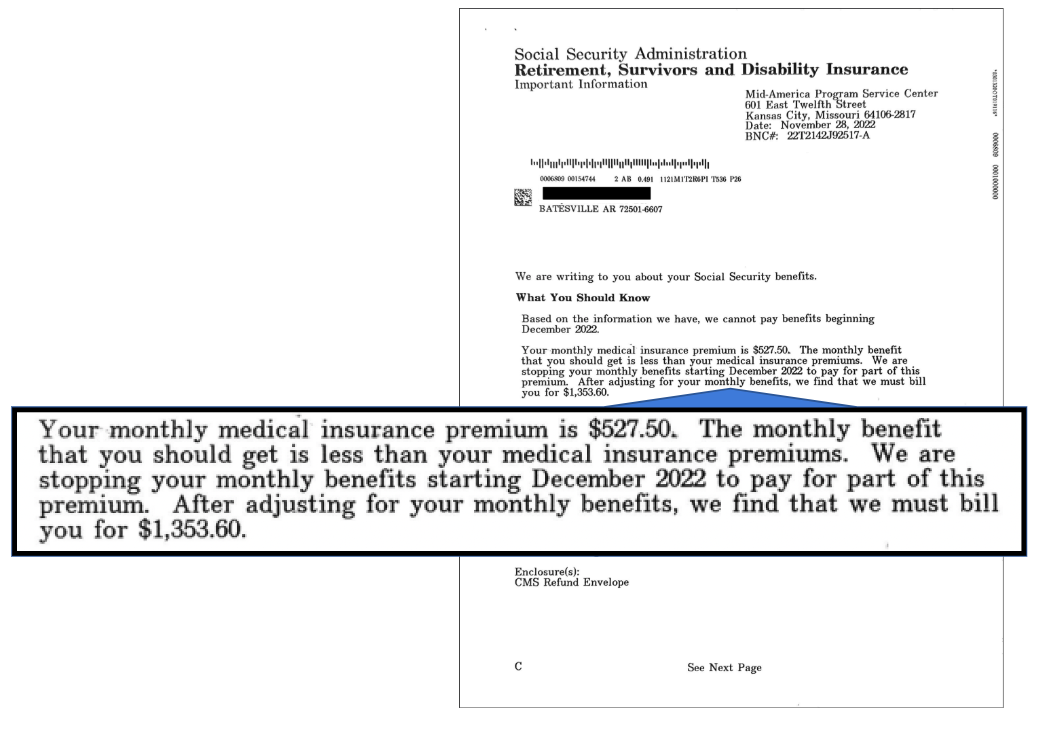

Many Americans retire only to discover Medicare premiums and surcharges exceed their monthly Social Security Benefit payouts.

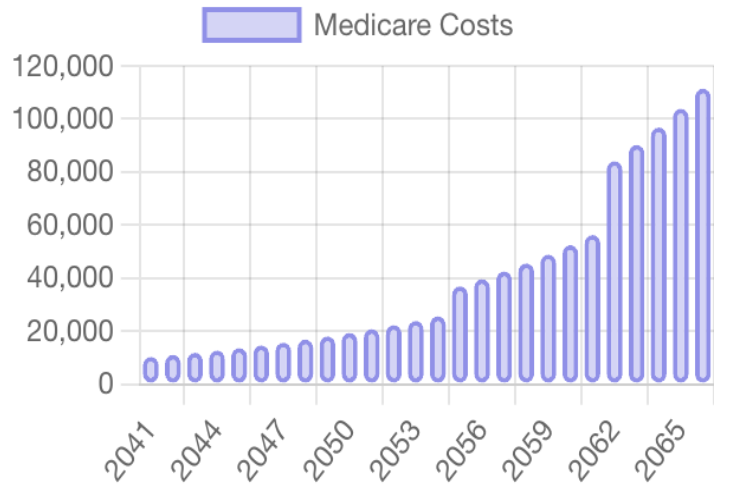

IRMAA stands for Income Related Monthly Adjustment Amount. It’s a surcharge on Medicare’s base premium for parts B and D.

The government uses IRMAA to determine if you must pay more for Medicare and how much to take out of your Social Security.

Here are three things everyone must know about IRMAA:

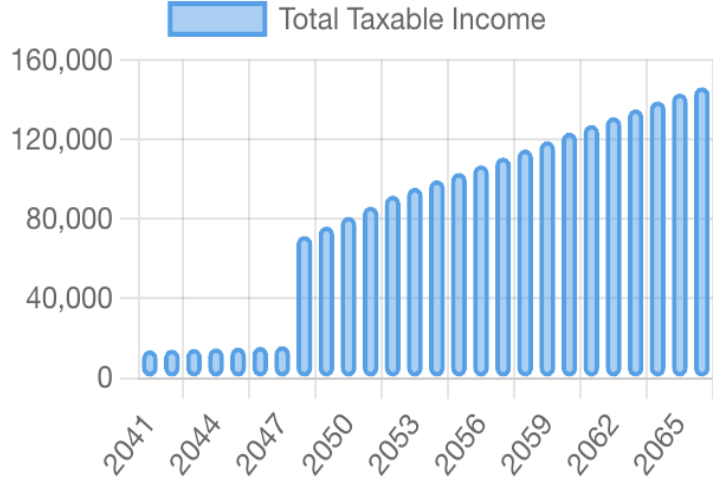

- Medicare calculates premiums and surcharges based on your income. The higher your income, the more you pay.

- Medicare automatically deducts premiums and surcharges from your monthly Social Security Benefit.

- You can use your assets to reduce your Medicare premiums.

“I started by hearing about IRMAA and was looking to get more information as to how it would affect my retirement. This was the only tool I could find to help myself and my financial advisor plan for what could happen when I retire next year. After seeing the report, we were able to make adjustments to my retirement plan that literally saved me 10’s of thousands of dollars over the course of my retirement. Thank you!”

Jean S.

Madison, Wisconsin

Get clarity and peace of mind for under $20 with your personalized IRMAA Stress Test report.

What is the IRMAA Stress Test?

The IRMAA Stress Test gives you comprehensive financial clarity so you can take action to ensure you have the funds to retire comfortably.

For less than $20, you get a 35-page personalized report financial advisors pay hundreds, sometimes thousands of dollars to acquire.

Want to know which assets can reduce your premiums and increase your retirement savings?

Medicare Will Collect Over 23 Billion in IRMAA Surcharges in 2024

Millions of hardworking Americans like yourself received a letter from Medicare notifying them of surcharges being deducted from their Social Security benefit via Income Related Monthly Adjustment Amount (IRMAA) premiums.

Many types of retirement income affect IRMAA surcharges, including mandatory disbursement of RMDs, which Medicare uses to determine surcharges and premiums.

Medicare Premiums and IRMAA surcharges impact millions of retirement plans, and many don’t know if they’re affected until they retire—sadly when it’s already too late.

“Took me about 5 minutes to complete the report and I was able to see my retirement plan was going to cost me thousands in Medicare premiums and surcharges. I would have never known about this if a friend of mine hadn’t received an IRMAA letter. Now I can make some changes and safe that money that would have gone to premiums and surcharges.”

David B.

Ithaca, NY

Don’t Pay More Than You Have to!

What is Included in Your Personalized IRMAA Stress Test?