Ever thought about how your Social Security Tax Calculator could be the key to unlocking a stress-free retirement? Let’s take this journey together, navigating through the winding paths of Social Security benefits and taxes. We’re setting sail on an expedition that uncovers what lies beneath those intimidating figures.

The stakes are high but so are our spirits. As we delve deeper into uncharted waters, you’ll discover how your filing status can affect your Social Security taxes or why additional sources of retirement income might change the game altogether.

I’m extending my hand out to you now – will you join me as we chart these often murky financial waters?

This ain’t just some numbers game. We’re on a journey to help you gain financial peace of mind in retirement. So, strap in! Managing your golden years gracefully goes way beyond what’s visible at first glance.

Understanding the Role of a Social Security Tax Calculator

A Social Security Tax Calculator is a handy tool that can give you insight into your financial future.

This instrument uses information like your income, filing status, and social security benefits to estimate what portion of those benefits might be subject to taxes. But why does this matter?

Defining a Social Security Tax Calculator

In essence, it’s all about planning for retirement. Many people look forward to receiving their monthly benefit from the Social Security Administration (SSA). However, few realize these payments could be taxable depending on various factors such as other sources of income and marital status.

The role of a Social Security tax calculator is similar to that friendly GPS system guiding us through unfamiliar roads—it gives you directions based on where you are now and where you want to go.

If we liken our journey towards retirement as navigating through an unknown city—our earnings history being the starting point, our desired lifestyle post-retirement being the destination—the calculations done by this helpful device become clear street signs leading us there with minimum hassle.

Navigating Through Retirement Planning With The Help Of A Tool

Taking control over one’s finances has never been more critical than in today’s unpredictable economic climate. Knowledge really is power when it comes down to handling money matters effectively.

Apart from showing how much we owe Uncle Sam each year regarding social security taxes—a factor often overlooked while planning for golden years—it helps chart out an accurate roadmap for meeting specific financial goals during retirement. Thus ensuring comfort without compromising on living expenses or dipping into savings prematurely.

By helping to understand the intricate maze of taxes related to social security benefits, this tool makes it easier for retirees and financial professionals alike. So why not use a Social Security tax calculator today?

Key Takeaway:

Think of a Social Security tax calculator as your personal financial GPS for retirement. It uses your income and benefits info to estimate potential taxes on those benefits, helping you plan effectively for retirement. With today’s uncertain economy, understanding the role this tool plays can offer vital insights into managing money matters and achieving comfort in golden years without compromising lifestyle or dipping into savings early.

How Social Security Benefits are Subject to Taxes

You might be astounded, but your Social Security payouts can potentially be liable to federal taxation. The amount of social security benefits you’re collecting can affect whether they are subject to federal income tax.

Your taxable income isn’t just based on what’s coming from employment or a pension plan; it also includes half of your annual social security benefit. When this total crosses certain thresholds, part of your social security benefit becomes taxable.

The first threshold is $25,000 for single filers and $32,000 for married couples filing jointly. Cross that line and up to 50% of your benefit could be taxed. The second threshold sits at $34,000 for singles and $44,000 for joint filers – exceed these figures and as much as 85% of your benefit may face taxation.

Taxable Income Calculation: An Example

Let’s consider John Doe who has an adjusted gross income (not including his social security) amounting to $18,500 annually with no other sources like dividends or interest incomes. He receives monthly payments totaling up-to a handsome sum of around about say…$20k per year from his hard-earned Social Security retirement savings.

To calculate if he owes taxes on his benefits we start by adding half the total yearly Social Security ($10k) plus non-Social Security earnings ($18.5k). That gives us an aggregate figure which stands below our first threshold limit i.e., well under the mark where one would need to pay taxes on their respective accrued Social Securities —in case they are sole breadwinners. So good news: John doesn’t owe any additional dough back towards Uncle Sam’s coffers from his benefits.

But, if John was a high-roller with an adjusted gross income of $35k and Social Security benefits amounting to another hefty sum of around say…$25k annually. His calculations would be completely different.

Table of Contents:

- Understanding the Role of a Social Security Tax Calculator

- How Social Security Benefits are Subject to Taxes

- The Process of Calculating Social Security Taxes

- Impact of Filing Statuses on Social Security Tax Calculation

- How Retirement Income Interacts with Taxable Social Security Benefits

- Minimizing Your Social Security Taxes Through Strategic Planning

- Utilizing a Social Security Tax Calculator to Estimate Potential Taxes

- Comparing Social Security Taxes with Other Forms of Taxation

- Tips for Maximizing Your Social Security Benefits and Minimizing Taxes

- FAQs in Relation to Social Security Tax Calculator

- Conclusion

The High-Roller Scenario

So, in this case, you’re looking at half the annual Social Security amounting to $12.5K along with non…

Key Takeaway:

Getting the lowdown on how taxes can affect your social security benefits is crucial for managing your money. If you’re pulling in a decent income, you could see up to 85% of those benefits taxed. Say you’re single and earning over $34k or part of a couple raking in more than $44k together – tax time might sting. Knowing this lets you plan smarter for when it’s time to kick back and retire.

The Process of Calculating Social Security Taxes

Cracking the code on how to calculate Social Security taxes can feel like a daunting task. But with some understanding and a bit of patience, it becomes less complex.

Your social security benefits become taxable when your combined income exceeds certain thresholds. For singles, the combined income limit for taxing social security benefits is $25,000; married couples filing jointly have a higher threshold of $32,000.

Don’t fret if you’re uncertain about whether or not your Social Security benefits are taxable in light of the limits for single and joint filers. We’ve got you covered.

Determining Your Combined Income

The first step in calculating your potential tax liability is figuring out what constitutes combined income. This figure includes adjusted gross income (your total annual earnings), non-taxable interest and half of your yearly social security benefit amount.

So let’s say Bob has an adjusted gross income of $20,000 from his part-time job during retirement. He earns approximately fifteen thousand dollars a year in Social Security benefits, plus he has investments from his retirement plan that bring him an additional few thousand annually from tax-free bonds.

Using our formula: ($20k AGI + 0.5*$15k SS Benefit + Tax Exempt Interest) = Total Combined Income

For Bob’s case: ($20k+$7.5K+1K)=Total which would be just under the IRS threshold if he were single – so no additional tax owed.

Filing Status Matters Too

An important thing to remember here is that this process changes slightly depending upon whether you’re single or filing jointly with a spouse—this directly impacts those tax thresholds. For instance, married couples filing jointly have a higher combined income threshold before their social security benefits become taxable.

Though it may seem daunting, with some practice and dedication you’ll soon find that the process is easier than expected. Remember: knowledge is power—especially when it comes to planning for your financial future.

Key Takeaway:

Calculating Social Security taxes might seem intimidating, but it’s simpler with some patience and understanding. Your benefits are taxable when your combined income—adjusted gross income, non-taxable interest, and half of your yearly benefit—exceeds $25k for singles or $32k for married couples filing jointly. Remember: the way you file can affect tax thresholds.

Impact of Filing Statuses on Social Security Tax Calculation

Your filing position has a major bearing on how much tax you’ll be paying for your social security gains. For instance, if you’re married and file jointly, the income thresholds for taxation are higher than for other statuses.

When it comes to calculating taxes on social security benefits, here’s what happens: If you’re single or head of household, no taxes are due until your combined income (that’s adjusted gross plus 50% of your social security) exceeds $25,000. But if you’re part of married couples filing jointly, that number jumps up to $32,000 before any portion of your benefit becomes taxable.

The Role Of Adjusted Gross Income In Social Security Taxation

To calculate these figures accurately though, we need to first understand ‘adjusted gross income’. This is basically all the money earned in a year including wages and self-employment earnings but excluding some deductions like student loan interest and half the self-employment tax.

In terms of calculating how much social security benefit will be taxed at what level based off this figure; once total income (including half your SS benefits) exceeds $44k for joint filers or $34k for everyone else – then 85% may become subject to federal income tax.

Tax Bracket Influence On The Outcome

Beyond just being aware about where they fall within their respective bracket with regards as mentioned above however – people should also keep track closely because those percentages could change depending upon whether someone finds themselves moving between brackets over time too.

So remember folks – even when thinking retirement plans out ahead now can seem daunting; taking a few moments each year to keep abreast of any potential changes could save you thousands down the line. Don’t hesitate to get help from a financial professional if needed.

Key Takeaway:

The taxes on your social security depend a lot on your filing status and adjusted gross income. If you’re single or the head of household, you’ll start paying taxes once your combined income goes over $25,000. For those married and filing together, that number jumps to $32,000. And watch out if your total income is more than $44k (for joint filers) or $34k (for everyone else), because up to 85% could be hit with federal tax. So keep an eye on it.

How Retirement Income Interacts with Taxable Social Security Benefits

Your retirement income can directly affect the taxability of your Social Security benefits. Not all types of retirement income are handled identically when it comes to taxation.

The Role of Other Income Sources in Social Security Taxes

If you have other sources of retirement income, like a pension or 401(k) distributions, these could potentially push your adjusted gross into a higher bracket for calculating taxes on social security benefits. For instance, if you’re married and filing jointly, once your combined incomes plus half your social security benefit exceed $32k annually according to Social Security Administration guidelines, up to 50% – or even 85% -of those benefits become taxable.

The Influence of Adjusted Gross Income on Benefit Taxation

In addition to regular wages and self-employment earnings that make up one’s gross income, non-taxable interest and half the amount received from social security also contribute towards what is known as ‘combined’ or ‘provisional’ income. This total sum plays an important role in determining how much – if any – tax is owed on one’s monthly payment from Social Security.

A Practical Example: Couples Filing Jointly

To illustrate this further let’s take John & Jane Doe who file their returns together. Their collective annual pensions total $18k while they draw another $30k collectively from their IRAs which contributes towards their adjusted gross making them liable for some level of taxation on their respective Social Security benefit.

Note: This example may not apply universally as individual financial situations differ widely due circumstances such as living expenses varying by region.

Be mindful of how other retirement income sources may impact your social security benefits, and seek professional advice to ensure that you’re taking full advantage of your savings while minimizing tax liability. It’s wise to consult a financial professional who can help understand these complexities and ensure that you’re maximizing your retirement savings while minimizing potential tax liability.

Key Takeaway:

Your Social Security benefits’ taxability hinges on your retirement income. Other sources, like pensions or 401(k) payouts, could nudge you into a higher tax bracket for these benefits. The key is your ‘combined’ or ‘provisional’ income – factoring in wages, non-taxable interest and half of your social security benefit – which shapes whether you owe any taxes.

Minimizing Your Social Security Taxes Through Strategic Planning

The right plan can help you keep more of your hard-earned Social Security benefits. By understanding how taxes on these benefits work, you can minimize what’s owed and maximize your retirement income.

Know Your Income Thresholds

A portion of your social security benefit becomes taxable when combined with other income it exceeds certain thresholds. For couples filing jointly, when other income surpasses $32k it can affect the taxation of their Social Security benefits; for others, this limit is set at $25k.

Roth IRAs: A Tax Advantage?

A Roth IRA could be a smart move to lessen the tax impact on your benefits. While contributions are taxed upfront, withdrawals in retirement are tax-free – not adding to that crucial adjusted gross income figure used to calculate taxes on Social Security payments.

Leveraging Capital Gains

If a large part of your wealth lies in non-retirement investment accounts subject to capital gains tax instead of ordinary income tax like an IRA or 401(k), consider leveraging those assets strategically. Capital gains don’t count towards the thresholds mentioned above unless they’re realized by selling investments at a profit. So keeping turnover low in such accounts may let you draw down assets without pushing yourself into higher taxation levels for Social Security.

Your Monthly Benefit Matters Too.

Bigger isn’t always better when it comes to monthly payment amounts from Social Security. If collecting full benefits pushes you over one of those critical earnings benchmarks discussed earlier (especially if just barely.), then delaying collection or accepting lower payments might actually leave more money in your pocket after all taxes considered.

By carefully planning and considering all your income sources, you can help ensure that you keep more of your social security benefits and live comfortably in retirement.

Key Takeaway:

Strategic planning can help you hold onto more of your social security benefits. Understanding tax rules, knowing income thresholds, and considering Roth IRAs or capital gains strategies are key. Even the size of your monthly benefit matters – sometimes less is more. With careful consideration of all income sources, you’ll be better equipped to maximize retirement comfort.

Utilizing a Social Security Tax Calculator to Estimate Potential Taxes

Estimating potential taxes on your social security benefits can feel like navigating through murky waters. But with the help of a Social Security tax calculator, it becomes as easy as pie.

A benefit calculator is an online tool that enables you to calculate the amount of your monthly social security payments that may be subject to taxation, based on factors such as gross income and filing status. You plug in numbers, hit calculate, and voila. An estimate pops up.

To use this tool effectively, start by knowing your total annual retirement income sources – pension, IRA withdrawals, dividends from investments or any other source. Next, add half of your expected yearly social security benefits to this amount. This gives you what’s known as combined income or provisional income which is used for calculating the taxation level.

Your Filing Status Matters

Filing status plays a significant role too when using these calculators. For instance, if you’re married and filing jointly, then up to 85% of your Social Security Benefits could be taxable if both halves exceed $44k (source). If single or head-of-household, that threshold lowers to $34k.

Tax Withholding Strategies

You might ask, “Can I control my tax liability?” Absolutely yes. Here’s where smart planning comes into play: having precise estimates enables strategic withholding strategies so unexpected bills don’t surprise come April 15th (the usual deadline). Consider adjusting withholdings across all retirement distributions including pensions, IRAs, etc., thus helping lower overall liabilities while ensuring adequate funds are available throughout the year.

Remember:

Every bit of preparation helps when it comes to your retirement finances. With a social security tax calculator, you can get the insights needed to plan ahead and enjoy a more secure future.

Ready for some practical number crunching? Grab that benefit estimate letter from the Social Security Administration or check online via My SSA account and start estimating.

Key Takeaway:

Using a Social Security tax calculator simplifies the task of estimating potential taxes on your benefits. You just need to know your total annual retirement income sources and filing status. With these insights, you can plan smartly for tax withholdings across all retirement distributions, helping you avoid unexpected bills and secure a more comfortable future.

Comparing Social Security Taxes with Other Forms of Taxation

If you’re like most folks, tax season can be a bit of a head-scratcher. Especially when it comes to understanding how different forms of income are taxed. But fear not. We’ve got your back.

Social Security benefits and regular income aren’t taxed the same way. In fact, depending on your combined income – which includes adjusted gross from other sources plus half your social security benefits – up to 85% of these benefits could be subject to federal taxes. Sounds daunting? Stick around for more.

Different Types Of Income: Different Tax Rates?

It’s simple to become overwhelmed with all the jargon such as “standard deduction,” “taxable income,” and “tax bracket” floating around. Certain amount, remember that the taxman treats each differently.

Your employment salary or self-employment earnings fall under ordinary taxable income – no exceptions there. On the flip side, social security benefit taxation is based on ‘provisional’ or combined incomes:

- Single filers earning less than $25k annually won’t see their SS checks touched by Uncle Sam.

- The story changes if you earn between $25k-$34k; now only 50% is taxable…

- Earning over $34K? Up goes this percentage…to 85%. And yes, married couples filing jointly have slightly higher thresholds here.

The Twist: Not All States Tax Your Benefits

A quick shout out here for retirees residing in states where social security isn’t considered part of their state’s ‘adjusted gross’. If you’re fortunate, your state won’t be taxing the money from these benefits.

Confused? Well, don’t worry. With a good financial professional by your side and a handy social security tax calculator at your disposal, understanding this maze will become easier. With the right resources and a reliable expert, navigating the complexities of Social Security taxes can be made easier.

Key Takeaway:

Sorting out taxes can be tough, but knowing how Social Security benefits are taxed lightens the load. Your combined income determines whether and to what extent your benefits get taxed – potentially up to 85%. Keep in mind not all states tax these perks. But don’t worry. With a trustworthy financial guru and a handy social security tax calculator, you’ll navigate this taxation labyrinth with ease.

Tips for Maximizing Your Social Security Benefits and Minimizing Taxes

Maximizing your social security benefits while minimizing taxes can feel like a balancing act. However, with the correct info, you can accomplish both objectives.

The Power of Timing

Your monthly benefit amount largely depends on when you start collecting Social Security. Waiting until full retirement age ensures maximum benefits. However, if circumstances demand early withdrawal, understanding how it impacts your tax liability is crucial.

Mindful Withdrawals from Retirement Savings

Drawing income from various sources affects how much of your Social Security benefit becomes taxable income. Carefully strategize withdrawals from IRAs or 401(k)s to manage adjusted gross income levels and potentially reduce the portion of benefits subject to taxation.

Filing Status Matters

Married couples filing jointly, singles, head-of-household filers – each status has different thresholds affecting the taxation level of their social security benefits.

Incorporate Tax-efficient Investments

To further minimize tax impact on retirement funds, consider investing in Roth accounts or real estate investments offering depreciation deductions. Roth IRA distributions are not included in adjusted gross income calculations which influence how much of your Social Security gets taxed.

But remember: what works best varies per individual situation so seek advice from a trusted financial professional before making any decision.

- Social Security Calculator Tools

- When estimating potential future taxes owed on Social Security earnings, tax calculators can provide valuable insights. Tax calculators can compute an estimate of taxes owed on Social Security earnings by considering your income, filing status and home state.

Understanding the interplay between retirement income sources, social security benefits, and tax implications is crucial in maximizing what you keep from Uncle Sam’s reach. It’s a complicated process but worth the effort for a financially secure future.

Key Takeaway:

Master the Timing Game: When you start collecting social security affects your monthly benefit. Wait until full retirement age for maximum benefits, but understand early withdrawal’s tax implications if necessary.

Smart Withdrawal Strategy: What you pull from your income sources can change how much of your social security gets taxed. Be wise when taking money out of IRAs or

FAQs in Relation to Social Security Tax Calculator

How do I calculate how much Social Security tax I will pay?

You can use a Social Security tax calculator. It’ll factor in your income, filing status, and the current taxation rules to estimate your potential taxes.

How are Social Security benefits calculated if you make $35000 per year?

Your benefit is based on average indexed monthly earnings during the 35 years of highest earned income. So making $35000 yearly could influence it but other factors also matter.

Is it better to take Social Security at 62 or 67?

This depends on personal circumstances like health and financial needs. Claiming early reduces payments, but waiting until full retirement age boosts them by up to 8% annually.

What is the max Social Security tax for 2023?

The maximum taxable earnings change each year with changes in national average wages. For precise numbers check out updates from SSA’s official site.

Conclusion

Retirement shouldn’t be a puzzle, right? With our guide and the help of a Social Security tax calculator, you’re now better equipped to tackle those calculations.

From understanding how your filing status impacts taxes to considering other retirement income sources, we’ve shed light on these often murky waters.

Strategizing your taxes can help you reduce the amount of social security taxes you owe. Remember: It’s possible to minimize social security taxes with strategic planning.

The power is in your hands! Use this knowledge wisely for financial peace of mind during your golden years.

Your journey doesn’t end here though – keep exploring, asking questions, and seeking advice as needed. After all, sailing smoothly into retirement requires an ongoing commitment!

Streamlining the Medicare Surcharge Calculation Process.

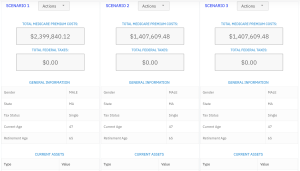

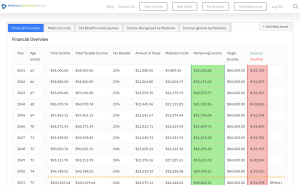

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.