The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge that Medicare beneficiaries may be required to pay based on their income. IRMAA affects the coverage premium amounts for both Medicare Part B (outpatient medical insurance) and Medicare drug Plan Part D (prescription drug coverage). This article will provide a comprehensive overview of the 2022 IRMAA brackets and how they impact Medicare beneficiaries.

Medicare IRMAA 2022 Brackets: Information on Plans and premium

What is Income-Related Monthly Adjustment Amount (IRMAA)?

IRMAA is a means-tested adjustment that is applied to the standard premium amount for Medicare Part B and Part D drug coverage. The standard premium amount is the same for everyone, regardless of income, but IRMAA is based on a person’s modified adjusted gross income (MAGI) as reported on their federal tax return from two years prior. For example, the 2022 IRMAA brackets are based on the MAGI reported on the 2020 tax return.

IRMAA is designed to make sure that those who can afford to pay more for their Medicare coverage do so. In addition, those with lower incomes continue to receive a lower premium amount. For as long as a beneficiary is enrolled in Medicare Part B or Part D drug coverage, IRMAA is a monthly surcharge in addition to their standard premium.

How to prepare for IRMAA

Knowing the 2022 IRMAA brackets will help beneficiaries plan their finances accordingly and avoid any unexpected costs. It is also important to note that IRMAA 2022 is calculated based on the tax return from two years prior. Therefore, it is crucial to estimate your income for the upcoming year and consider any life events or changes that may affect your income. By doing so, Medicare beneficiaries can plan and budget for their healthcare costs and avoid any financial surprises.

Medicare 2022 IRMAA Brackets

The 2022 IRMAA brackets have been adjusted to reflect changes in average Social Security beneficiary income and inflation. The following table outlines the 2022 IRMAA brackets for Medicare Part B and Part D:

| Individual MAGI | Couple MAGI | Part B Premium | Part D Premium |

|---|---|---|---|

| < $91,000 | < $182,000 | $170.10 | Premium (varies) |

| $91,000 - $114,000 | $182,000 - $228,000 | $238.10 | Premium + $12.40 |

| $114,000 - $142,000 | $228,000 - $284,000 | $340.20 | Premium + $32.10 |

| $142,000 - $170,000 | $284,000 - $340,000 | $442.30 | Premium + $51.70 |

| $170,000 - $500,000 | $340,000 - $750,000 | $544.30 | Premium + $71.30 |

| > $500k | > $750k | $578.30 | Premium + $77.90 |

It is important to note that the above amounts are for the standard monthly premium for Medicare Part B and Part D. If a person’s income is above the IRMAA 2022 threshold, they will be required to pay the standard premium amount plus the IRMAA surcharge.

Types of Income Used to Calculate 2022 IRMAA Brackets

Medicare looks at certain types of income in order to determine which IRMAA bracket you are in. Note that depending on which ones of these you have, the calculation is based on all of the included types of income and determined on a year by year basis along with if you are filing single, married jointly or married filing separately.

| Social Security Benefits | Distributions From: |

| Wages | Traditional 401(k) |

| Pensions and Rental Income | Traditional IRA |

| Interest | Traditional 403(b) |

| Capital Gains | Traditional Sep-IRA |

| Dividends | Qualified Investments and Annuities |

Some 2022 Medicare IRMAA Facts

1. Higher income earners will pay more for Part B and Part D coverage in 2022.

The IRMAA surcharge for Part B and Part D health benefits coverage will increase for higher income earners in 2022. The brackets for both Part B and Part D have been adjusted for inflation, which means that more people may fall into higher income categories and pay more. Note to pay attention to late enrollment penalties.

2. The Part B IRMAA brackets have expanded.

The Part B IRMAA brackets for 2022 have expanded to include more income categories. This means that the surcharge will be more targeted to income levels, rather than having a broad range of earners in the same bracket. For example, the highest income bracket for Part B now starts at $750,000 of MAGI, instead of $500,000.

3. The Part D IRMAA brackets remain unchanged.

Unlike Part B, the Part D IRMAA brackets will remain the same in 2022. This means that the income thresholds for each bracket will remain at the same level as in 2021. If you’re an individual who is enrolled in both Part B and Part D, you’ll need to pay attention to both sets of brackets to calculate your total IRMAA surcharge.

4. Medicare Premiums are deducted from your Social Security Benefit

Calculating IRMAA with MAGI

Your IRMAA is calculated based on your Modified Adjusted Gross Income (MAGI). That’s just a fancy way of saying they add up your taxable income, tax-exempt interest, and foreign earnings. The final IRMAA payment amount depends on what you reported on your tax return two years ago. So, don’t try to hide that yacht you bought.

How the Social Security Administration Determines Your IRMAA

The Social Security Administration (SSA) is the boss when it comes to calculating your Income-Related Monthly Adjustment Amount (IRMAA). They dig into your income from two years ago, as reported on your tax return, to see if you’re in the high-income bracket and subject to extra charges.

Your Tax Return: The Time Machine of Medicare

It’s like the SSA has a time machine. They use your Modified Adjusted Gross Income (MAGI) from two years ago to decide if you’ll be hit with the dreaded Medicare IRMAA surcharge. If your MAGI was over $97,000 (individuals) or $194,000 (couples filing jointly) in 2021, brace yourself for extra premium costs.

How to Appeal 2022 Medicare IRMAA Decision

If a person feels that their IRMAA amount is incorrect, they can file an appeal. There are several reasons why a person may want to file an appeal, including:

- They had a change in income or marital status

- They are no longer required to file a tax return

- They received a significant increase in Social Security benefits

To file an appeal, a person must complete the IRMAA Appeal Form and provide supporting documentation to prove that their income has changed. The form and supporting documentation

Should you Appeal your IRMAA Surcharge?

Should you or should you not appeal IRMAA is all based on your own personal situation. For many who are new to Medicare the answer will be a resounding yes you should, but for those already enrolled into Medicare that answer may be a very hard no.

According to Social Security there are few reasons to appeal an IRMAA decision which are:

- You believe the wrong tax-return was used. The IRS provided a tax return from 3 years prior instead of using the latest

- You can produce a more up to date tax return that may have been amended or corrected.

- You have experienced a qualifying life changing event, which are:

- Tax status change

- Married, Divorced, Widowed or Annulment

- Work stoppage or reduction

- You retired from your employment

- Loss of income producing property

- Any real or personal property that generates income which lost due to circumstances out of your control.

- Reduction or Loss of Pension Income

- Receiving a pension from an employer that is going to end

- Employer Settlement Payment

- Receiving a pension or payout that will abruptly stop due to employer no longer being able to fund it.

- Tax status change

For those who are new to Medicare:

The answer is of course you should appeal.

Remember the process and keep in mind the reasons to appeal. The SSA is asking the IRS for your MAGI from 2 years prior, which is when you were working.

The SSA has already given you a built-in reason to, which is “Work Stoppage or Reduction”. All you need to do from this point to get out of IRMAA is fill out an SSA-44 Form from the SSA, which can be found here.

For those who are not new to Medicare and have received an IRMAA notification:

The hard answer is that appealing may lead to much bigger problems for you later.

Instead of remembering the process, at this point you need to remember how someone can reach IRMAA in the first place.

IRMAA is based on your MAGI that is determined from any income that you generate from Wages, Taxable Social Security benefits, Capital Gains, Pension and Rental Income, Dividends AND DISTRIBUTIONS FROM ANY TAX-DEFERRED INVESTMENTS LIKE A TRADITIONAL 401(k).

The SSA is asking the IRS for your tax information from 2 years prior which is most likely when you started to take your required minimum distribution (RMD) from that Traditional 401(k).

Not only does that RMD count as income towards IRMAA, but it is also used to ensure that 85% of your Social Security benefit becomes taxable.

That RMD from your Traditional 401(k), unfortunately, creates income for IRMAA on its own, but it also aids and abets in making your Social Security benefit taxable, which is then used to create even more income that counts towards IRMAA.

The icing on the cake of your Traditional 401(k): it still gets taxed as ordinary income too…after ensuring you pay more Medicare and receive less in Social Security benefits.

So, without a qualifying life event when it comes to appealing IRMAA and all you are doing is challenging the MAGI which is provided from the IRS.

With 87,000 newly hired IRS agents this may not be the wisest decision to make, but if you are going to move ahead there are couple of way to do that.

Streamlining the Medicare Surcharge Calculation Process.

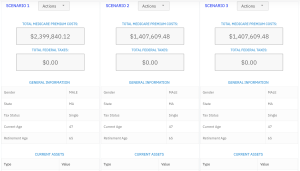

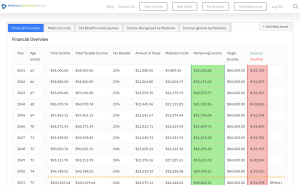

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.

Mark Has been working in the Medicare and IRMAA space for the past 8+ years. He is the architect of the leading Social Security and Medicare IRMAA software. He is also the Co-Founder of IRMAA Certified Planner and Healthcare Retirement Planner.

Who is Healthcare Retirement Planner

At Healthcare Retirement Planner we have spent the last 15 years researching the impact of IRMAA on Medicare and individual retirement plans. Taking the knowledge and applying it to helping financial professionals service their clients better.

We also provide individual guidance, seminars and software to help both financial professionals and individuals illustrate costs, impact and how to mitigate moving forward.

Healthcare Retirement Planner has also partnered with IRMAA Certified Planner to help educate and certify financial professionals. Through this designation, financial Professionals will be able illustrate and navigate structuring retirement plans to mitigate issues arising from IRMAA.

Get Certified through IRMAA Certified Planner and become your clients go to expert.

Frequently asked questions

How can I Learn More about IRMAA as a financial professional

If you would like to learn more you can go to www.irmaacertifiedplanner.com for certification and designation to be an IRMAA Certified Planner

What is IRMAA?

The Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an amount you may pay in addition to your Part B or Part D premium if your income is above a certain level.

Does everyone have to pay IRMAA

How do I calculate my IRMAA exposure over the duration of a retirement?

Using the software provided by www.healthcareretirementplanner.com